Table of Contents

When uploading journals you have created in excel - see also Importing Open Transactions

Columns in XLS to create multiple journals in the system

One Journal will be created for each date listed.

GST direction must be chosen when uploading to a general journal

- Date = D/MM/YYYY

- Account = Account Code

- Notes

- Dr = $ Amoujnt

- Cr = $ Amount (only one column to have a value

- Tax = Tax code eg GST or NA

- Tax Amt = GST tax $ amount

- GST Inc = Y or NA

Step by step example of uploading file from ePayroll

Export the file from ePayroll

- Ensure your ePayroll account has had the GL Accounts uploaded and mapped first

- Export the file from epayroll = this will be a csv normally.

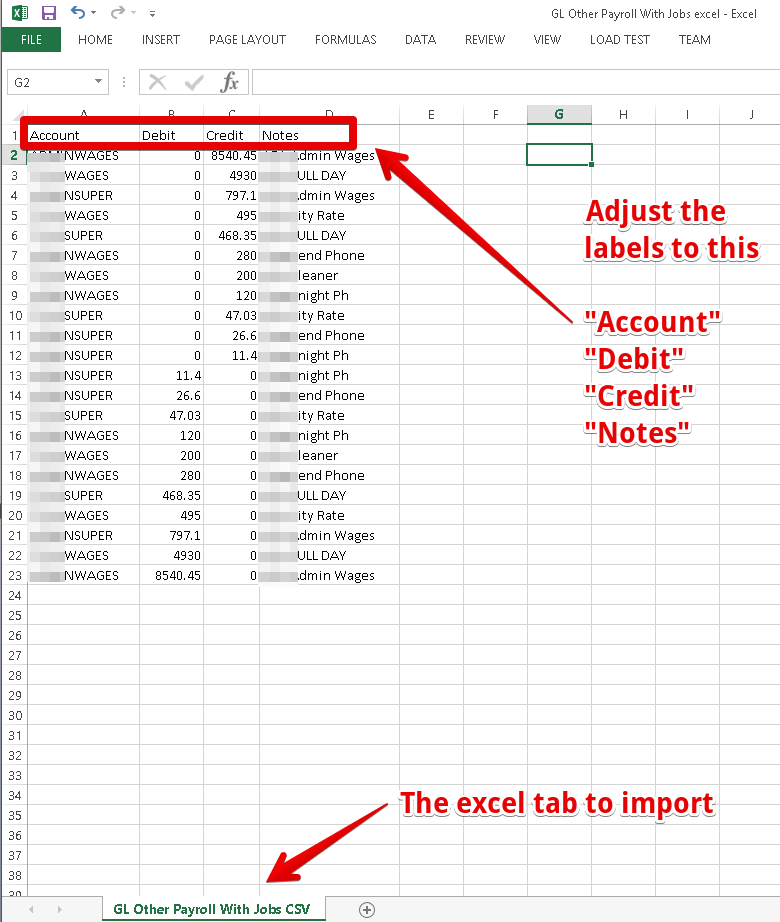

Make some changes to the file to get it ready for import - and save it as a .XLS file (File-save as)

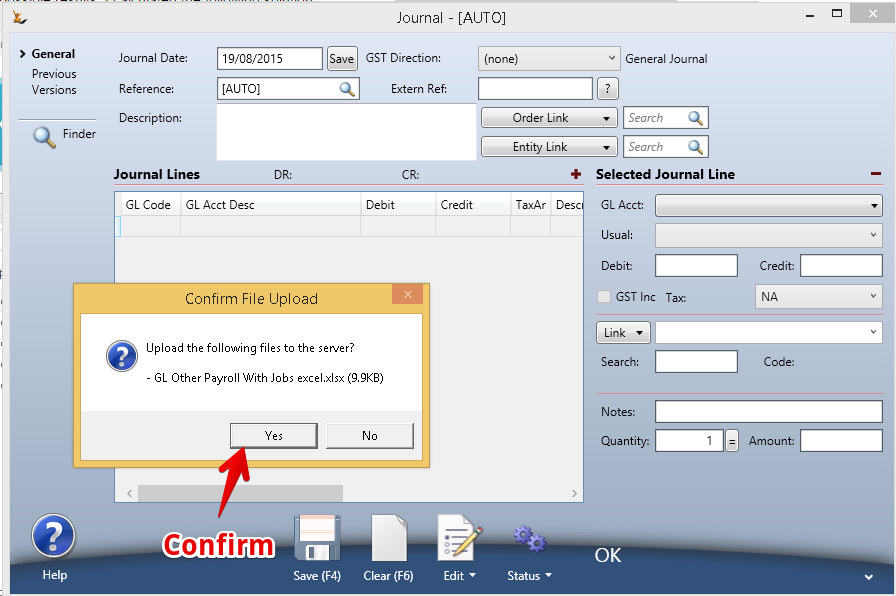

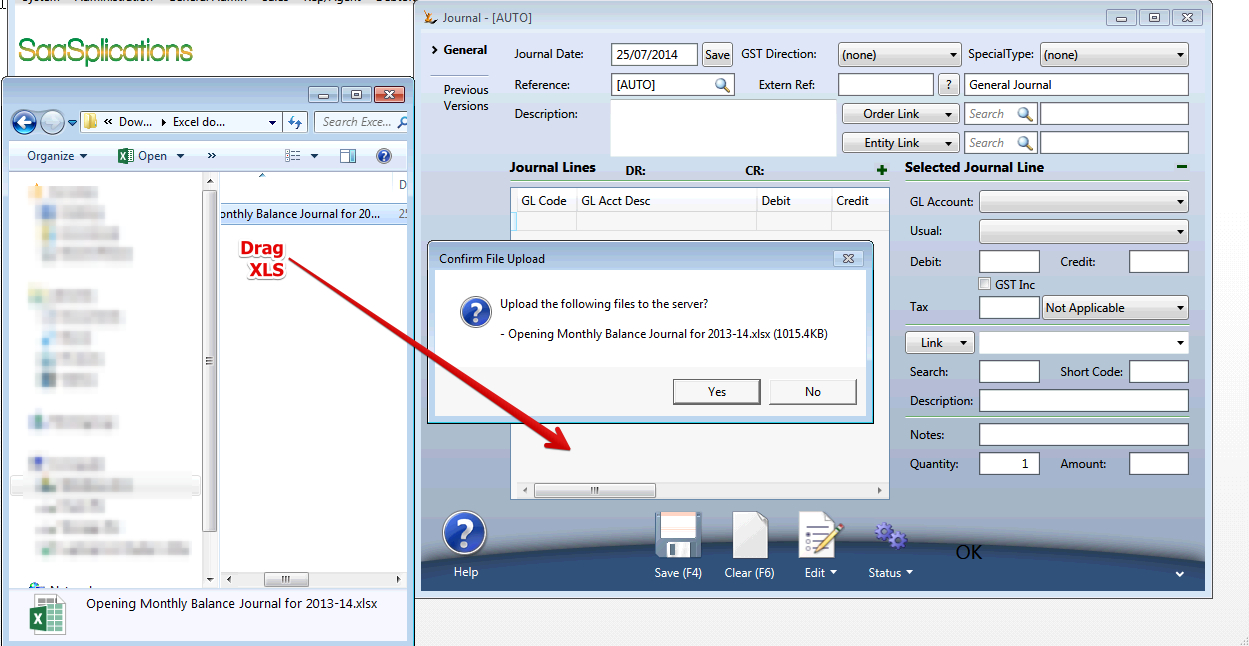

Drag the XLS file over the general Journal grid - confirm the upload

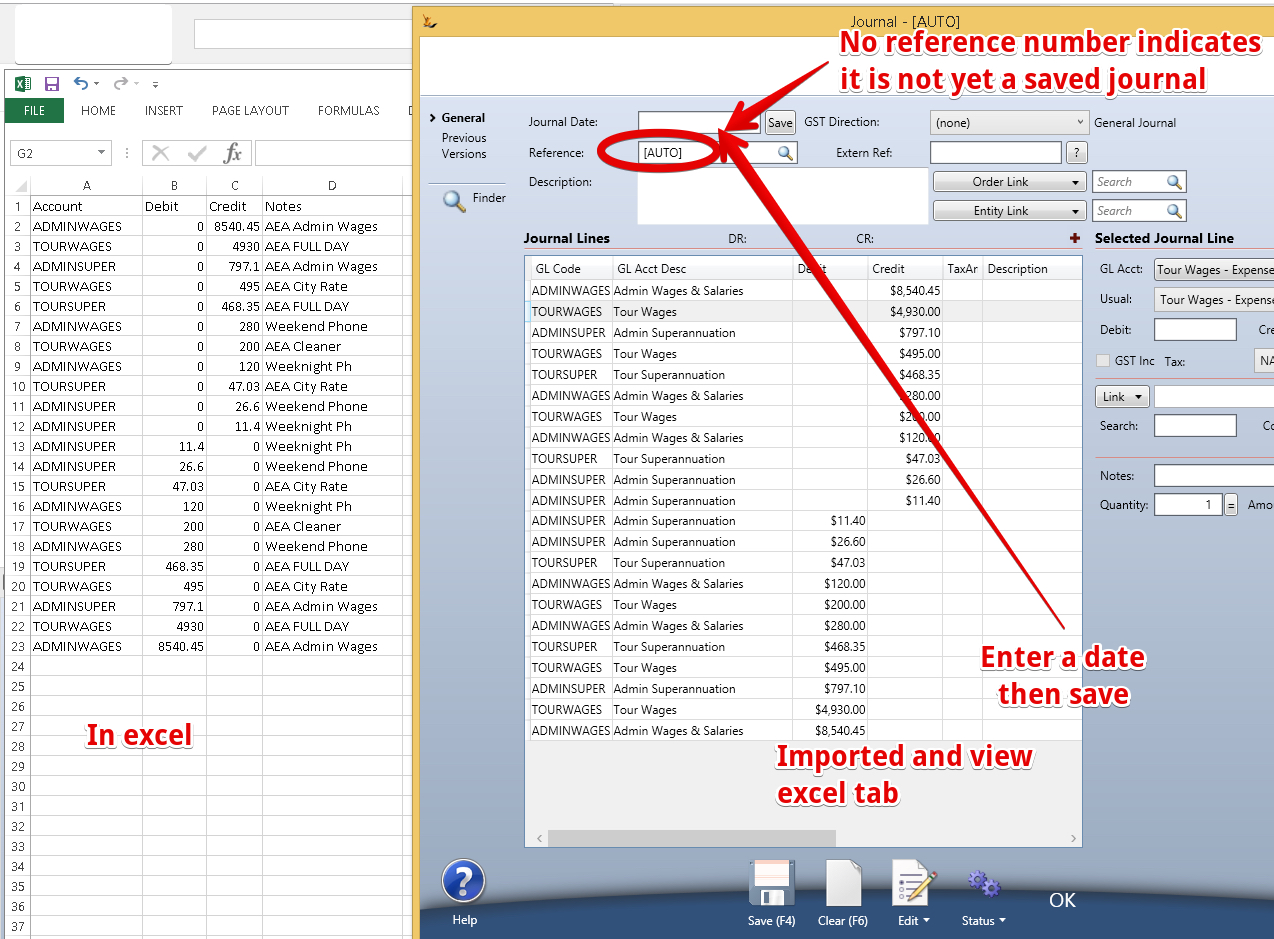

Populate the screen from the tab on the excel sheet

The grid will populate with the details - enter a date and save

Once saved the journal has been created in the system.

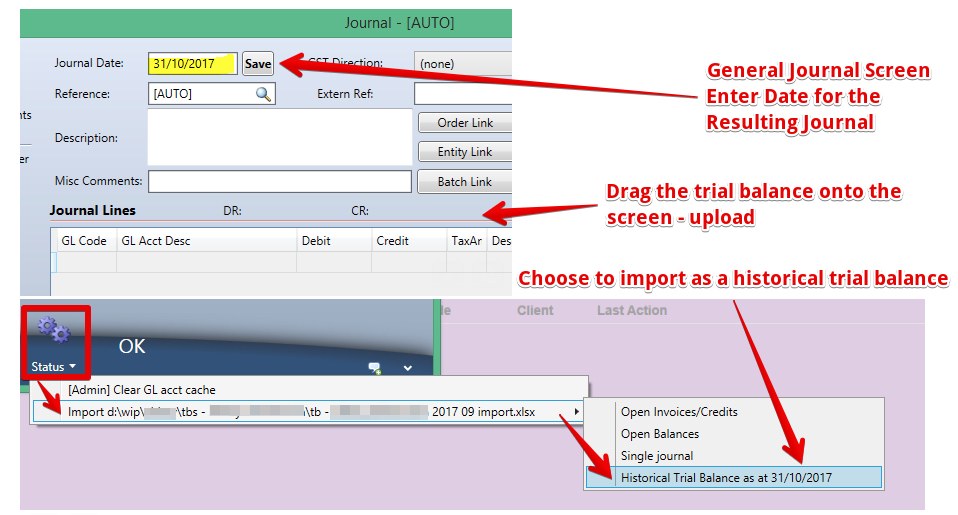

Historical Trial Balances

It is common that companies would like a reference for their financial accounts of 1 or 2 years from their previous system - this is how to create that history.

See Starting on SaaSplications for other setup steps.

Retained Earnings is NOT a GL Account , it is calculated values at the end of each financial year - the Trial balance for the year uses the calculation from the previous year.

Earnings YTD is not a GL account either.

So to illustrate with an example - how to create retained earnings

- First year using SaaSplications is 2014.

- Plan to bring in 2012 and 2013 monthly (or weekly) historical balances

- Will require a journal in 2011 to create retained earnings for 2012.

- Create 2011 as a financial year

- Create a Journal from a Revenue Account to a Balance Sheet Account in 2011

- Close all periods and roll periods - "Current year earnings" will now show for 2011, The retained Earnings Figure will now show in FY2012

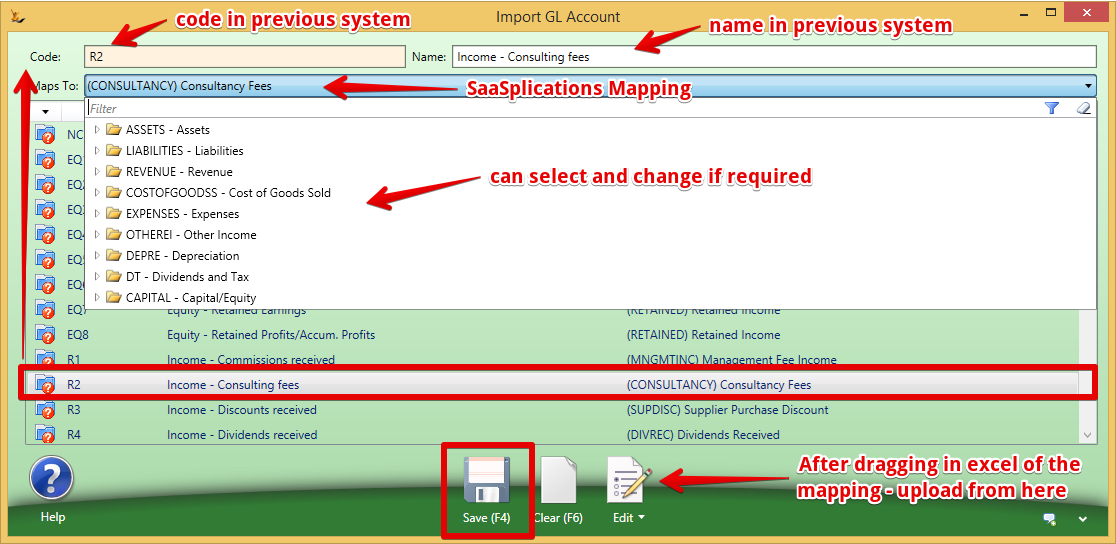

Mapping your old systems GL to the SaaSplications GL

Your GL in SaaSplications should be a lot simpler than your old system - as you will not need to rely on the GL for so much reporting as in other systems.

Export your GL from your previous system

If it does not have a column for Account code - make one up for the import process.

There is no GL Account required for Retained Earnings in our system - do not map it to a GL Account

Any line that is not mapped will be ignored in the import

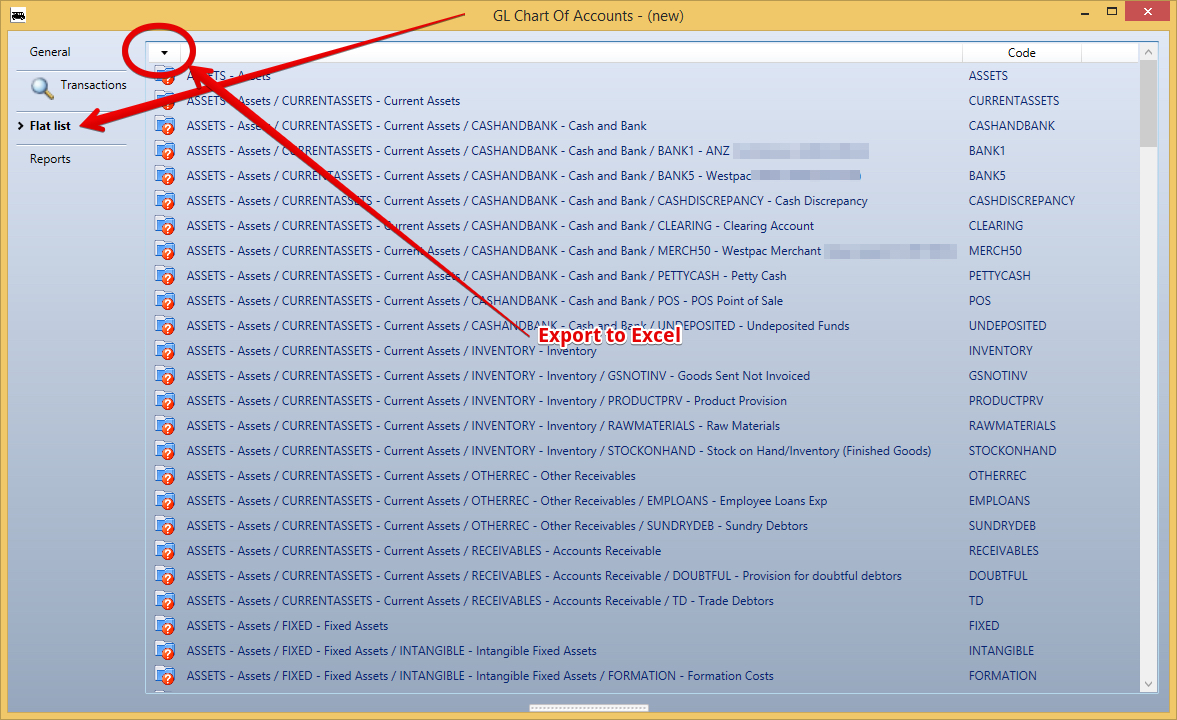

Export the GL from SaaSplications - the flat list

Build a mapping in excel

Columns

| Description of columns | Old System GL code | Name in old system (optional) | SaaSplications GL Code |

|---|---|---|---|

| Column Headings for Spreadsheet | Code | Name | Maps To |

Upload the excel mapping - and review

Drag the excel sheetonto the GL Account Mapping screen - Edit - Import

Can edit from this screen if required

Import the first Target Trial Balance

Run a trial balance for the date you want to update before uploading see - Financial Reports including Balance Sheet, Profit and Loss, Trial Balance, Aged Debt and Payable, Stock Valuation keep it open and then after upload run another one to see the results.

Retained Earnings line is not required from the trial balance

The journal created is NOT the trial balance verbatim

It IS a journal that is REQUIRED on the date of the upload to move the trial balance to the values uploaded. In essence - the journal created is the difference between the systems current trial balance - and the new target trial balance

The retained earnings on the imported trial balance must be the same as the retained earnings in the system for the previous year (create the required journal if necessary)

Remove "Retained Earnings" and remove "YTD earnings" as these are not GL accounts - they are calculated values in our system.

Columns required in the spreadsheet

- Account (the Account code in the previous system)

- Account Name from the previous system (this is not used)

- Debit

- Credit

From a General Journal Screen - upload the xls and choose the import option

continuing the example above - the first one will be in July 2012

Review the Resulting Journal

The resulting journal will display in the General Journal Screen - not yet saved.

Review and save if ready.

Run the trial balance again - check the results

Then do the next month until the last one before operating.

- You must do them in increasing date order - otherwise the resulting journal will not be correct.

- You can cross financial years without any concern - Retained Earnings is NOT a journal in our system - it is a calculated value.

If Splitting a GL account

When splitting a GL account into multiple new accounts

- Import the last trial balance

- After this create the journal between the trial balance import and the new GL account for the partial amount

Example - Deposits for suppliers on Purchase Orders

Suppliers sometimes require a deposit. SaaSplications will create a deposit invoice and match the deposit invoice and then later credit that amount on the final PO invoice.

It is common that other systems do not handle this elegantly - and may simply have payments they expect accounts to manage or set aside.

In this case - importing the transactions will create the Deposit Payment AND the Deposit Invoice as a matched pair. Hence some funds will need to be moved from Accounts Payable to the new control account "Supplier Deposits" after the import of the trial balance.

Step-by-step guide example of creating journals

First create the journal in excel

- Mandatory Columns in the spreadsheet (use these headers)

- Date (of journal)

- Account (Can be Acct)

- DR (or can use Debit)

- CR ( or can use Credit)

- Optional columns that may follow mandatory columns in the spreadsheet (use these headers) - check with us before using these as they are not yet tested.

- Link (from list on Journal - Asset, BusinessEntity, Stock, ItemForSale, CompanyDivision, Brand) - note Brand will link to the supplier.

- Search code (eg for a brand that would be the supplier search code in the system, for Asset it is the Asset Search Code in our system)

- External reference (normally this would hold the reference that was in the old system)

- Notes

- Qty

- Amount

- Note GST is not relevant for General Journals

Once the journal is ready to import - Drag the XLS over the grid in the General Journal

- A confirmation will ask if you meant to do this

- A confirmation will confirm the file is available for the session you are logged in for (if you log out you will need to do upload the file again)

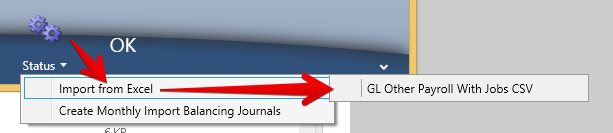

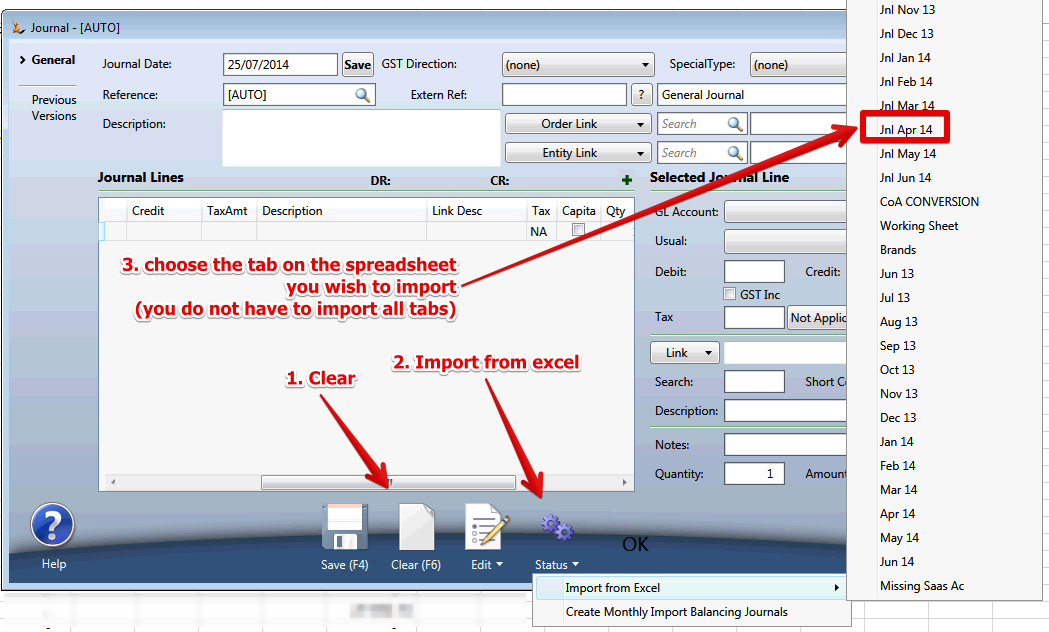

Choose the Excel Tab to import

- Action > Import from excel > Choose the tab on the spreadsheet you wish to import

The Journal screen will populate

Save

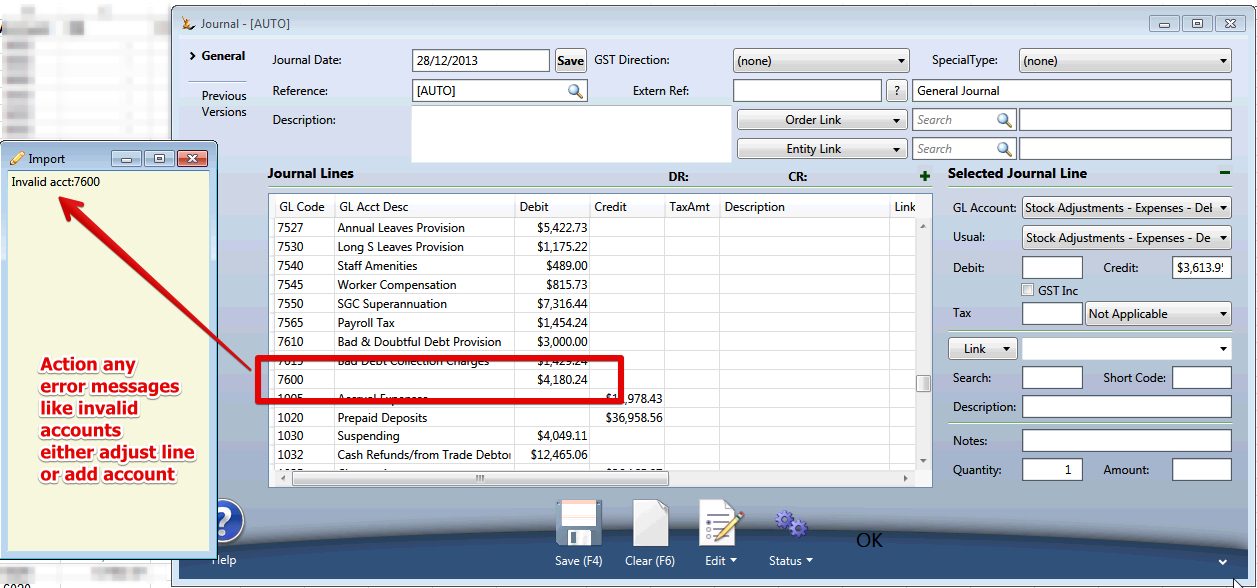

- If the journal does not balance you will get an error message and journal will not saveIf there are GL accounts the system does not recognise

- The journal will not save

- A note will popup with a list of the problems

- There will be an indicator on the lines in the journal for you to review / adjust

- If there are values outside a reasonable range (example very small values like 0.0000000000001

- The journal will not save

- A note will popup with a list of the problem accounts - review and adjust

Save the Journal

Clear

Import the next tab.

Importing mass Debtor Invoice Journals (and creating mirror transactions)

requires loans setup between the entities to enable a journal in one entity to create a mirror journal in a related entity.. see Loans Between Trading Entities

When one business pays suppliers or employees and then recharges other companies in the group - a lot of transactions can be created.

- An example is a franchisor paying for security or payroll or phones etc for the rest of the group and then invoicing the franchisees

- A debtor invoice is required in the Franchisor - a mirror Creditor invoice is required in the Franchisee

- The GL accounts used will come from the service linked to the line (one for selling the service and one for buying the service).

This can be simplified the following way.

- Define the journal you want in Excel across the multiple entities

- Upload to the entity that is sending a debtor invoice to the others

- All mirror creditor invoices will be created in the other entities

Here is an example upload file that will create Debtor invoices for 4 entities (and matching creditor invoices in those entities).

- Debtor Code

- Date for Journal (same date will be on same journal created)

- External Ref (used to group journal lines onto the same journal for the same date

- DR amount inc GST

- CR amount inc GST

- Tax Code

- Tax $

- Service Code.

- You will need to define a service in the system with both a Buy GL account and a Sell GL account so the system knows what GL accounts to use

- Order - if the debtor invoice is to link to an order (sales order, purchase order, repair order, return etc) then can add that column

| Debtor | Date | Extern Ref | Description | Debit (GST Incl) | Credit (GST Incl) | Tax Code | Tax Amount | Service Code |

| AC001 | 3/31/2018 | PAY 2018 03 | Salaries/Wages recharged | $15,198.18 | GST | $1,381.65 | PAY | |

| AC001 | 3/31/2018 | PAY 2018 03 | Superannuation recharged | $1,443.83 | GST | $131.26 | PAY | |

| AC001 | 3/31/2018 | PAY 2018 03 | Annual leave provision recharged | $1,168.74 | GST | $106.25 | PAY | |

| AC001 | 3/31/2018 | PAY 2018 03 | Payroll tax recharged | $970.68 | GST | $88.24 | PAY | |

| AC001 | 3/31/2018 | PAY 2018 03 | Workers comp insurance recharged | $355.64 | GST | $32.33 | PAY | |

| AC001 | 3/31/2018 | PAY 2018 03 | Payroll processing fee | $683.91 | GST | $62.17 | PAYF | |

| JP005 | 3/31/2018 | PAY 2018 03 | Salaries/Wages recharged | $25,506.86 | GST | $2,318.81 | PAY | |

| JP005 | 3/31/2018 | PAY 2018 03 | Superannuation recharged | $2,423.16 | GST | $220.29 | PAY | |

| JP005 | 3/31/2018 | PAY 2018 03 | Annual leave provision recharged | $1,961.48 | GST | $178.32 | PAY | |

| JP005 | 3/31/2018 | PAY 2018 03 | Payroll tax recharged | $1,629.09 | GST | $148.10 | PAY | |

| JP005 | 3/31/2018 | PAY 2018 03 | Workers comp insurance recharged | $596.86 | GST | $54.26 | PAY | |

| JP005 | 3/31/2018 | PAY 2018 03 | Payroll processing fee | $1,147.81 | GST | $104.35 | PAYF | |

| BOOKERS | 3/31/2018 | PAY 2018 03 | Salaries/Wages recharged | $24,707.28 | GST | $2,246.12 | PAY | |

| BOOKERS | 3/31/2018 | PAY 2018 03 | Superannuation recharged | $2,347.19 | GST | $213.38 | PAY | |

| BOOKERS | 3/31/2018 | PAY 2018 03 | Annual leave provision recharged | $1,899.99 | GST | $172.73 | PAY | |

| BOOKERS | 3/31/2018 | PAY 2018 03 | Payroll tax recharged | $1,578.02 | GST | $143.46 | PAY | |

| BOOKERS | 3/31/2018 | PAY 2018 03 | Workers comp insurance recharged | $578.15 | GST | $52.56 | PAY | |

| BOOKERS | 3/31/2018 | PAY 2018 03 | Payroll processing fee | $1,111.83 | GST | $101.08 | PAYF | |

| GH002 | 3/31/2018 | PAY 2018 03 | Salaries/Wages recharged | $14,579.74 | GST | $1,325.43 | PAY | |

| GH002 | 3/31/2018 | PAY 2018 03 | Superannuation recharged | $1,385.08 | GST | $125.92 | PAY | |

| GH002 | 3/31/2018 | PAY 2018 03 | Annual leave provision recharged | $1,121.19 | GST | $101.93 | PAY | |

| GH002 | 3/31/2018 | PAY 2018 03 | Payroll tax recharged | $931.18 | GST | $84.65 | PAY | |

| GH002 | 3/31/2018 | PAY 2018 03 | Workers comp insurance recharged | $341.17 | GST | $31.02 | PAY | |

| GH002 | 3/31/2018 | PAY 2018 03 | Payroll processing fee | $656.08 | GST | $59.64 | PAYF |

Related articles

Filter by label

There are no items with the selected labels at this time.