...

Supplier payments need to be entered into the system so the Bank Reconciliation process has the relevant transactions in it and the financial information is up to date.

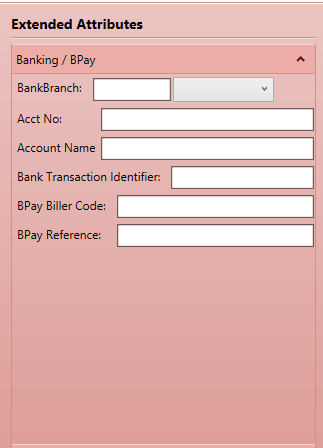

Supplier Banking and BPAY Details

Used by the system when creating ABA files to pass to the bank or referenced when making manual payments

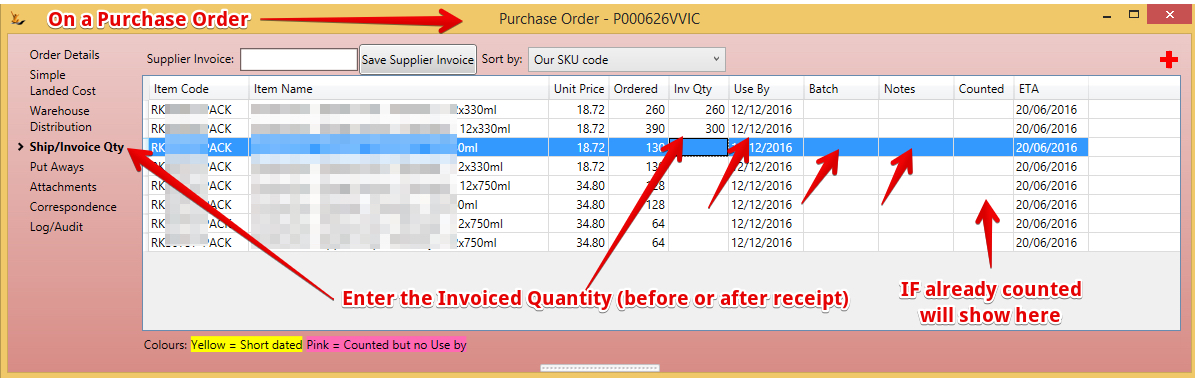

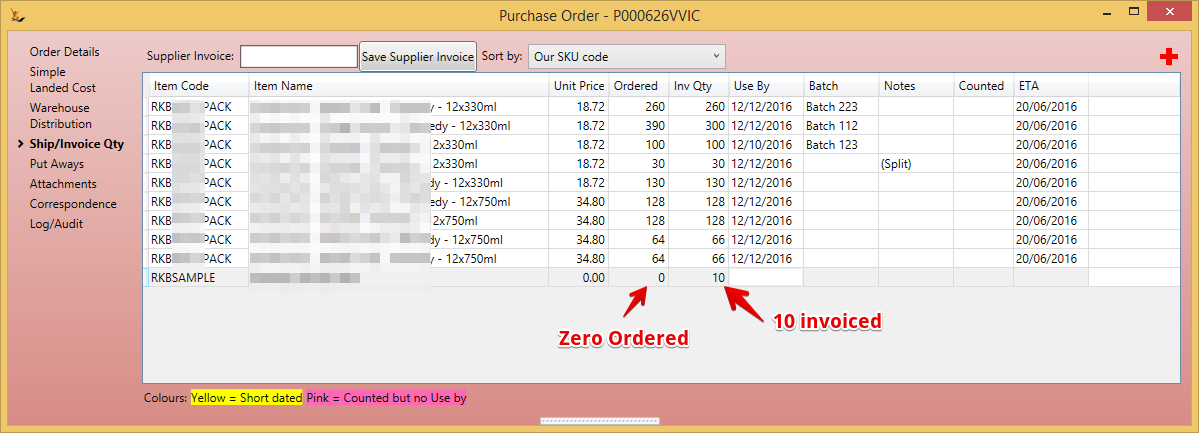

When a Supplier Invoice relates to a Stock Purchase Order

Enter the quantities on the supplier invoice

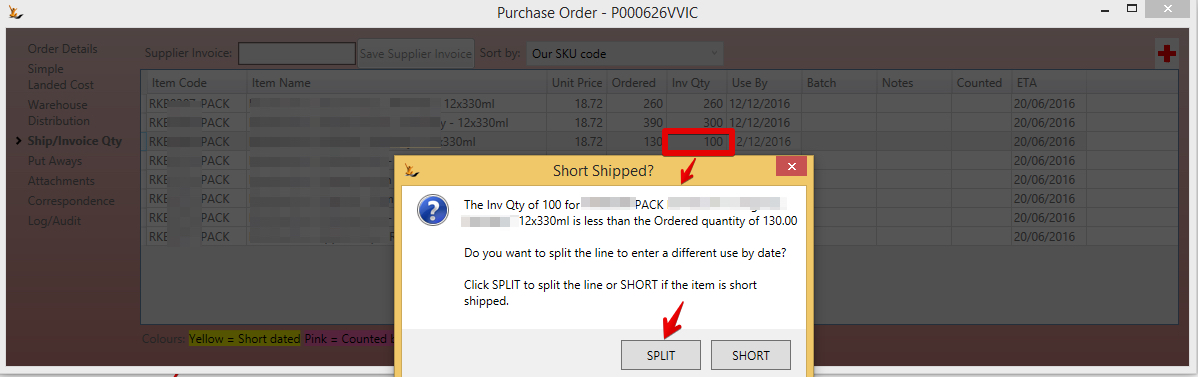

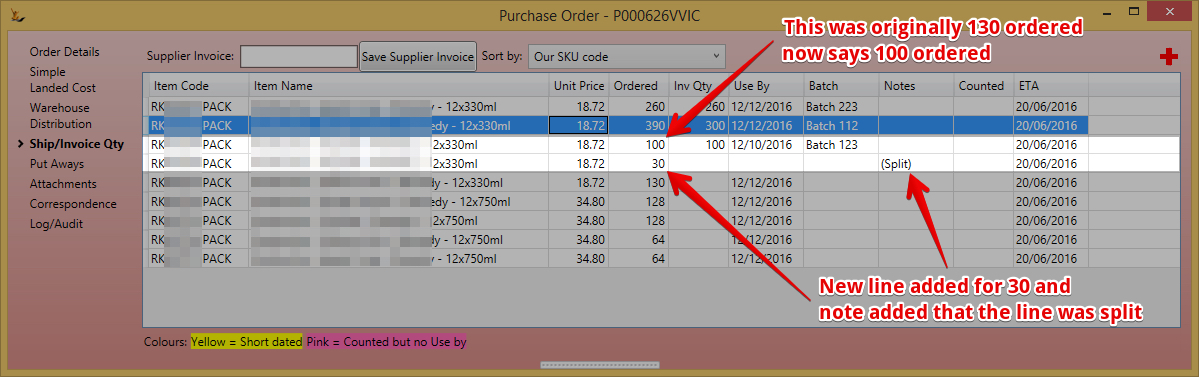

If multiple batches / useby's sent then may split the lines

Result

Or Accept the Short Option

If More than PO quantity then accept Over

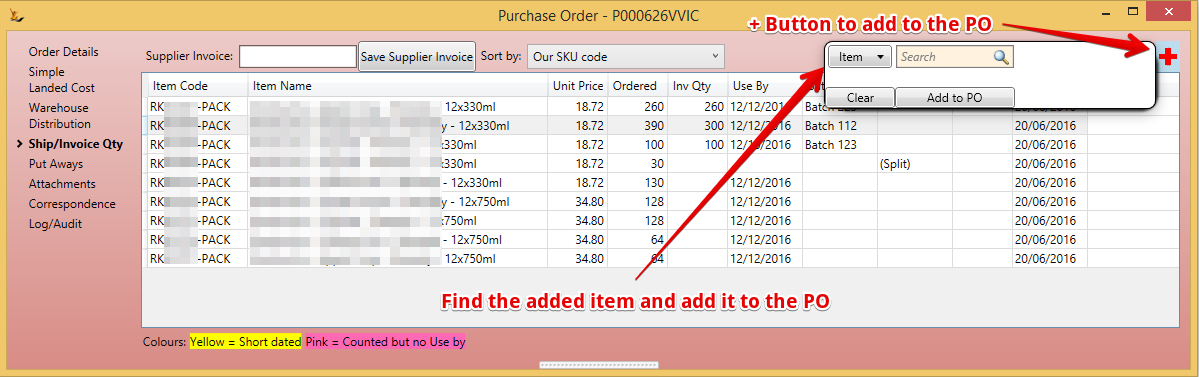

If products that were not on the original order are on the invoice - add lines

Result

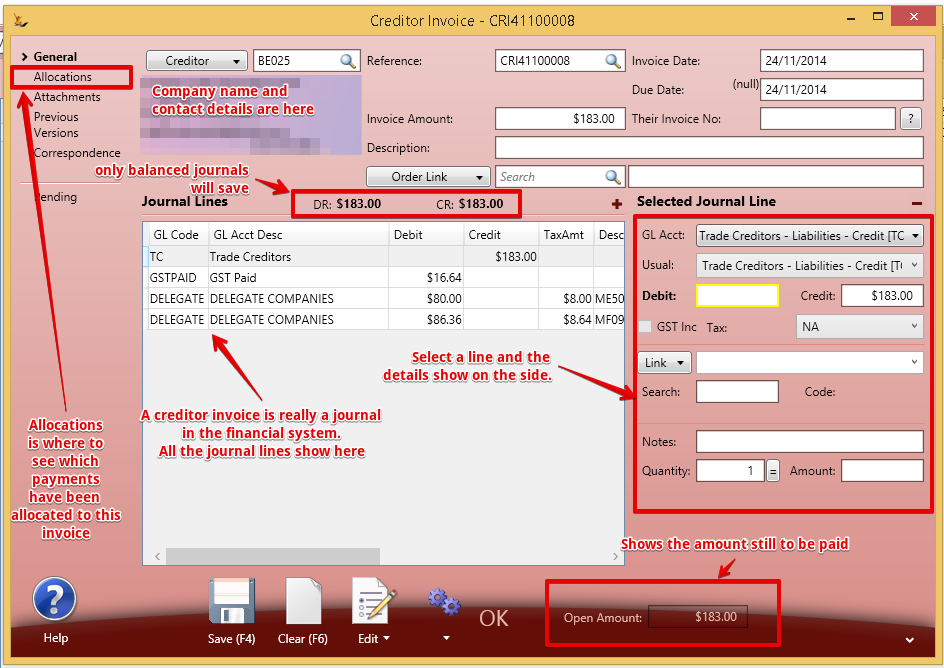

Supplier Invoice - Manual Creation

Open a Supplier (Creditor) Invoice screen

| Note |

|---|

Do not manually create creditor invoices for stock purchases - they require a purhase order / stock receipt - and the invoice is created on the back of the purhase order. If a stock transaction is not required - it it was receipted into a previous system and the invoice has just been received - then create a manual invoice (similar to importing open invoices when first starting) |

Once you have filled in the header information - then add the lines to the invoice (add more lines using the "+" above the grid RHS )

If you want to purchase a service - set the link to service - find the service and the GL account will default from the service chosen

| Note |

|---|

Step 1 = creditor, their reference, invoice date, due date, invoice amount (incGST) - description you would use to find the invoice later Step 2 = add the lines you want to have on the invoice - then save (Trade Creditors line will add when you save) Step 3 = Edit > Attach > attach a scanned document (if your attached printer is also a scanner) = put the supplier invoice face down on the scanner and a copy will be added |

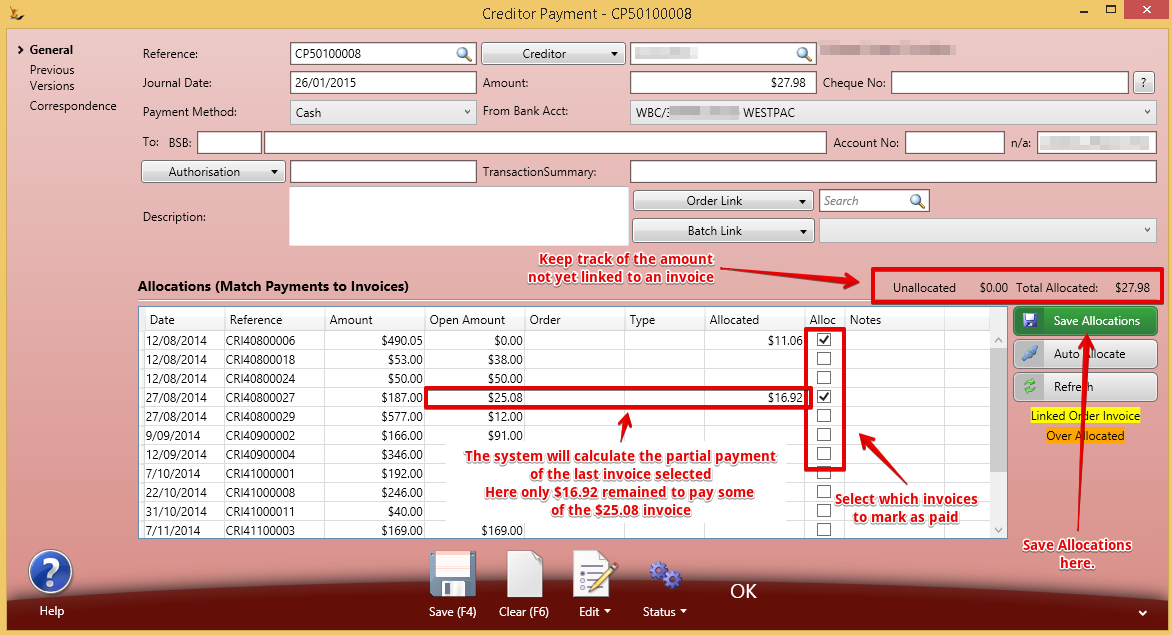

Supplier Payment

Use the Action Button on an Invoice to create a payment

...

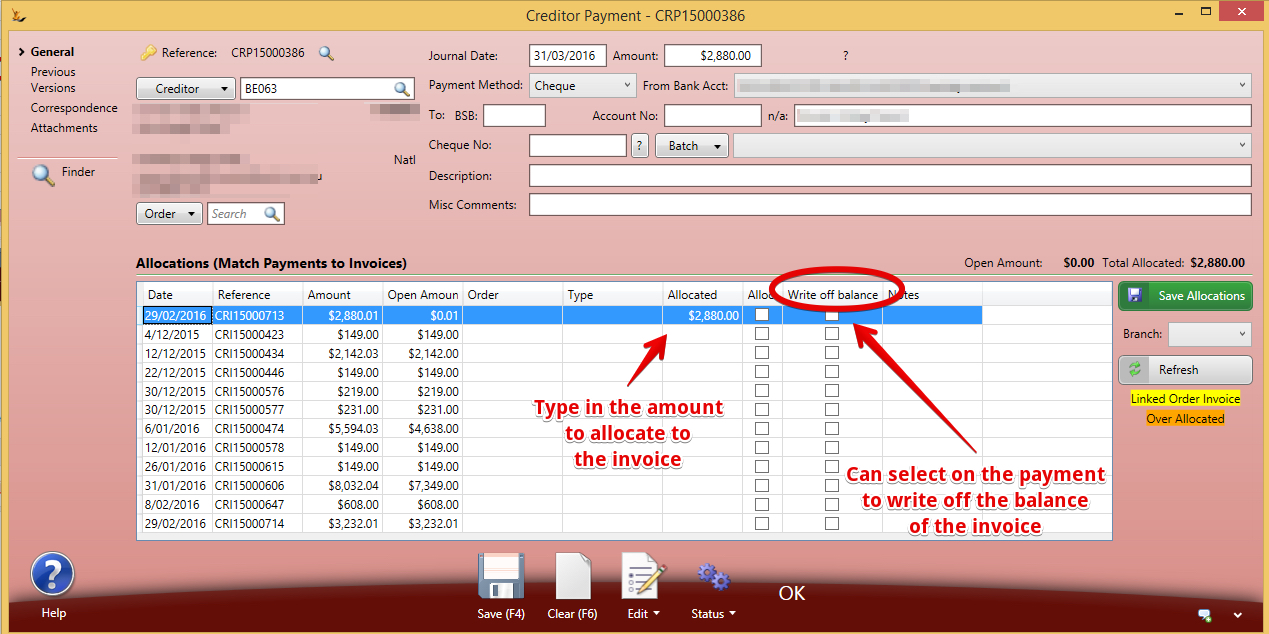

Next allocate the payment to the invoice/s you wish to mark as paid

Allocations of Payments and Credit Notes to Invoices

From the payment screen

Now the payment will be allocated to the invoices.

Small Amount Write offs

Small amounts occur when the rounding of the system is different to the rounding used in your customers system - and is normally only a few cents.

| Note |

|---|

to use this feature the user needs Secure FeaturesFeatures#CanWriteoffCreditorBalance. Note also that small amount write offs are limited on Creditors to 10c per invoice by the system. Larger amounts you will need to use create a Creditor Credit notes. |

...

note |

A small (<10c) write off will create a Creditor General Journal that will be allocated to the invoice. >10c will create a creditor credit note.

Small Amount Write off of the invoice from the Payment

An invoice has a small rounding error you want to write off

Small Amount Write off from the Invoice

Bulk Payment of Suppliers

| Include Page | ||||

|---|---|---|---|---|

|

...

| Page Properties | ||

|---|---|---|

| ||

|