Table of Contents

Table of Contents

Spending Company Money

Spend Money - is spending some company money (normally cash)

...

- Spent your own money - and need money back

- Used a company card - so a journal will be required on your card

- Spent cash you collected - a journal is required that reduces your cash count

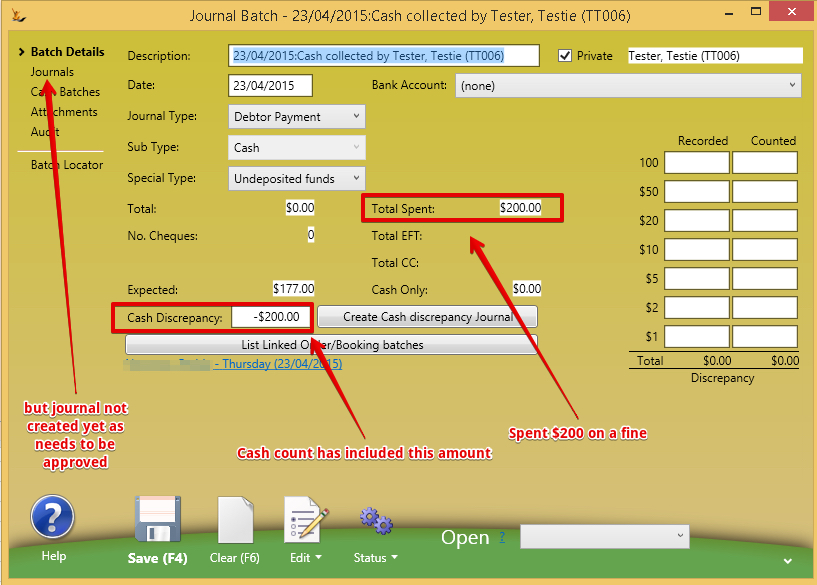

Counting expected Cash includes spend money amount

The cash count has already included the Spend money amount and reduced the expected cash count.

Approving the Spend Money amount

A person says they spent company cash - however the expense needs to be approved

...

The Journal Batches cannot be finalised without the spend money approved (as the approval creates the required journal)

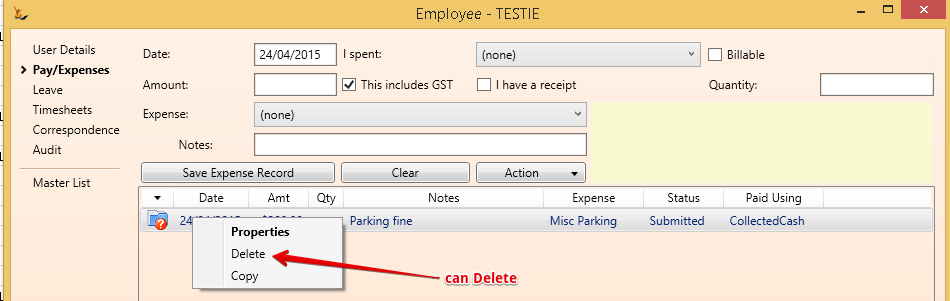

If the claim is not allowed - Delete it

Or move to "Rejected" status.

Funds will be short on the cash count and need to be made up. If the batch is closed and banked short of cash a discrepancy journal will be created that is linked to the batch.

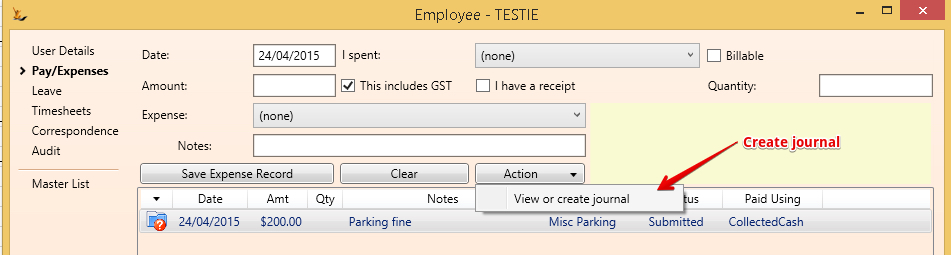

If the claim is allowed - Create the associated journal in the system

The journal will attach to the batch as an amount spent.

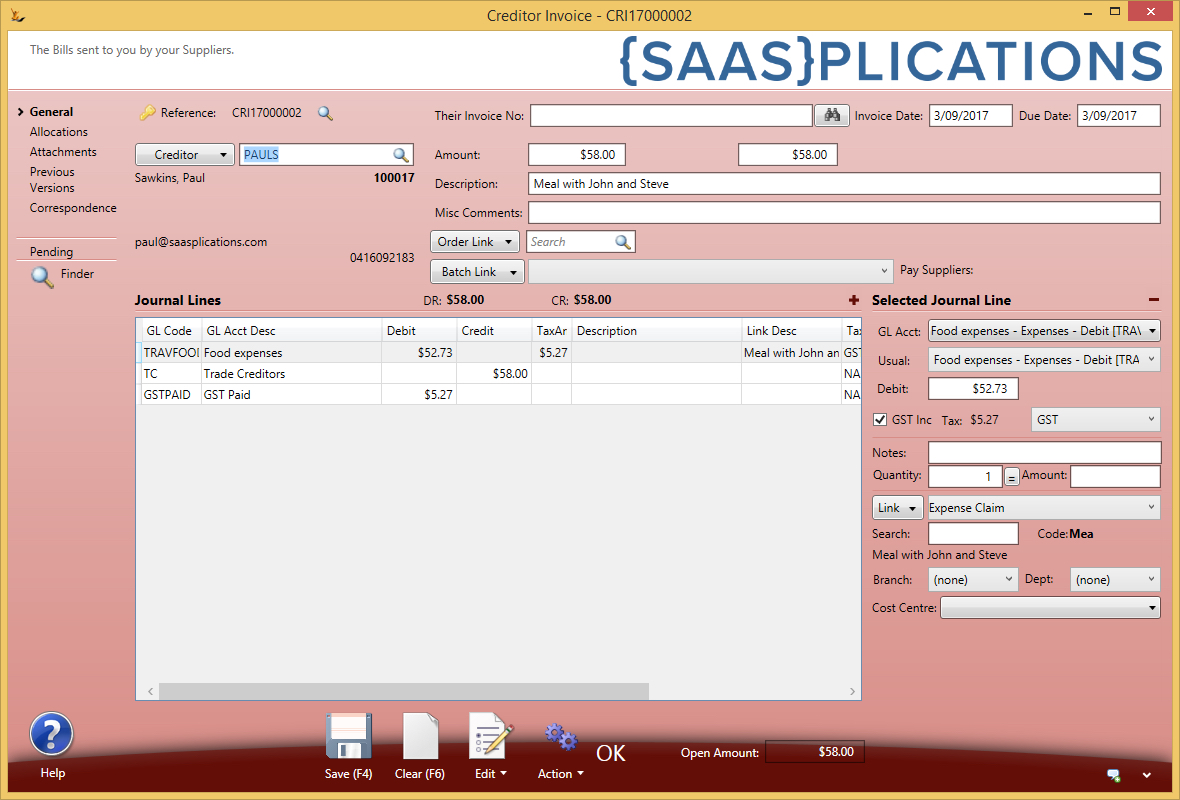

If it was NOT company money = then the person needs to be re-imbursed

Expenses - is spending your money - you need to be re-imbursed - a creditor invoice will be created and a payment can then be made.