Overview

Review all the GST transactions for a period (see GST information)

...

Use the BAS Statement tab to calculate the amounts to enter on your BAS statement.

Period

This specifies the date range that applies to all of the totals and journal lists on the form.

BAS Reporting Period

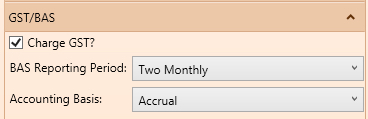

The BAS Reporting Period must be specified for the host company (Admin menu, Your Host Company, General tab, Extended Attributes, GST/BAS) before you can select a period on the GST Explorer. Choose from Monthly, Two Monthly, Quarterly, Four Monthly, Six Monthly or Annually.

| Note |

|---|

The last month of the financial year can be specified in a Symbols Config (Admin menu, config, Symbols Config) with a key of financialYearEndMonth. The value should be the month number, e.g. 1 for January, 12 for December. If not specified it defaults to 6 (June). |

The period name is made up of the financial year and the period.

- If the last month of the financial year is December then the financial year will be the 4 digit year, e.g. 2013, otherwise it will be the years, e.g. 2012-2013.

- If the BAS Reporting Period is Annually then there is no period after the financial year.

- If it is monthly then the period is a 3 character abbreviation of the month, e.g. Jan.

- If it is Quarterly then the period is Q followed by the quarter in the financial year, e.g. Q4.

- Otherwise it is the first and last month of the period, e.g. May-Jun.

If the period is locked then 'Locked' will show after the period name.

Selecting a Period

The default period selected is the most recently completed period, i.e. the period before the current one.

...

- The Current period, if it is not selected

- The Last period, if it is not selected

- The period before the selected period (Previous)

- The period after the selected period (Next)

- If a date is entered in the box between the period name and the Action button then the period that includes the entered date

- All locked periods

- If there are more than 12 locked periods and the BAS Reporting Period is not Annually then the locked periods will be grouped by financial year

Action

The options available on the Action menu depend on the selected period:

- If the selected period is not locked then 'Calculate Period'

- If the selected period is not locked, it ends before today and either there are no locked periods or the previous period is locked then 'Calculate and Lock Period'

- If the selected period is locked then 'Display Period'

- If the selected period is locked and the next period is not locked then 'Unlock Period'

- If a period has been calculated or displayed then Print Displayed Totals to produce a PDF report showing the totals in the same format as the form.

Locked Periods

Once a period has been locked only the next period after the last locked period can be locked and only the last locked period can be unlocked.

...

When a period is locked all of the journals that are included in the totals for that period are locked and cannot be changed or deleted.

Unlocked journals in locked periods

Any new journal with a date in a locked period becomes an unlocked journal in a locked period.

...

To determine the journals included in a period but which are dated before that period (i.e. new journals added to a locked period) then list the journals in the period and note those with a date before the period.

Data selection

Only journals for the company of the user are used in all GST Explorer calculations and lists.

Accounts

The account specified on a journal line is used in the selection of journals or journal lines to be included in a number of totals. The accounts referred to are defined in the GL Control Configuration form (Admin menu, Finance, GL Control Accounts).The accounts used are:

- GL tab:

- Trade Debtors

- Trade Creditors

- GST Paid

- GST Collected

- Withholding Tax

Tax Amount

The tax amount in a journal does not have a sign. The tax is considered to have the same sign as the total of the journal line on which it appears.

Calculated Totals

Listing the journals that are included in a given total

Many of the totals have an exclamation mark (!) button to their right. Clicking this button will produce a list of totals by journal of amounts and tax included in this total. The list is displayed on the Journal List (Details) tab. The totals for the list of amount, tax and overall total is shown at the top right of the BAS Statement tab.

...

All capital purchases are taxable.

Purchases

For the purpose of calculating G11, G14 and G17, purchases are considered to be all journal lines not to GST Paid or Withholding Tax:

...

Note that this shows the total value of the taxable imports, not the amount of tax paid on them. The tax paid is included in the GST Paid total.

List Journals for button

Use this button to display diagnostic lists of journals that might be in error. These reports show the journal reference number, date and description, the debtor or creditor ID (search code) and name, the journal amount and the journal tax amount, as well as other fields relevant to the particular list. NOTE that with the exception of the 'Taxable non-capital purchases' list the lists are not restricted to the selected period.

...