The debtor card has a lot of information on it now. This flow explains how it works and the impact of different fields on the Debtor. Note that each field also has "hover over help".

Table of Contents

Also review Leads

How Host Company Settings impact on the Debtor

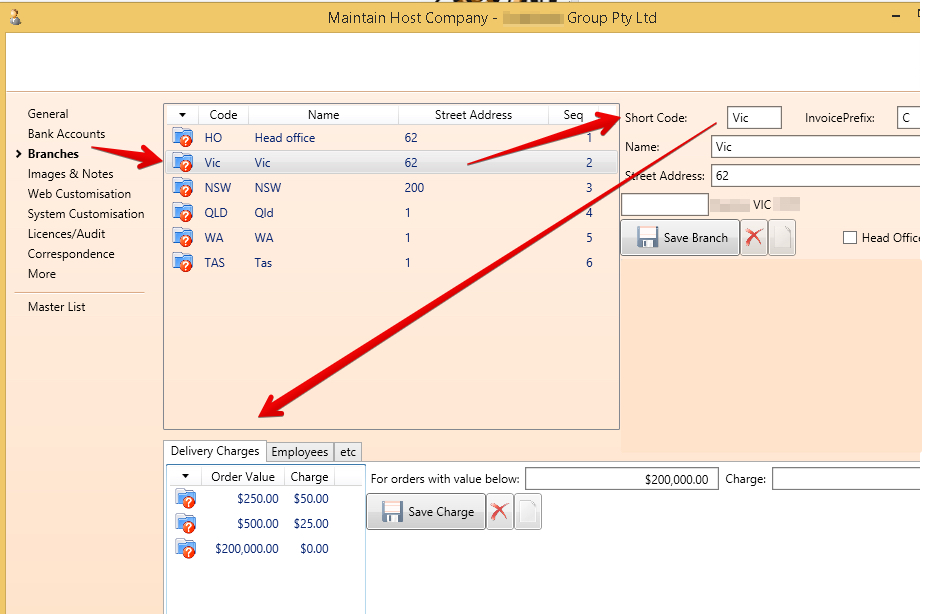

Branches of your Host Company

Branches are optional in the system

Companies and Persons belong to a Branch

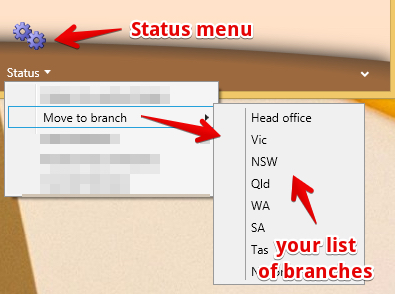

To change the branch use: Status > Change Branch

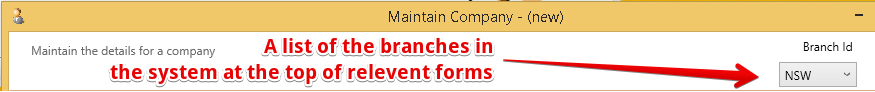

Branches are used across the system to filter the information in the screens - choose the branch in the top of the screen to filter the information you find in the screen

Branches are also used to default some lists that may be branch specific like:

- Warehouses

- Delivery Zones

- Sales Reps

- Invoice templates

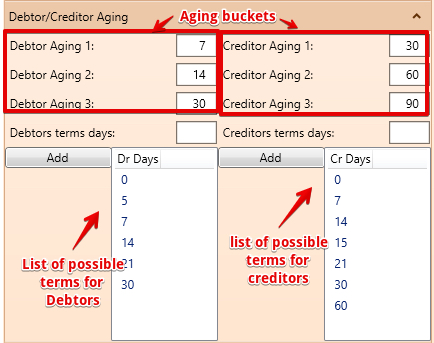

Customer (Debtor) terms and Supplier (Creditor) terms on the Host Company

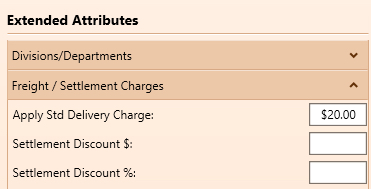

Standard Delivery Charges

Settlement discounts = the $ amount or % amount of an "Asked for" discount to the invoice if it is paid within terms.

Standard Delivery Charges = delivery charge to apply to all invoices - unless branch charges apply (see below)

Branch Standard Delivery Charges based on Order Value

Note that each branch may have different delivery charges based on order value

Settlement discounts - the $ amount or % amount of an "Asked for" discount to the invoice if it is paid within terms.

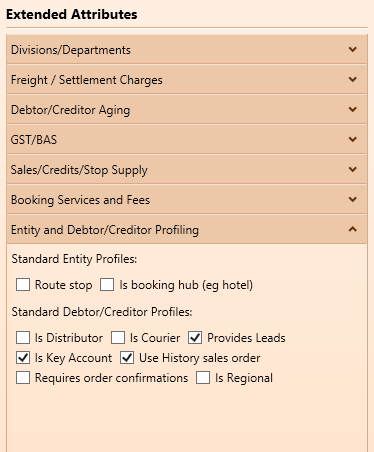

Profiles to appear on your Debtor and Creditor cards

Selection of any of these profiles will cause the profile to appear on Debtor / Creditor cards in the system

Is distributor = can purchase "Buy Only" items

Is courier = will be in courier dropdown lists

Provides Leads = can link a new lead to them and provide a report

Global Persons and Companies

A Person and a Company may be Global - ie visible and a single record across Host Companies.

Owner host company code shows in Advanced Extended Attributes of Person and Company. Will show blank if global.

The relationships between Companies, Persons and Debtors

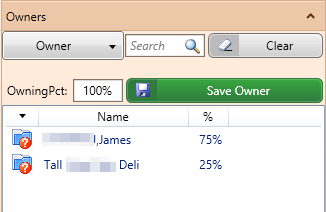

A company may be owned by a number companies or persons

On the company card indicate owner

On the company card you can see all the children

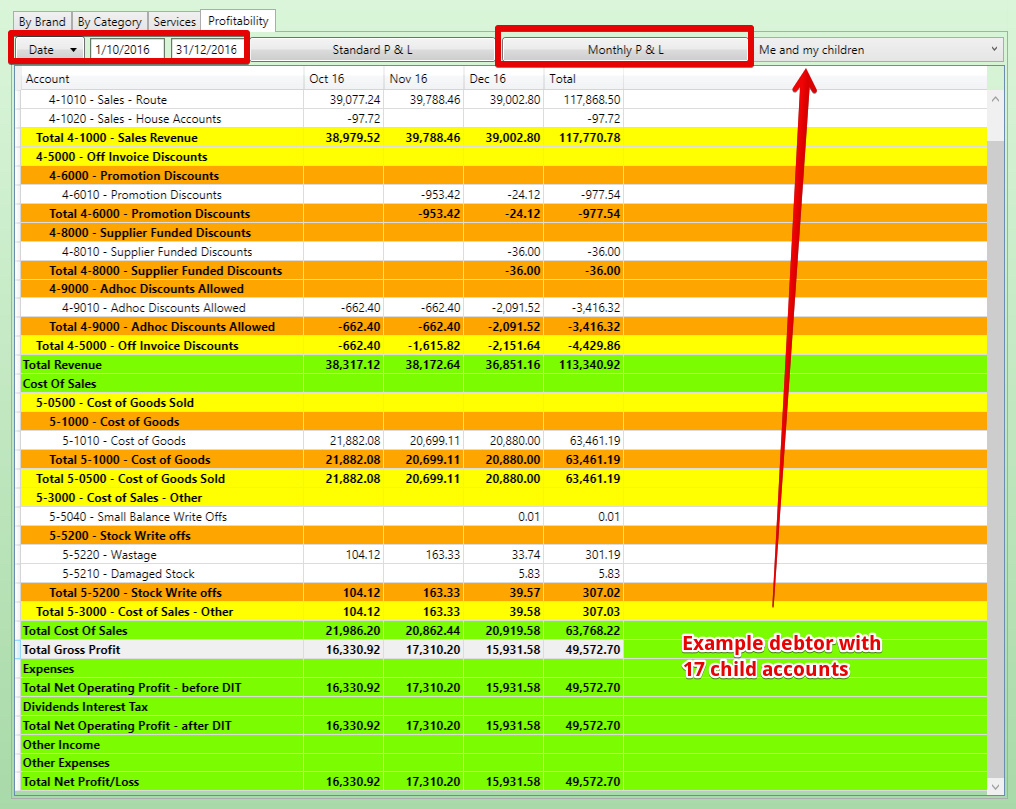

Debtor profit and loss can include the children transactions

Auto emailing Invoices and Credit Notes

If Auto email invoices is ticked then both invoices and credit notes are emailed immediately they are created.

Who gets the emails?

- The system checks who gets the invoices. Debtors can be invoice me, invoice my parent or invoice my buying group

- On the entity that gets the invoices AND on the entity that placed the Order

- Any contact that has a role of type "Accounts" on the Debtor

- Any AP email address from the Entity Card

- If none of the above exist - then the email address on the Debtor card for the invoice entity only

- If none of the above exist - then the email address on the Company/ person card for the invoice entity only

The email

- A PDF of the invoice will be attached.

- Email logged in Correspondence of debtor and invoice.

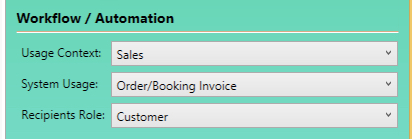

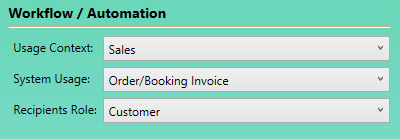

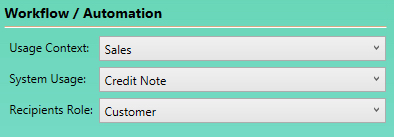

The email template used for invoices:

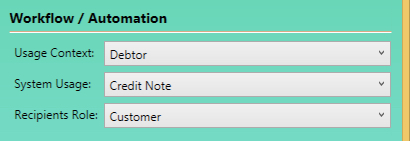

The email template used for Credit Notes

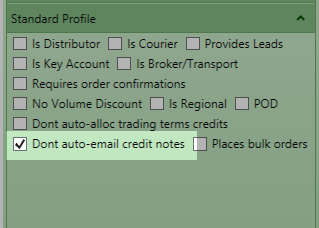

If you do not want to also auto-email credit notes then set this option on your host company debtor profile settings and it will appear as an option on the debtor

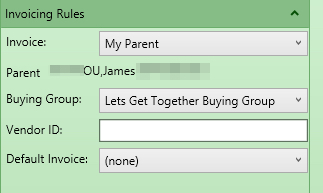

Sending invoices to a Parent Company

On the Debtor

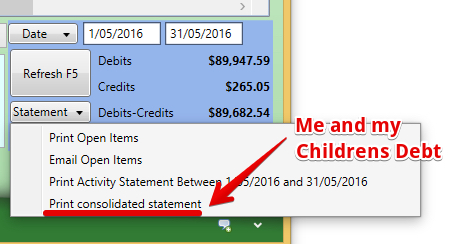

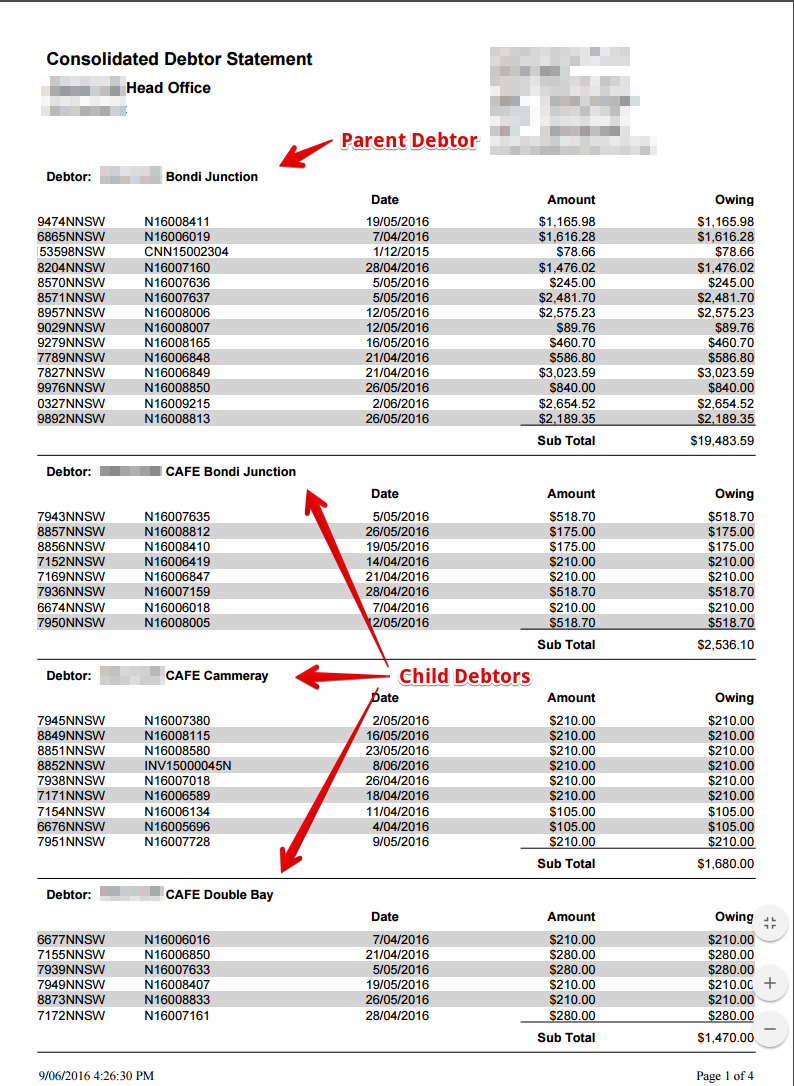

Parent Company Statements

From the Parent Debtor create a statement showing the parent and the children debt

Example printout

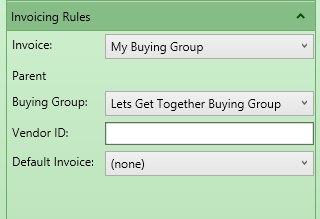

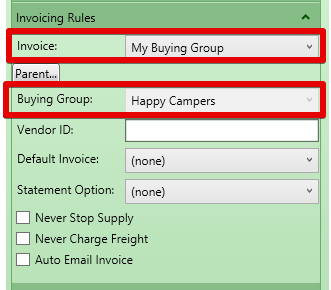

Debtors may be part of a Buying Group

A Buying Group indicates that any order I place will be invoiced to my Buying Group.

Invoice my Buying Group

IF the buying group receives the invoices - then

- Reference the buying group as a membership

- Configure who gets the invoice

Deliver to my Buying Group

A buying group may be the delivery address for the goods for example in the case of a central warehouse Distribution Centre (DC).

Cross Dock

If a Debtor has the Delivery to "My Buying Group" then they are a Cross Dock Customer ( the buying group picks up the stock, takes it to a DC and then delivers it to the store)

Charge Through

If a Debtor has Delivery by your company + invoice to my buying group - then they are a Charge through customer. They will be charged using the buying group price list.

Goods not sent using the default delivery method

Note: The debtor that gets invoiced may be different if you do not send the goods to the default delivery method.

The Invoice will still go to the buying group - but will be sent to a different entity for the buying group - see Buying Group Definition

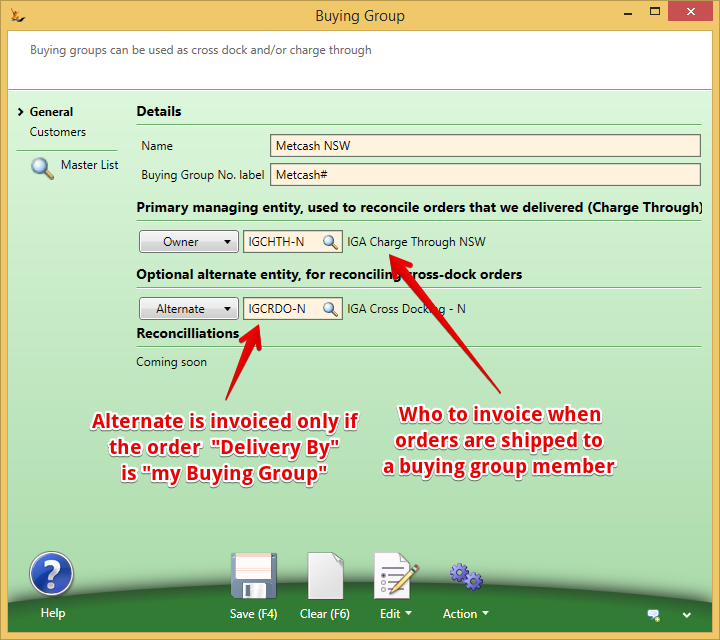

Buying Group Definition

A buying group is a debtor in the system

Normally when a customer is a member of a buying group = they place orders and the invoices will be paid by the Buying Group.

A special case is Buying Groups that invoice from a different entity if they do the delivery to the store ( normally they will charge the store a greater markup) - this is the Alternate on the Buying Group

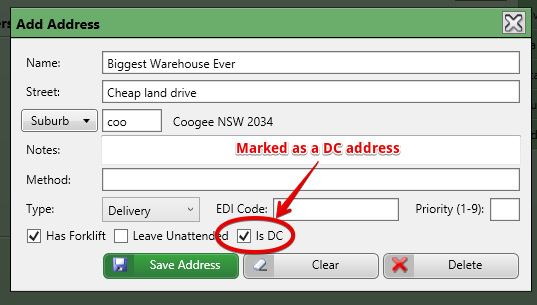

Sending goods to the Buying Group DC

The buying group may be the delivery address - If if there are multiple addresses on the buying group debtor then the system looks for the one flagged as the DC.

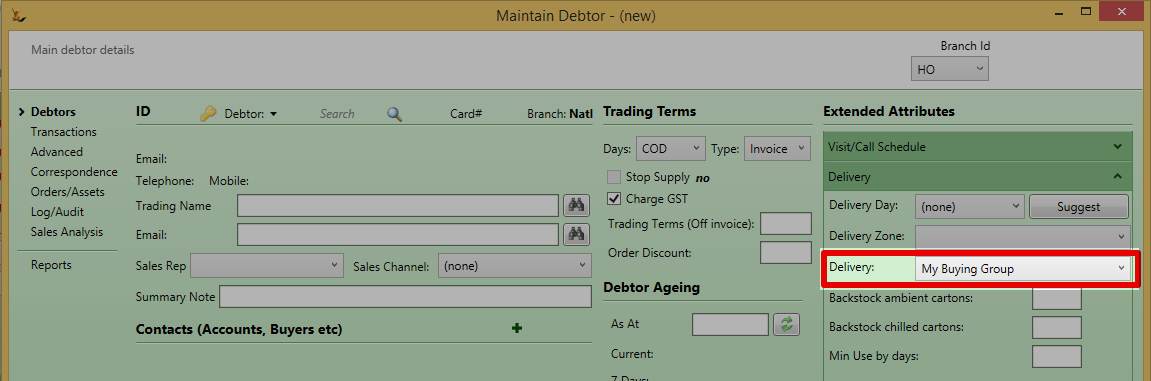

To make a debtor a member of a buying Group

Any Debtor may be a member of a buying group

A Debtor may have invoices sent to the buying group for payment

Note that if the Debtor is the owner or alternate of a buying group the field will not be selectable

If the Buying Group delivers the goods to store by default

ie if goods are delivered to the Buying Group DC and they deliver to the store (can be over-ridden on the sales order)

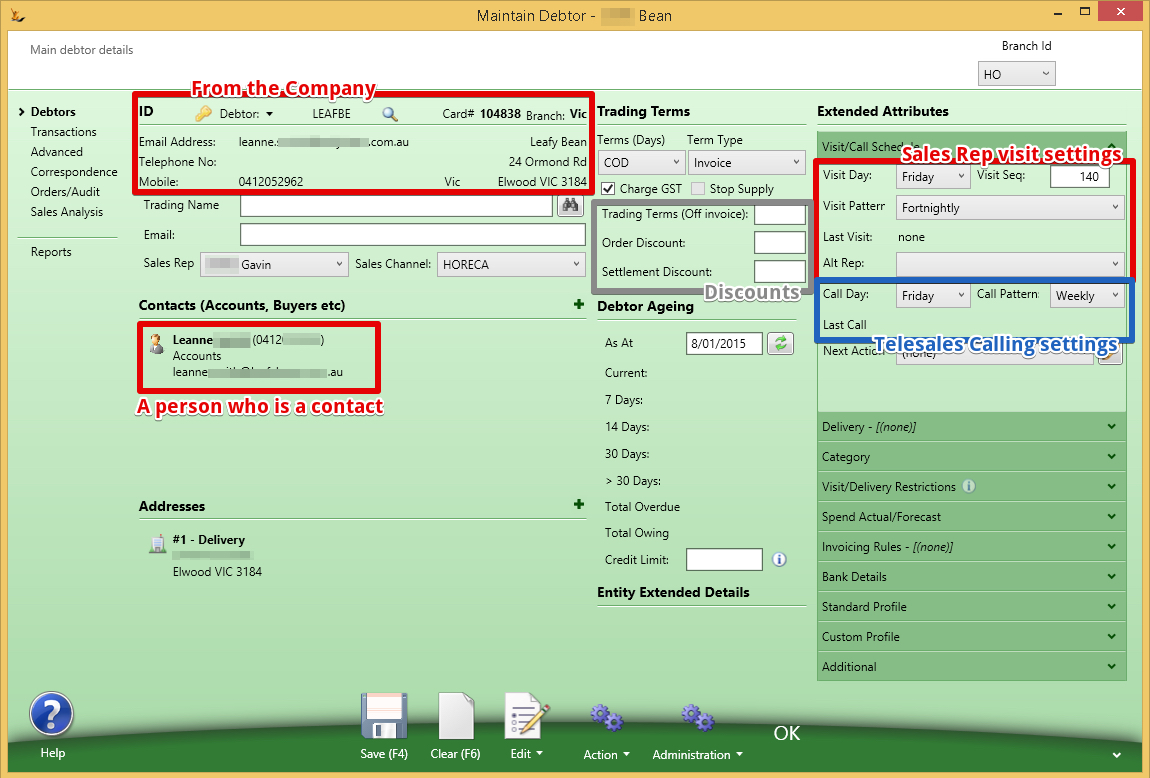

Debtor Main Screen

Key information that is commonly required is on the main screen area.

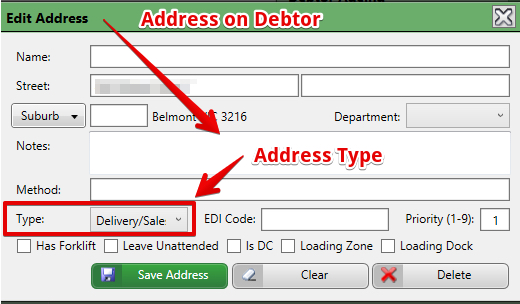

Customer Addresses

The company card will have an address - if no other address is found then this is used on sales orders

When the company has departments setup (eg Dairy, Drygoods etc) then an address may be the default for a department

If the customer has addresses at the debtor level - then these will be available options on the sales order using priority if defined

The number of days delivery on the address is the default number of days from XWarehouse date to customer receipt to go on the sales order

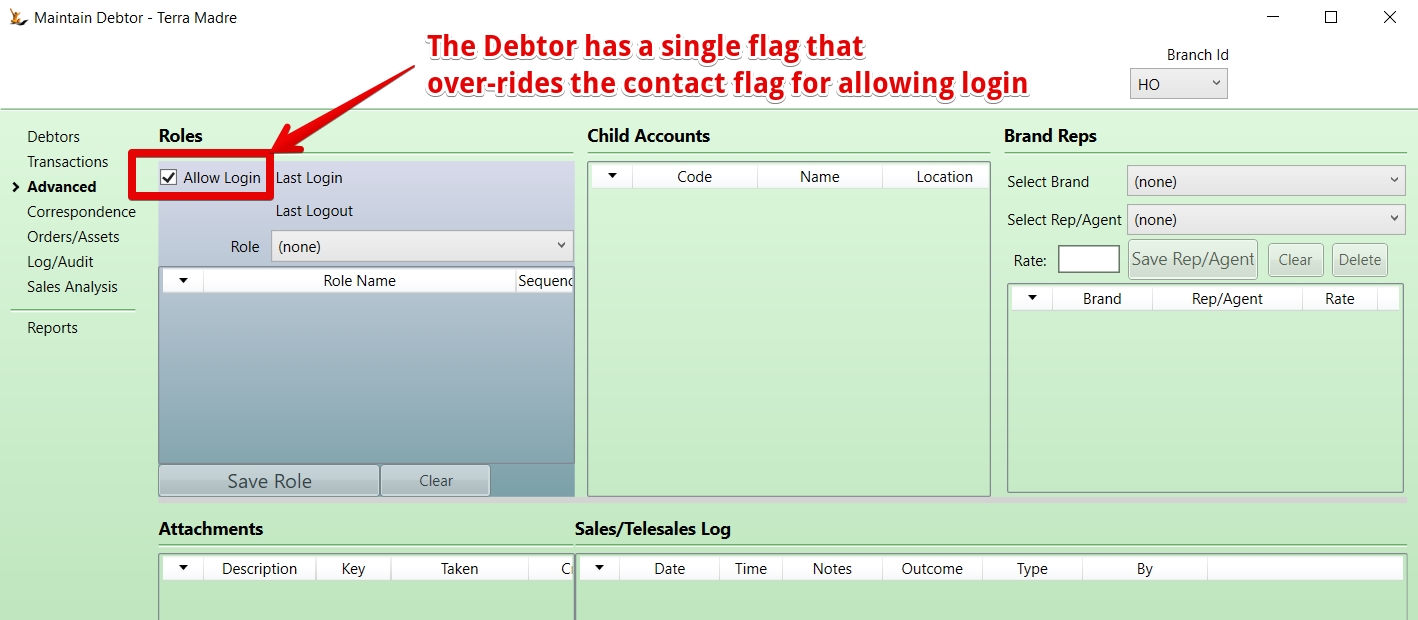

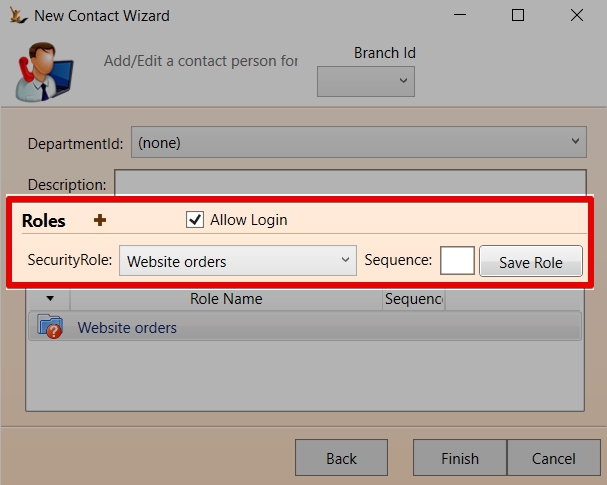

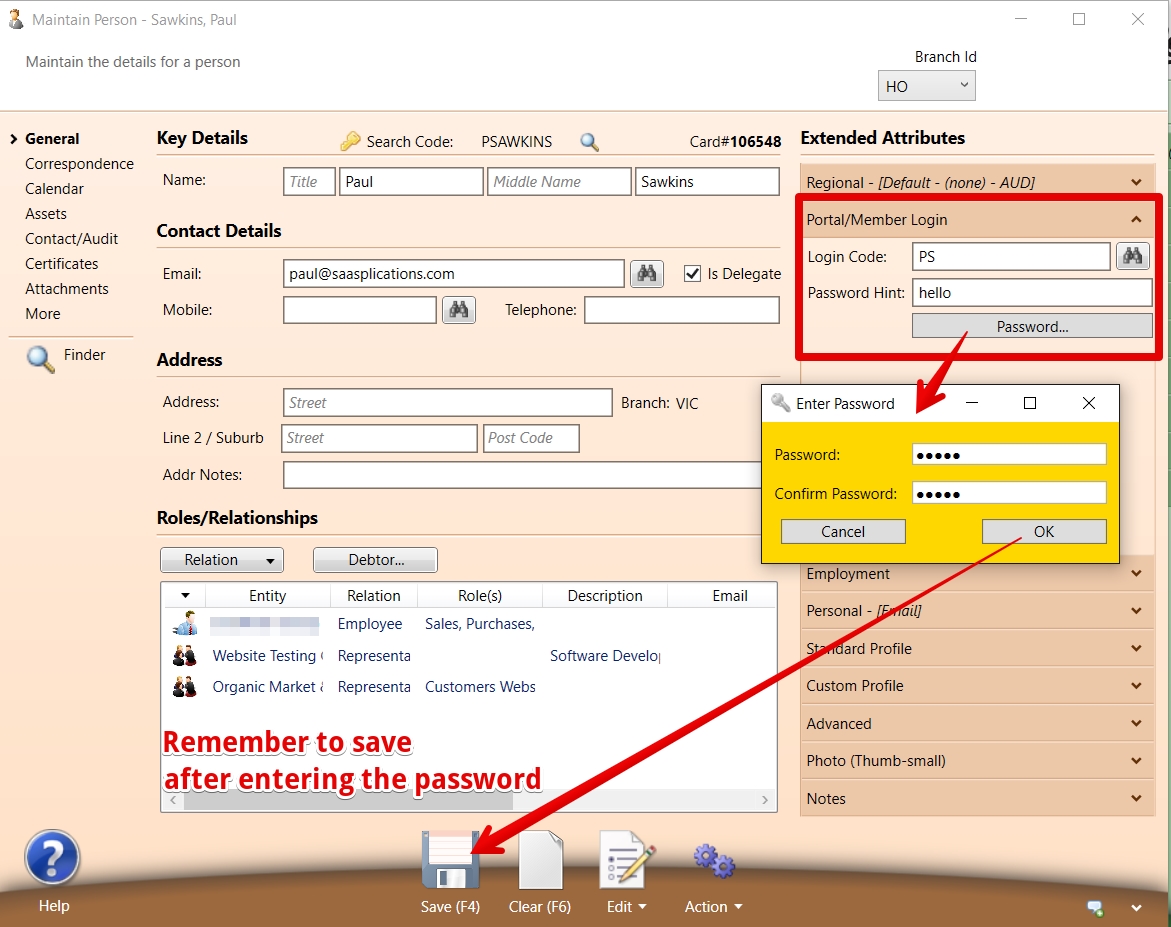

Persons who can login on behalf of a company

Normally required to a website for placing orders or to a Portal to view information

First the company must allow login

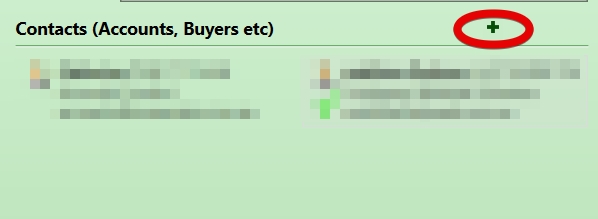

Add the person as a Contact on the Debtor Form

Ensure they have the website menu and tick "Allow Login"

Ensure the person has a login code and password setup

How to tell if a contact is allowed to login to see the debtor information

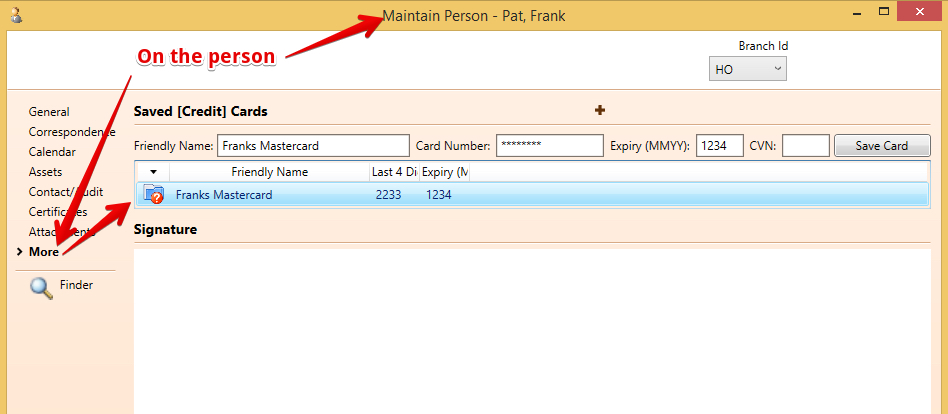

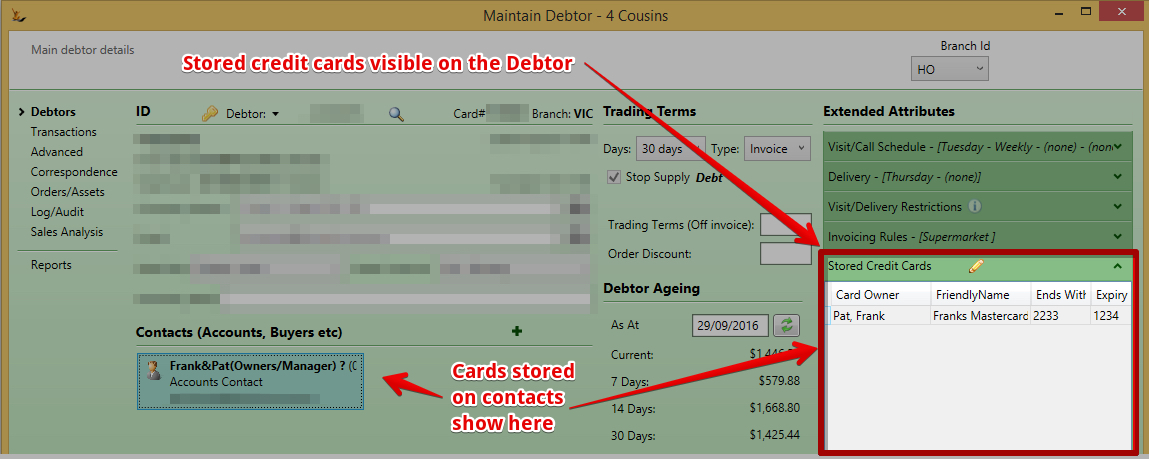

Credit Cards

Credit Cards stored on Person

Credit Cards are always personal - a person is responsible for the card - so they are held on the person

The credit cards held by contacts at the company can be used to make payments

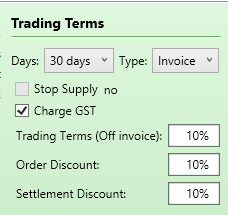

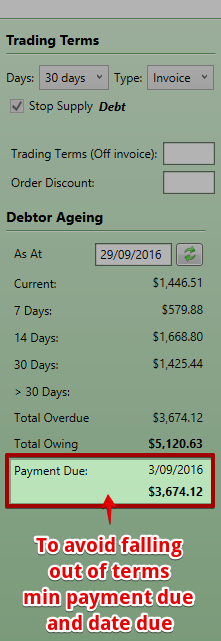

Trading Terms Explained

Trading terms includes

- Days and Reference Type = difference between invoice date and due date = here the due date is based on 30 days from invoice date. Changing the terms will change due dates on all open invoices

- Order Discounts = automatically applied discount to all lines on an order

- Note Order Discounts will not apply to order lines with Promotions of any kind including Pricing Contracts

- Settlement discount = A discount that can be manually applied if an invoice is paid within terms

- Trading Terms (Off Invoice) = A discount that is automatically applied when an invoice is created by creating a credit note for the amount of the trading terms at the time the invoice is created

- The credit note that is created will be allocated to the invoice - unless you have selected "do not allocate trading terms credit notes" on the customers "Standard Profile"

- If a company does not want a per invoice trading agreement - instead based on revenue over a period of time - this is best done manually as a credit note with supporting documentation.

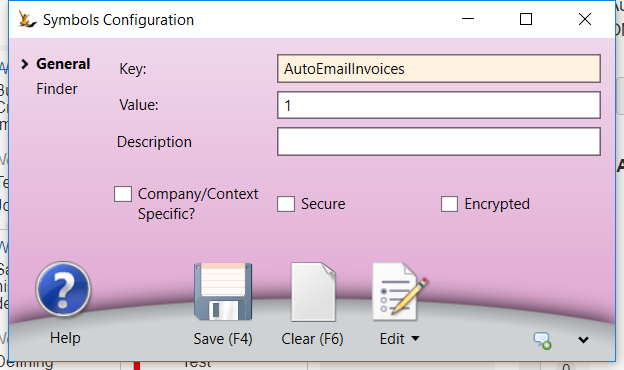

Auto-Email Invoices

Invoices are emailed once an invoice is marked delivered.

Requires also a profile setting to be activated

See Email Templates to setup the following templates:

Configurations available:

| Requirement | Symbol Config Required |

|---|---|

| FromEmailAddress | emailaddress@yourcompany.com |

| FromEmailAddressAP | emailaddress@yourcompany.com |

| FromEmailAddressAR | emailaddress@yourcompany.com |

| AutoEmailInvoices | 1 |

| AutoEmailInvoiceDefault | 1 |

Email template for Invoices:

Email Template for Credit Notes:

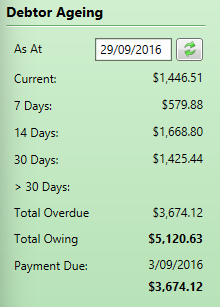

Debtor Ageing can be shown for any date

Shows the amount owing compared with the Due Date.

So All Current is within payment terms. All other amounts are out of payment terms.

This Debtor has amounts 7 days, 14 days and 30 days overdue = sums to total overdue.

The Payment Due is the amount and date that a payment must be made to remain in terms. This date may be in the past.

Deliver Address

Setup the addresses and determine if they are an office or a delivery address

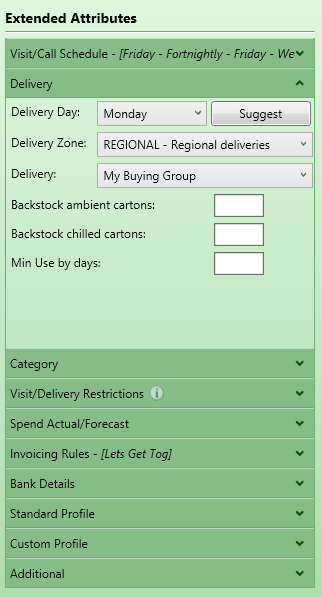

Detailed information is the concertina

Note most items have hover help and are self explanitory. Some are clarified here

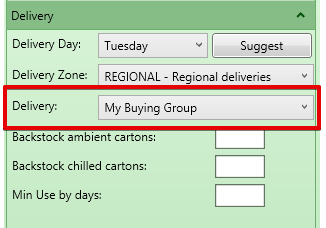

Delivery Information

Delivery day is used to calculate ETA date on Sales Orders when created

Suggest will review the delivery zone and the other debtors in that zone

Delivery by my buying group indicates stock will be sent to a buying group DC and not directly to the customer

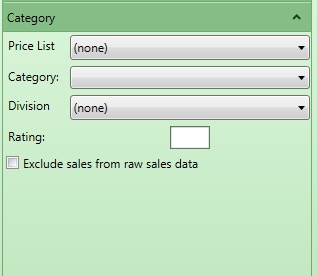

Category Information

The Customer Category from sales categories and used in sales reports

The division (From Host Company) used to indicate internal groups

A Rating - used only for scarce stock allocation

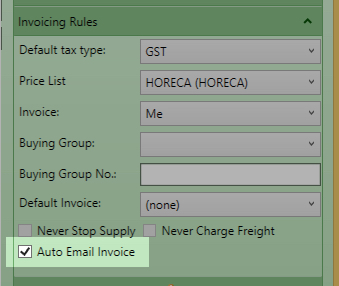

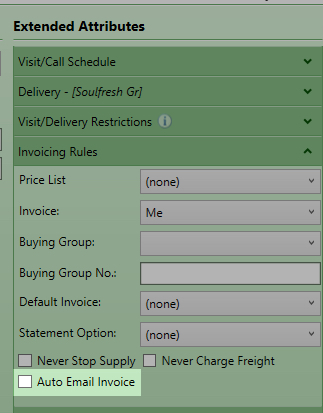

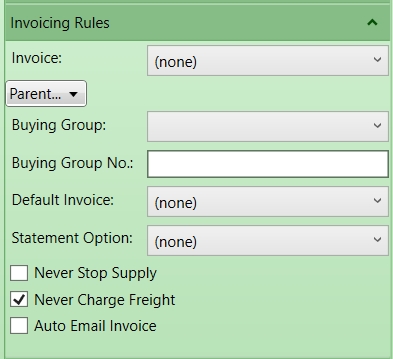

Invoicing Rules

Invoice : who pays my invoice

If my company has a parent (see company card)

Default invoice layout

Statement Option (do I want it emailed / mailed etc)

Never Stop Supply - to avoid this customer being put on stop supply for late payments

Never Charge Freight - to avoid smaller orders attracting freight

Auto Email Invoice - every invoice is immediately emailed to all contacts with an Accounts Role as the goods are dispatched

Standard Profile

Contains the system flags that have been turned on in the Host Company to be used on Debtors / Creditors

Custom Profile

Custom fields you have created to track on debtors

Customer registration process on the web

When a customer registers on your website - they might already be in the system.

- If the last name and mobile number matches the email address on record - they will be linked to this record. Password will be emailed to them using the Email Template with - Usage: Authentication System Usage: Created Role: Customer

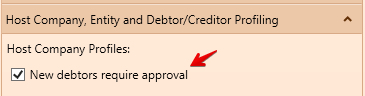

Who can create an Active customer

By Default all users can create Active Customers unless a restriction is set on Your Host Company:

If New Debtors require approval then:

- Users with Secure Feature "Can Maintain Debtor Terms" can make debtors active

- Users without this secure feature will create Debtors in status "Proposed" status

- Orders placed on users in "Proposed" Status will be on hold until the debtor is made active.

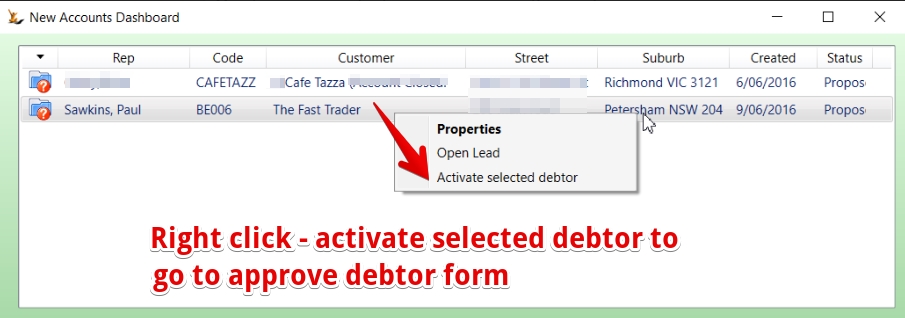

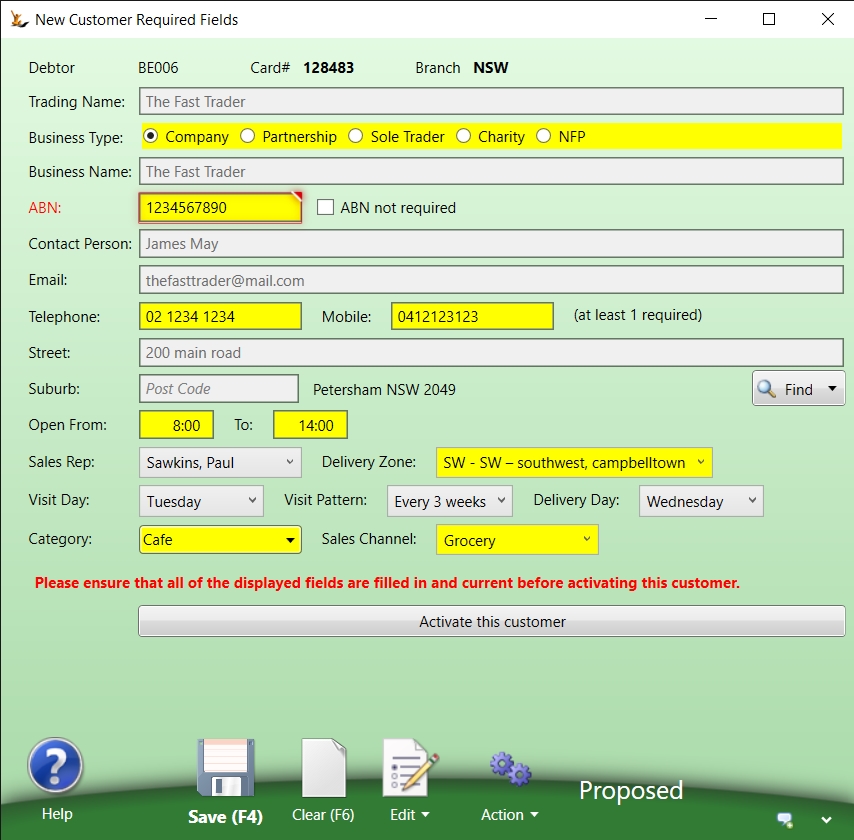

Making Customers Active (if require approval)

Review the new debtors dashboard - this shows all the leads or debtors in proposed status

Fill in the details required to make the debtor Active

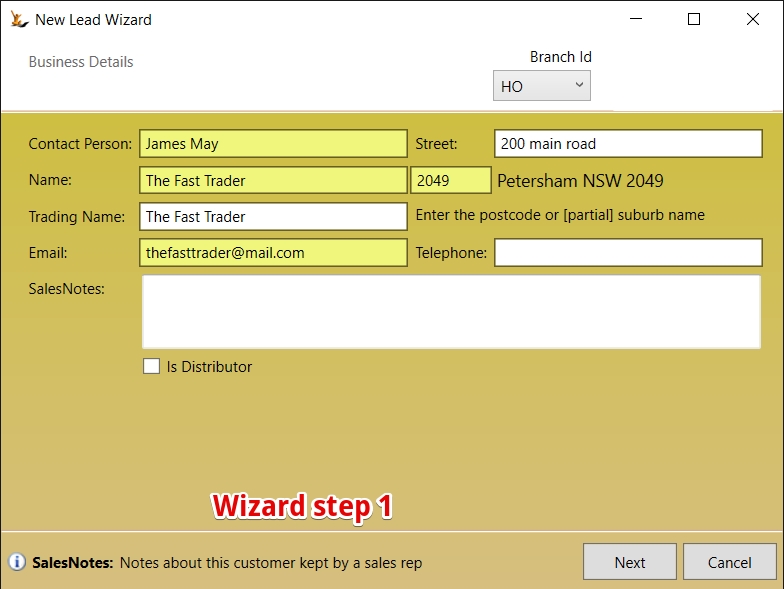

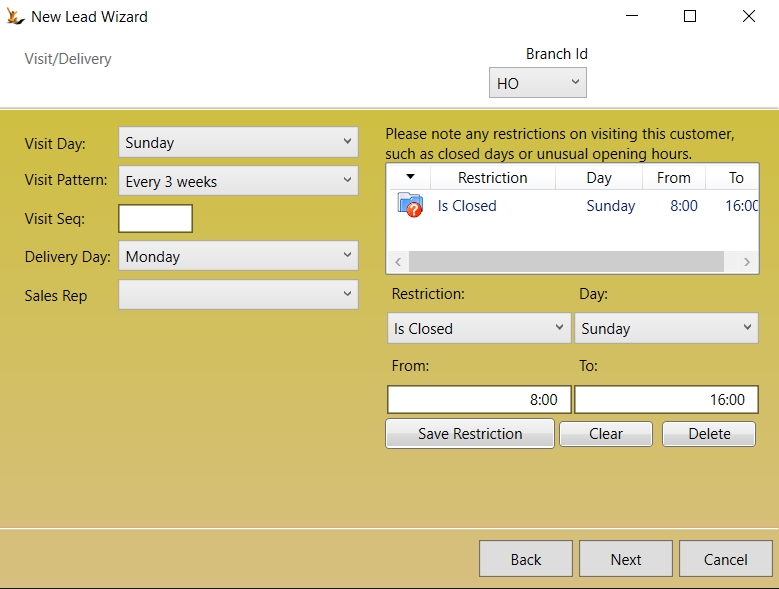

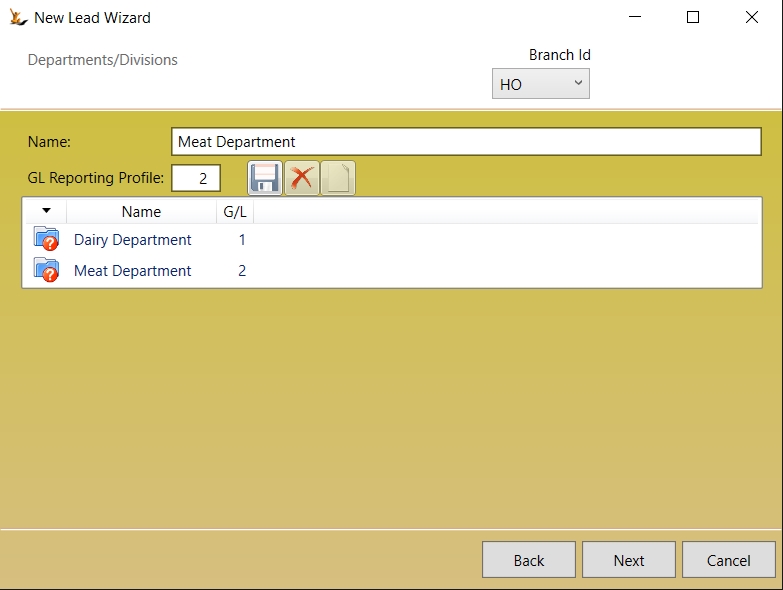

Wizard for creating new Leads and Customers

New lead wizard steps through setting up fields on the customer.

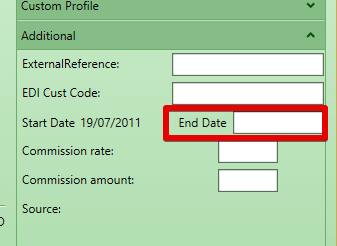

Making Debtors Inactive

To Make a debtor inactive - put an end date on the debtor (this can be in the past or the future).

See Archiving Debtors including "Collect Only" status to explain the process involved if the customer still has debt owing

See Collecting Debt from Customers for collecting processes

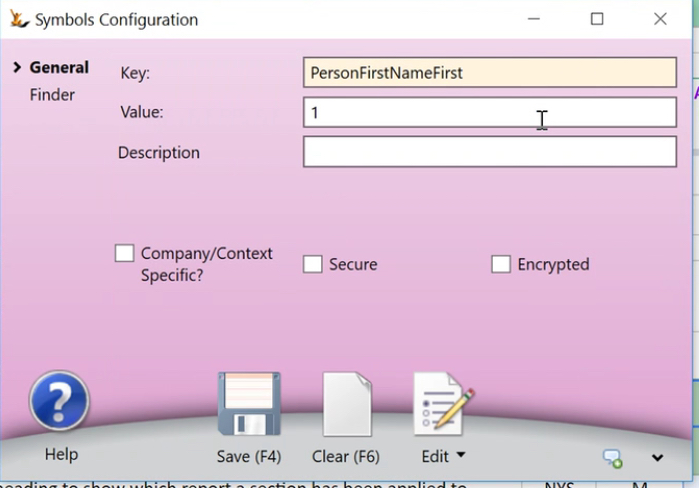

Persons - First name First in lists

Secure Features that Affect the Debtor Card

Deliver entity is unsecured – anyone can do it.

- Secure Features#IsEDImanager can update

- EDI code

- Secure Features#CanMaintainCreditHold can update

- Manual Credit Hold - stop supply checkbox

- Never Credit Hold checkbox

- Never Charge Freight checkbox

- Secure Features#CanMaintainDebtorTerms can update

- Terms Days

- Term Type

- Invoice Discount

- Buying Group

- Invoice Entity

- Vendor Code

- Bank Account Number

- Bank Branch

- Bank Transaction Identifier

- Account Name

- Commission Rate

- Statement Frequency

- Auto email Invoice

- Secure Features#IsSalesManager

- Price List

- Sequence Number

- Exclude Sales from Raw Data

- Standard Profile

- Secure Features#CanMaintainDebtorSalesRep

- Sales Rep

Foreign Currency Debtor Payments

- Financials menu, Advanced, Foreign currency debtor payment:

- Must be used if customer uses FC.

- Must not be used if customer does not use FC.

- Automatically used if:

- Debtor payment opened from FC customer's Transactions list.

- New payment started from FC customer's Action menu,

- FC amount from customer's total FC owing.

- AUD amount from customer's Total Owing.

- FX rate calculated as the relative rate between them.

- 'Record a payment for this invoice' chosen from FC debtor invoice Action menu:

- FC amount from invoice open FC amount.

- FX rate from invoice.

- AUD amount calculated from FC amount using FX rate.

- When a customer is selected on an FC debtor payment form:

- FC amount from customer's total FC overdue (i.e. excluding current).

- AUD amount from customer's Payment Due.

- FX rate calculated as the relative rate between them.

- On a new FC debtor payment the bank account will default to the lowest sequence bank account in the same currency as the customer. If no bank account in the customer's currency then the default debtor bank account.

- The FC amount, the FX rate and the local amount are all editable on a FC debtor payment form.

- If the FX rate is empty and either the FC or local amount is changed then the FX rare will be calculated as the relative rate between them.

- If the FC amount is changed then the local amount will be recalculated using the FX rate.

- If the local amount is changed then the FC amount will be recalculated using the FX rate.

- If the FX rate is changed then the local amount will be recalculated using the FC amount.

- Allocation:

- If a FC debtor payment is allocated to an invoice with a different FX rate then an adjustment journal will be written for the difference between the allocation amount converted to local currency using the payment FX rate and the allocation amount converted to local currency using the invoice FX rate.

- The adjustment journal will have local currency amounts only.

- Local currency bank account:

- If a FC debtor payment is made to a local currency bank account then the Trade Debtors line will have an FC amount but the bank line will not.