...

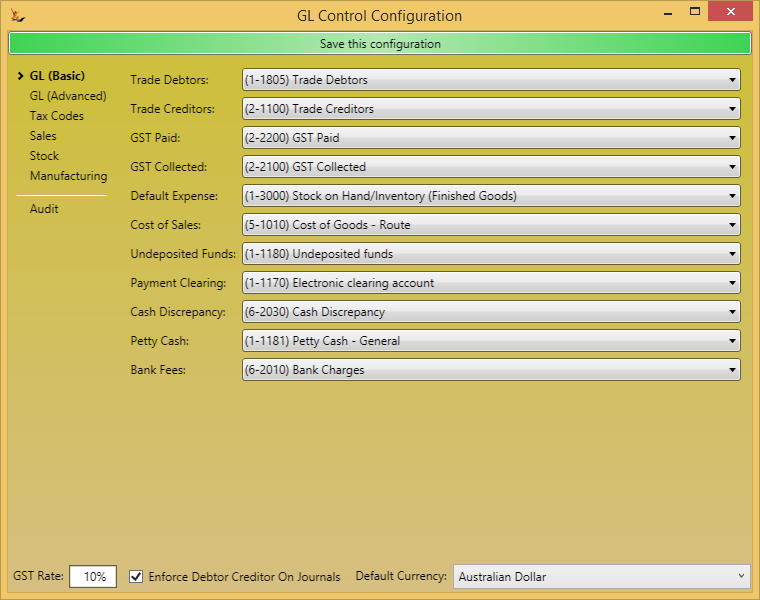

- Trade Debtors, Creditors - for invoices

- GST Paid and collected - for GST

- Dftl Income and Expense is Default Income and Expense Accounts

- Undeposited Funds - for funds received but not yet deposited (eg cash in a till)

- Cash Discrepancy - for when counting cash floats

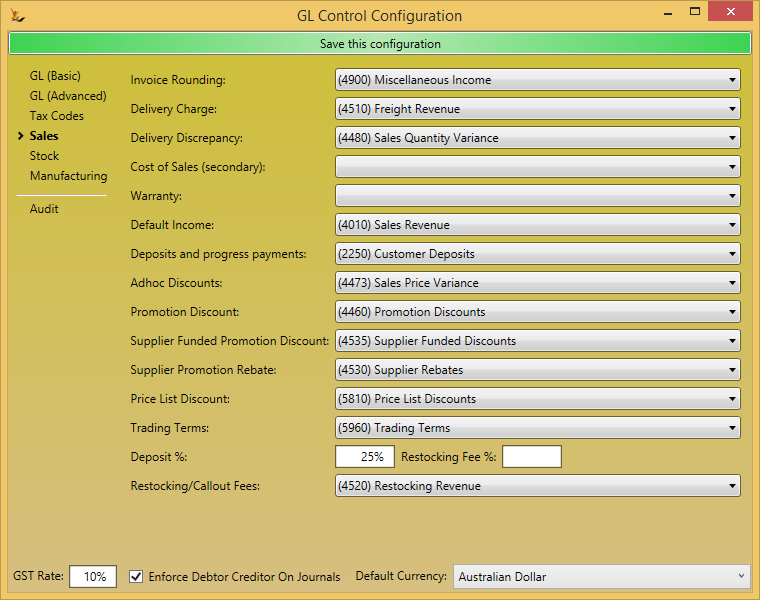

- Invoice Rounding on sales invoices when cash sales are made

- Delivery Charges on sales orders

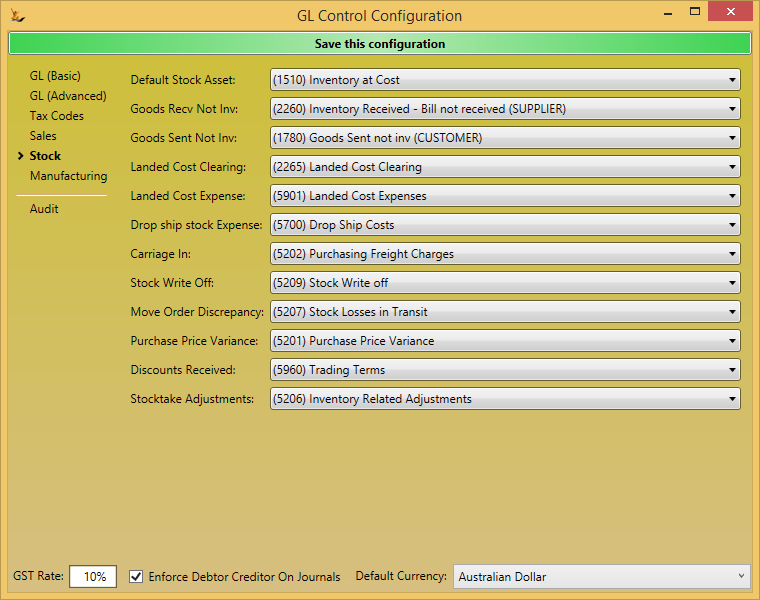

- Goods Received not Inv is goods received not invoiced

- Default Stock Asset - Inventory stock on hand

- Cost of Sales - COGS

- Cost of Sales AssemblAssembly - is cost of Sales Assemblies that are assembled only when sold and not stocked.

- Warranty costs for parts and labour

- Stock write off - example returns to scrap

- FC Position Foreign Currency

- GST Rate

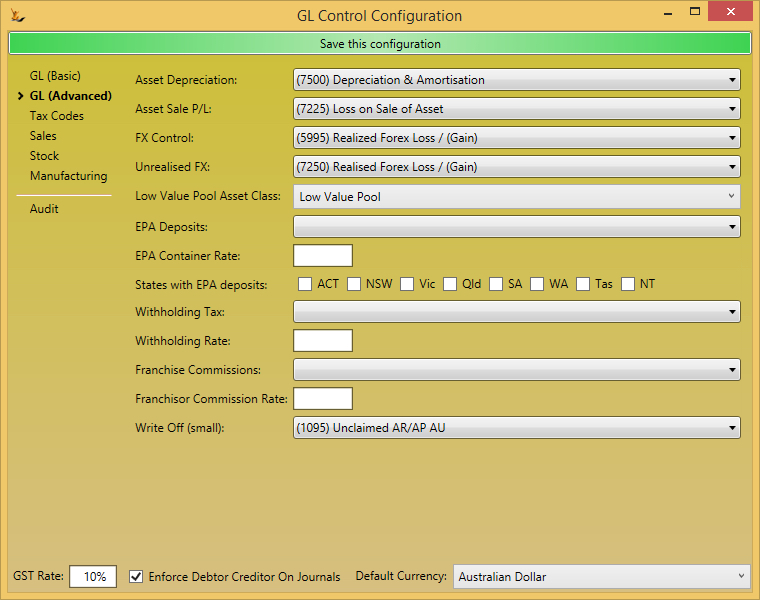

- Asset Depreciation - for depreciation expense

- FX Control - to track foreign exchange adjustments

- Unrealised FX - gains and losses

- EPA is deposits on drink bottles

- Withholding tax is for creditors that do not provide an ABN - The system will warn users on creation of Creditor Invoice. You may add a line to the invoice or instead create a creditors credit note for the withholding amount. The withheld amounts will show on the GST Explorer

- Deposits and Progress Payments - where an invoice may have been raised but with no GST as the funds have not been earnt yet

- Deposit % - where a standard deposit is required

- Restocking Fee - where a standard cancellation charge applies

COD customer orders can be defaulted to 100% payment required either (1) before authorisation or (2) before picking or (3) not defaulted. The % is held per debtor and so can be adjusted for each debtor.