...

- Any entity you deal with in a foreign currency - all transactions will be in that currency

- Your GL is always in local currency

- So transactions are always converted using the exchange rate to local currency

- Transactions will have their own exchange rate

- Reconciling transactions with different exchange rates (payment to invoice or credit note to invoice etc) will result in a realised gain or loss journal being created

- Bank accounts may have no transactions - however due to exchange rate movements you may need to revalue the local currency equivalent in the system

- Exchange rates can be maintained centrally and will default onto transactions - however they may be overwritten at the transaction level.

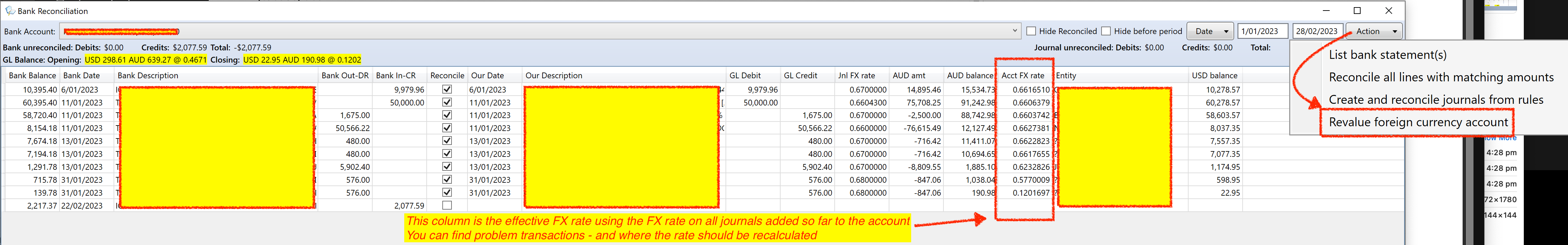

- Bank Reconciliation is in the foreign currency

- When creating Journals from the bank reconciliation screen > the FX value is fixed based on the value on the bank statement upload

- Changes

- If the FX Rate is changed:

- If the journal has a bank account and has been cleared in a bank rec then the amount of the bank account currency will be preserved and the other currency amount will be recalculated using the changed FX Rate.

- Otherwise the user will be asked if the local or foreign currency amount should be recalculated.

- If the local currency amount is changed:

- If the journal has a foreign currency bank account and has been cleared in a bank rec then the FX Rate will be recalculated.

- Otherwise the user will be asked if the foreign currency amount or the FX Rate should be recalculated.

- If the foreign currency amount is changed:

- If the journal has a local currency bank account and has been cleared in a bank rec then the FX Rate will be recalculated.

- Otherwise the user will be asked if the local currency amount or the FX Rate should be recalculated.

- Allocations are removed and a message displayed when

- Allocations exist

- The client is changed (Debtor or Creditor)

- Local currency amount of a local currency journal is reduced

- The FX currency amount of a FX currency journal is reduced

- If the FX Rate is changed:

- Marketplace Orders

- Definition: Drop Ship on behalf of a customer direct to their customer - ie Amazon, Myer Drop Ship, Catch of the Day etc.

- Are invoiced in bulk - so many orders are on a single invoice.

- Therefore the FX rate on the order is not relevant - the FX rate on the invoice is and the order must be updated

- When an invoice is created for marketplace orders then, for each order:

- If the FX rate of the order is different to the FX rate of the invoice then:

- Change the FX rate of the order to match the invoice.

- Recalculate the GP% of the order and the line margins and save them.

- If the FX rate of the order is different to the FX rate of the invoice then:

- If the FX rate of a debtor invoice is changed and saved and there are marketplace order lines linked to the invoice lines then, for each order:

- If the FX rate of the order is different to the FX rate of the invoice then:

- Change the FX rate of the order to match the invoice.

- Recalculate the GP% of the order and the line margins and save them.

- If the FX rate of the order is different to the FX rate of the invoice then:

Selling or Purchasing in a foreign currency

...

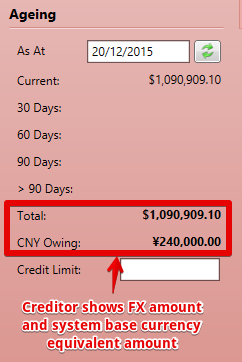

The amount outstanding on the Supplier shows in the FX currency as well as the system base currency.

Creditor Invoices for FX Purchase Orders that have a deposit the same as the final invoice amount

When an invoice is created for a PO with

- FC total prepaid

- and small local currency balance

- then create a creditor general journal to transfer the local balance from Trade Creditors to Write Off (small) GL account.

- The amount will be allocated between the 2 journals and both will be marked as fully allocated.

Manual small local amount write off for any FX Creditor invoice

If a creditor invoice is

- in a foreign currency

- the foreign currency balance is zero

- the local currency balance is not zero (might be credit or debit)

- and the open amount equals the local currency balance then the Action menu will have an option to 'Write off small local currency balance'. Choosing this will create a journal as described above.

Creditor invoices for Shipping Agents (that include 100% GST lines)

...

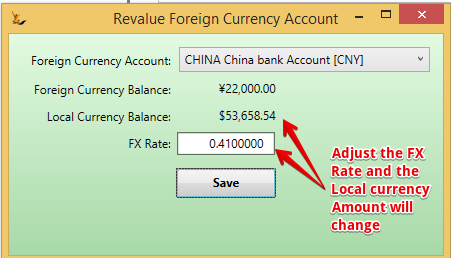

Normally this in only done at the end of a reporting period - but it can be done anytime

Can access from the Action menu on the bank account

A general journal will be created between the FX bank account and the account you have setup in GL Control Accounts for Foreign Currency Gains / Losses (normally an operating expenses account)

...