...

For simple landed costing see Simple Landed Costing

To see which purchase orders require action see Purchase Reports Dashboard

General Overview of Landed Costing

Landed costing adds costs incurred in getting the stock into store to the price paid for the stock and updates the average cost in the system

| Note |

|---|

Purchasing JIT items is a special case of landed cost

|

A simple view of what is going on

...

| Note |

|---|

Supplier freight is always allocated to the stock cost. Supplier freight is not known until the supplier invoice is entered and includes freight. The average cost is updated by averaging the freight based on line item value. The average cost update is limited to the value that would have resulted if all the stock is still in the system - if there is less stock remaining than was received then not all the freight will be allocated and some will remain in the "Carriage In" control account If you do not want the freight allocated or you want to allocate it using a different method then enter it as a separate invoice. |

Landed Cost for Drop Ship Purchase Orders

A drop ship purchase order is going direct to the customer and never passes through your warehouse. However it is important to know the cost to you of the goods.

To create a drop ship purchase order - create a sales order and right click on any order lines that will be drop shipped. Then on the created purchase order create a landed cost estimate.

- Landed Cost Estimate form, Results tab:

- If linked PO is a drop ship PO generated from a sales order:

- Show sales order code as a link to open the sales order.

- If sales order customer uses foreign currency:

- Show the currency code and the exchange rate from the SO.

- Add 2 columns showing 'Landed cost (ea)' and 'Total landed cost' converted to the SO customer's currency using the SO FX rate.

- If linked PO is a drop ship PO generated from a sales order:

- On a sales order line with SupplierShip YES, if the generated PO has a Landed Cost Estimate then add a context menu option to open the Landed Cost.

- If the landed cost has charges then 'Calculate and show apportions' and switch to the Results tab.

The landed cost for a drop ship purchase order can be updated from estimate to actuals but is never "Used" by the system to update average cost.

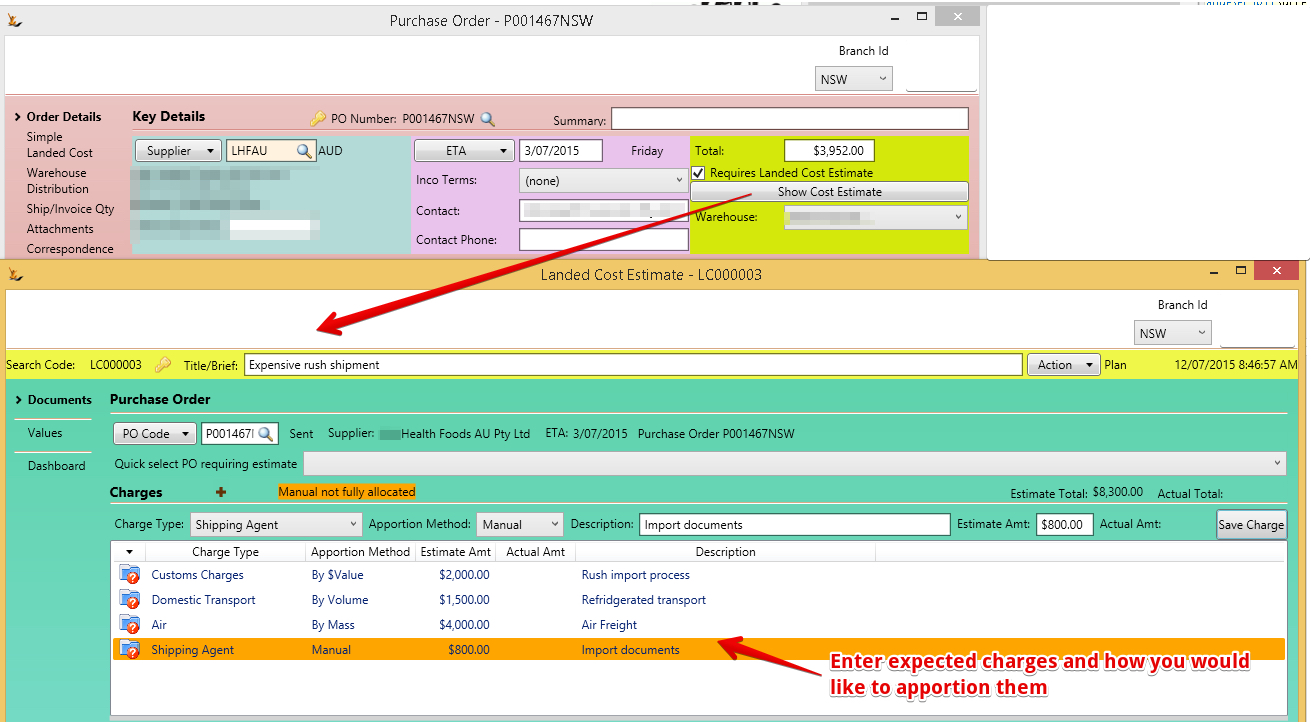

There are two stages in Complex Landed Costs

...

| Note |

|---|

to use Landed costing configurations are required

|

...

| Note |

|---|

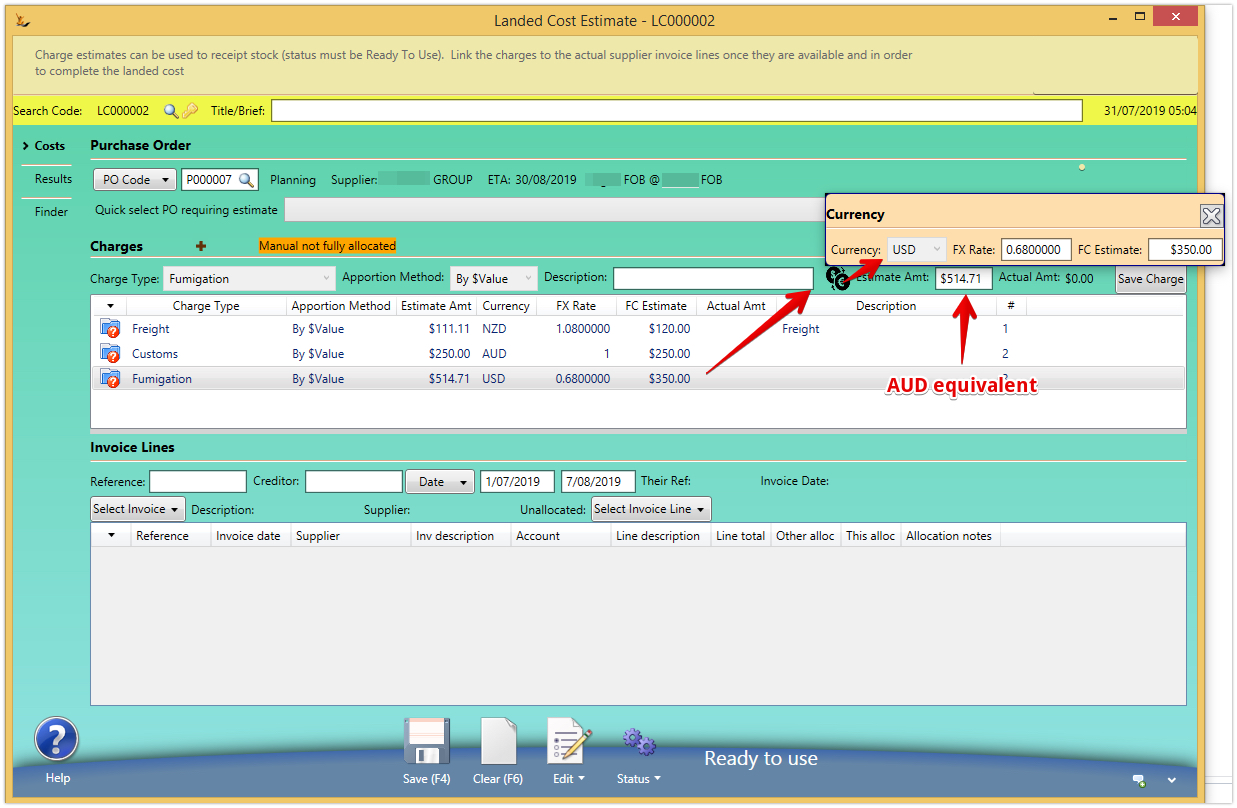

Expected charges may be entered as estimates and later (even after stock receipt) linked to the actuals and stock value recalculated if required. FX amounts can be used - they are converted to the base currency for the calculation |

- Enter Type of charge

- Charges are setup at Administration > configuration > Lookups > "ChargeType"

- enter Method of apportioning the charge

- By weight will look at the weight of each item and allocate by weight and is useful for shipping or air freight that is charged by weight

- By Dollar value uses the dollar value on the purchase order

- By volume uses the article volume

- Manual enables you to manually allocate the charges across all related lines

- Foreign currency and conversion rate if required

- Description - add a note to so you can remember what this charge was intended to cover

View the Estimated charges by Purchase Order Line

...

New Average cost = (current average cost * current stock qty + qty from the PO * final cost ea) / (current stock qty + PO stock Qty)

Supplier direct to customer (Drop Ship Purchase orders)

Where the supplier is sending direct to a customer a Sales Order lines is marked as Supplier Direct to Customer and on Authorise this creates a PO to the supplier with final address at the customer.

Where the PO has a Complex Landed Cost - the value of the final landed costs in the Sales Order currency is shown for clarity on margin in the sales order currency

Set the Estimate Ready to Use

...

| Note |

|---|

If you do not update the estimate with actuals you will have a balance in the GL Control Account "Landed Cost Clearing Account" Shipping Organisations may pay GST - to enter a 100% GST line on the journal - Choose TAX type of 100% Puts entire amount entered to Tax Column

|

From the Purchase Order from PO to Goods Receipt - open the estimate

...

- The Invoices listed are all invoices that are listed in GL Accounts with "Landed Cost" special type set

...

| Note |

|---|

Add additional cost lines if required |

...

| Note |

|---|

If the stock level at the time of applying the actuals is below the quantity of stock on the PO line

To illustrate

|

...

Landed costing diagram of the flow.

| Gliffy | ||||

|---|---|---|---|---|

|

Accounting Journals

| Journals for receipt of Stock item with locked estimate | Debit | Credit | Estimate of $20 costs |

|---|---|---|---|

| Stock on Hand - assets | 120 |

| Increase in stock value | ||

| Trade Creditors Liabilities |

| 100 | Amount paid to stock supplier | |

| Landed cost clearing account - liabilities |

| 20 | Total allocated other costs for these items based on the estimate | |

| Totals | 120 | 120 |

| Stock Supplier Invoice | Dr | Cr | Payment to supplier for stock |

|---|---|---|---|

| Trade Creditors - Liabilities |

| 100 |

| Goods Received not Invoiced | 100 |

| Total | 100 | 100 |

| CR Invoice Journal for a cost paid (customs) = must be linked to landed cost clearing account | Dr | Cr | Payment of $25 costs |

|---|---|---|---|

| Trade Creditors - Liabilities |

| 25 |

| Landed cost clearing account | 25 |

| Totals | 25 | 25 |

| Once a journal line is linked to a landed cost account |

|---|

| Adjustment journal required once actuals are associated | Dr | Cr | Adjustment of stock from $20 estimate to $25 Actual |

|---|---|---|---|

| Landed Cost Expenses To Stock - Expense Account |

| 25 | Expense account tracking landed costs in separate account | ||

| Landed cost clearing account - liabilities | 20 |

| Clear the clearing account of the estimate value | ||

| Stock on Hand - Assets - Credit | 5 |

| Update the stock on hand with the increase (Decrease) in value required | |||

| Totals | 25 | 25 | Result = Stock increases $5 (now $25 more than paid to stock supplier) and Landed Cost Clearing account = 0 Landed cost expense account = Actual = $25 |

| Adjustment Journal if Actuals are used prior to stock receipt | Dr | Cr | When $25 actuals are known prior to receipt of stock |

|---|---|---|---|

| Stock on Hand - assets | 125 |

| Increase in stock value | ||

| Trade Creditors Liabilities |

| 100 | Amount to be paid to stock supplier | |

| Landed cost expenses to stock - expense account |

| 25 | Expense account tracking landed costs in separate account | ||

| Totals | 125 | 125 | Result = Stock increases $25 more than paid to stock supplier Landed cost expense account = Actual = $25 |

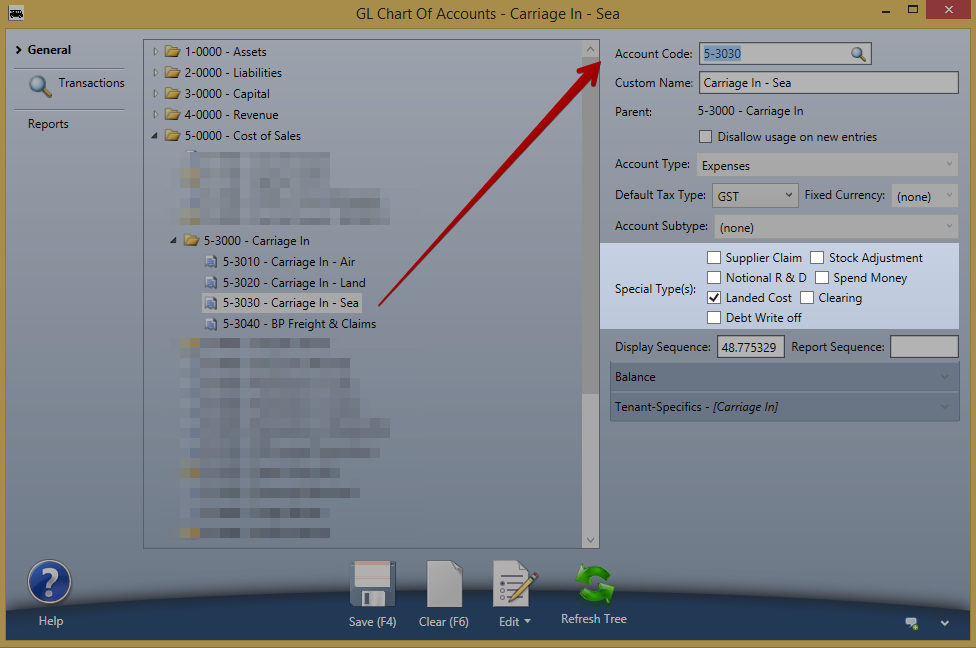

GL Control Accounts for Landed Costing

...

GL Account configuration to show invoices in landed cost Actuals list

Landed Cost Audit

Landed cost calculations are complex and it is important that the actual cost update reflects accurately the journaled amount. Because the average cost of a SKU is to two decimal places (as required by COGS journals) there is commonly a rounding difference.