What can vary ?

- The supplier does not have the stock now = sends it later with another purchase order to you

- The price on the supplier invoice is not the same as the purchase order and this is not discovered until after the stock has been received

- The supplier sends stock in multiple shipments - and hence there is multiple invoices for a PO

- The supplier sends invoices that cross Purchase Orders

- The supplier does not require pricing on the Purchase Order

For landed cost variations to expected landed cost prices - see Landed Costing

Contents

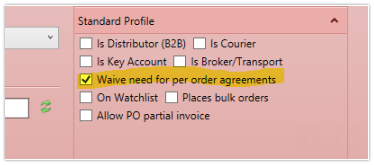

The Supplier does not know pricing until they send the goods

The Purchase Order can be sent to suppliers with no pricing - this flag will remove prices from the PDF sent to the supplier

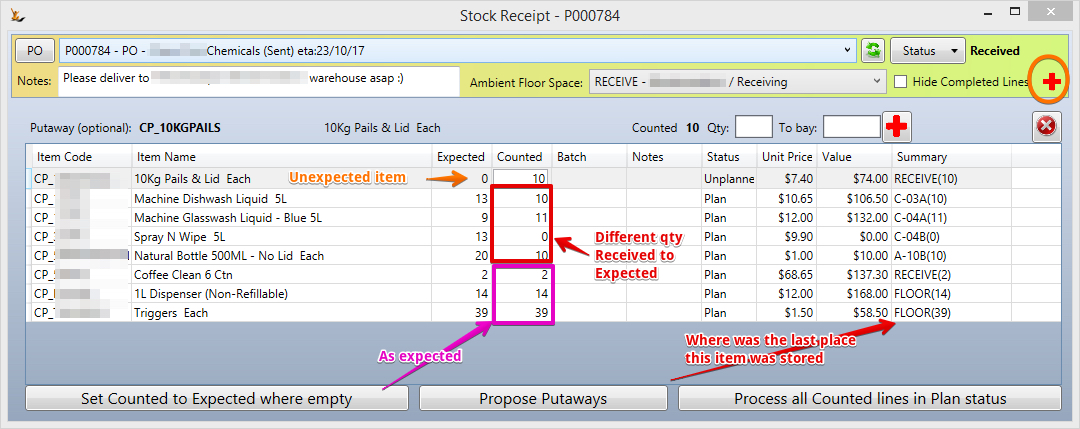

Stock does not arrive

If a stock item does not arrive on a purchase order - count the received qty as zero = the purchase order will then be processed normally.

The invoice will match up with the shipment

More stock arrives than expected

Count the stock that arrived - the counted will be greater than the ordered qty.

The system will prompt if the invoice includes the additional stock - or if it was sent as free stock

Unexpected Stock items arrive

Perhaps they were ordered on a previous purchase order that was short shipped.

Use the "Add Item" button on the stock receipt to enter the new item and qty, it will have a zero ordered qty - the invoice will be created for the counted quantity.

You will be prompted to make a choice about the "More Stock Arrived than Expected" as above.

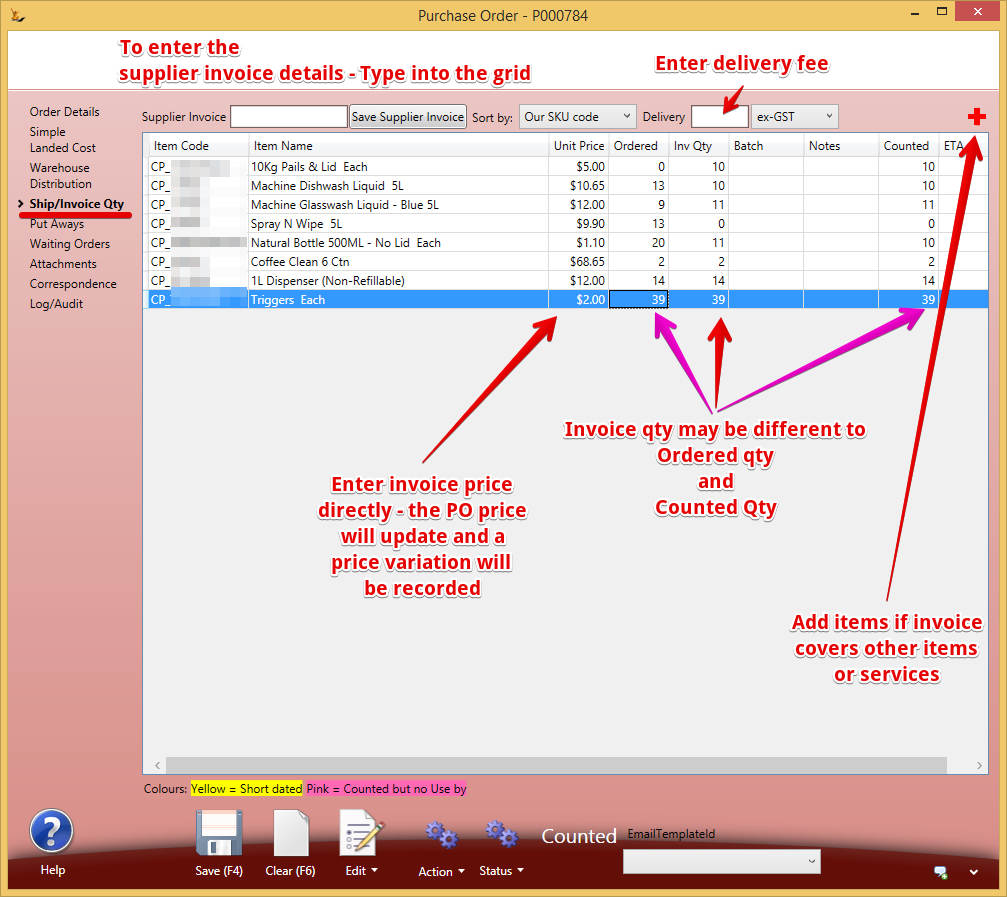

The invoice is a different price each to the purchase order after stock has been counted and received

The invoice price variance will be allocated by the system to a control account "Purchase Price Variance" and the stock will NOT be revalued.

After the PO has been received and the stock is in the system - the stock can be revalued using Landed Costing by allocating additional costs.

The supplier Charged Freight

When a supplier charges freight the costs are allocated by $ value across the goods by the system.

Supplier freight is not known until the supplier invoice is entered and includes freight.

- The average cost is updated by averaging the freight based on line item value.

- The average cost update is limited to the value that would have resulted if all the stock is still in the system

- if there is less stock remaining than was received then not all the freight will be allocated and some will remain in the "Carriage In" control account

If you do not want the freight allocated or you want to allocate it using a different method then enter it as a separate invoice.

Example PO

Here is a PO with all of the above issues.

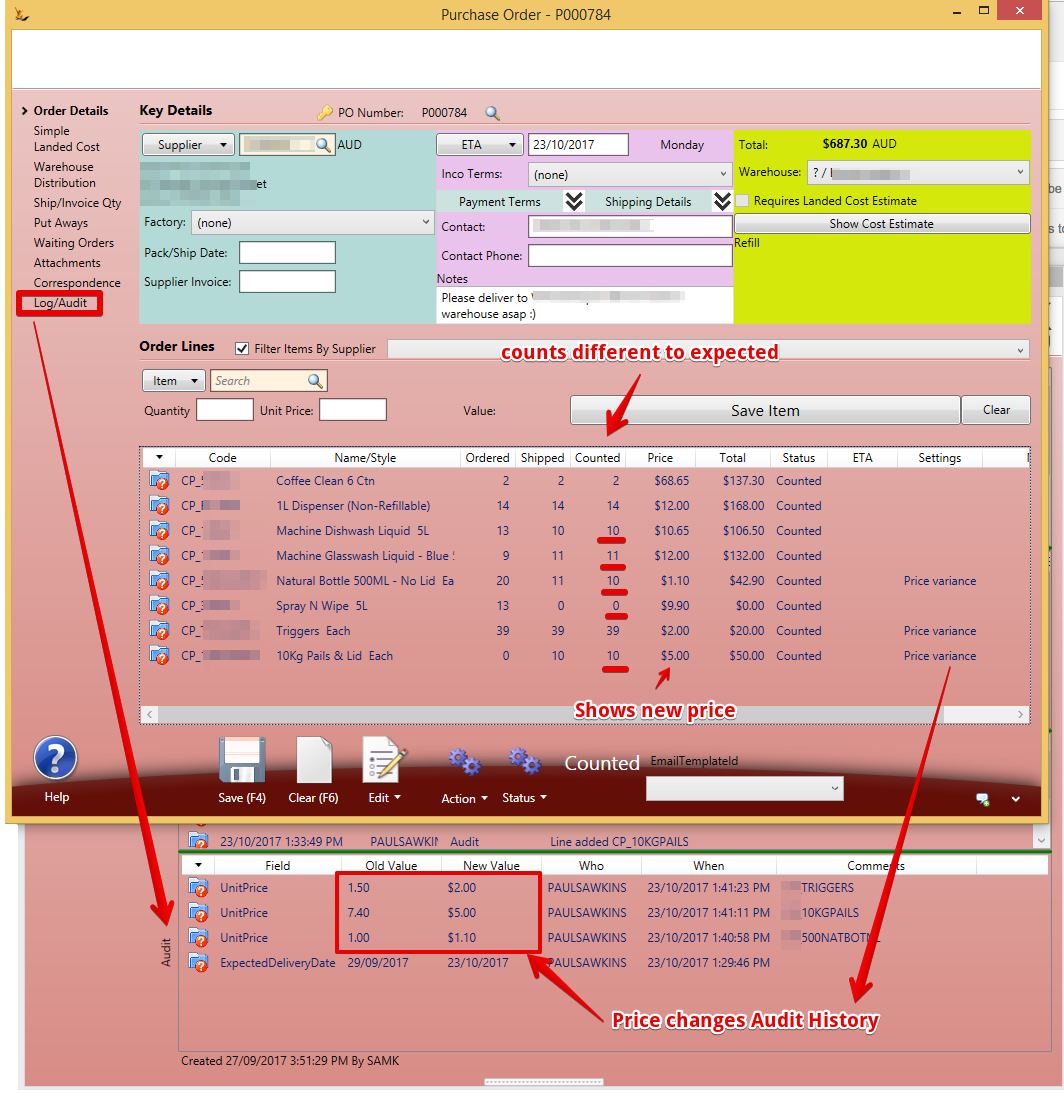

Stock count differences

Price Differences

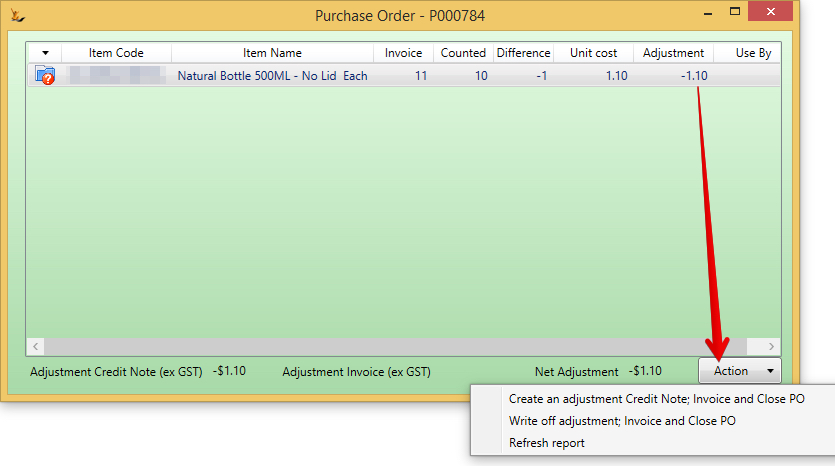

After all changes - user will be prompted - what to do when counted different to invoiced

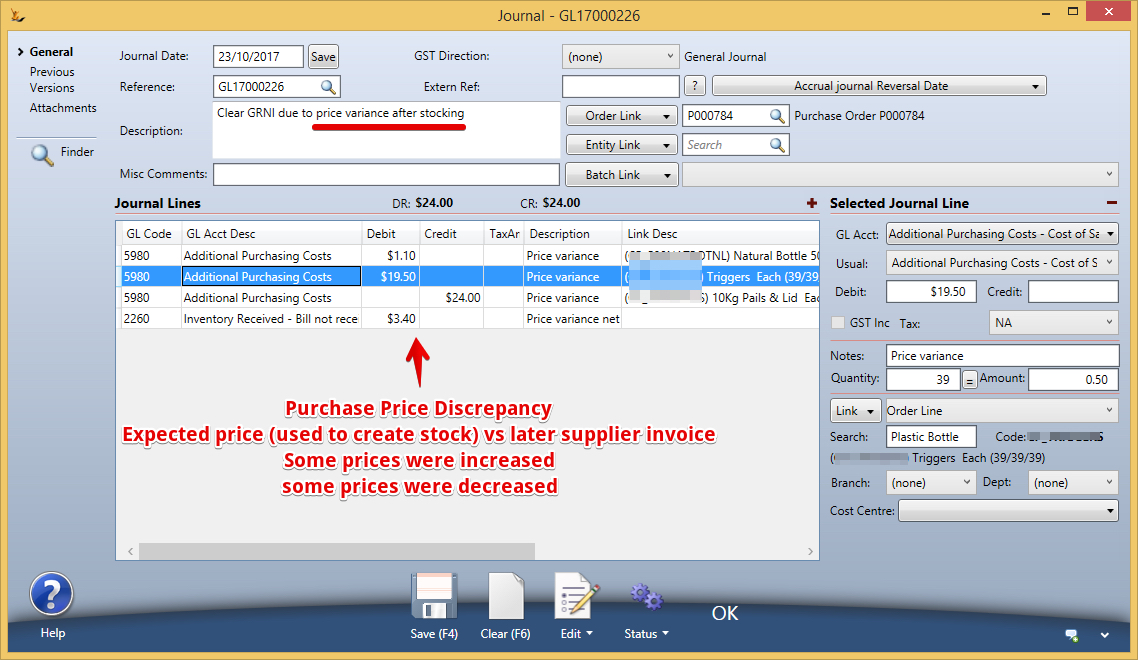

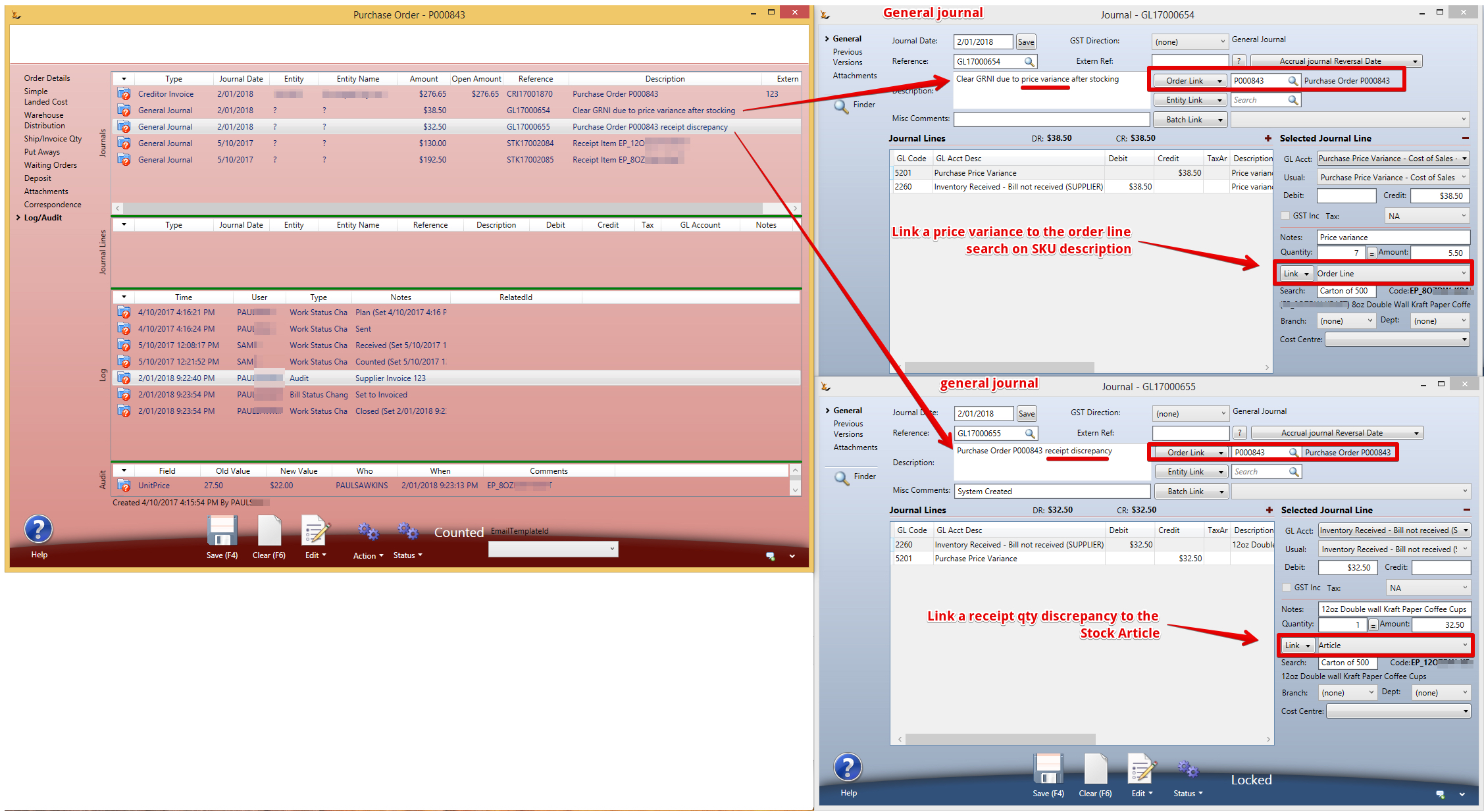

Price Variance Journals will be created the Creditor Invoice is created

Uses the Purchase Price Variance GL Control Account

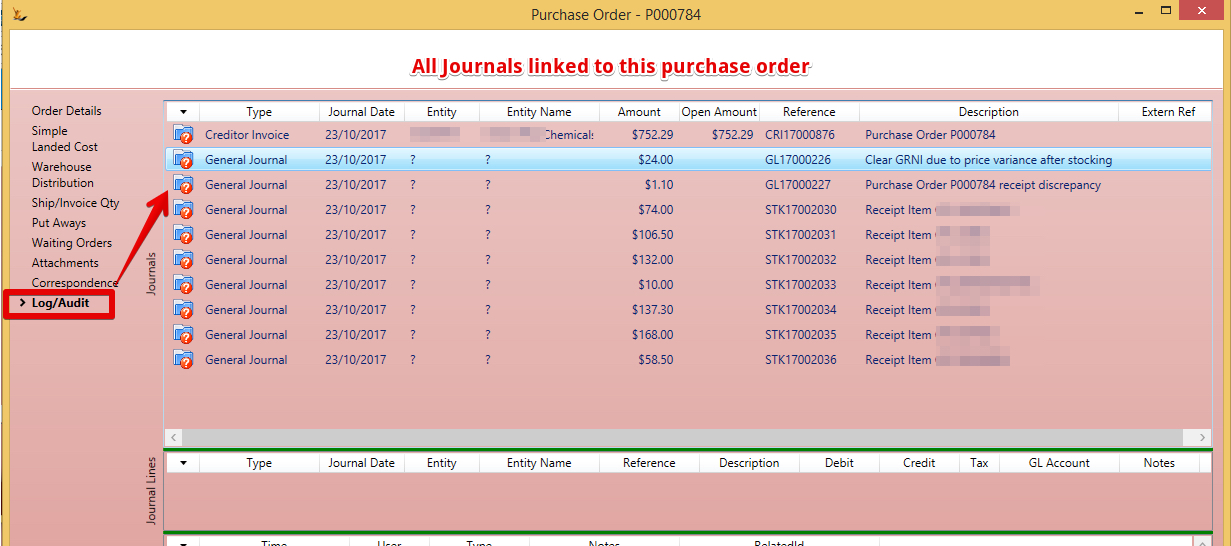

Can view all that has happened on the Purchase Order

All linked Journals can be found from the Purchase Order

An example of the Journals created by discrepancies

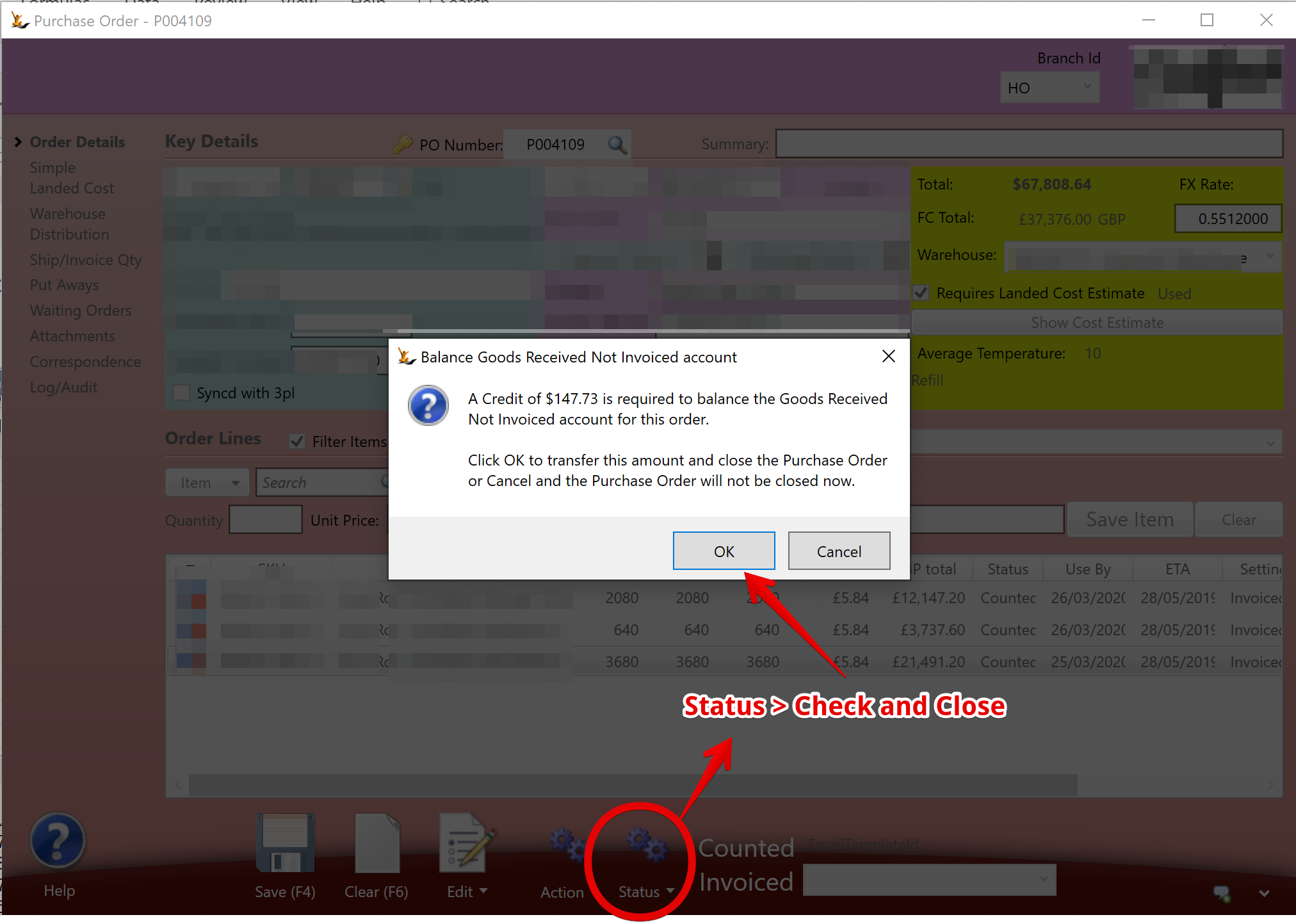

FX Purchase Orders and Goods Received Not Invoiced Account Balance from rounding

When the stock arrives - the value of stocking the goods is linked to the "Goods Received Not Invoiced" GL Account

When the invoice is created the same GL account is referenced - and the net result should be zero.

However - an Foreign Exchange purchase order may have a small variance due to rounding

- The Price each in the FX currency is converted to a price ea in AUD - this involves rounding to two decimal places

- The stock is received using the rounded AUD value each x qty

- The invoice line is calculated using the total FX amount (FX each x qty) and then converting this to AUD and then rounding it

- So because the calculations are different a variance in AUD may exist

- Example

- Qty 2080

- price ea 5.84 in British Pounds, FX rate of 0.55 AUD to GBP - results in AUD $10.62 each

- Stock receipt journal creates value in Goods receipt not invoiced GL account using AUD$10.62 each x 2080 = $22,089.60

- Creditor invoice removes value from Goods Receipt not invoiced GL account converting FX total (2080 x 5.84 = GBP 12,147.20) - converting to AUD $22,085.82

- This would leave a small value ($22,089.60 - 22,085.82 = $3.78) in the Goods Received not invoiced GL account for this line

- For many lines this can build up to a more significant value.

- Example