Overview

Review all the GST transactions for a period (see GST information)

...

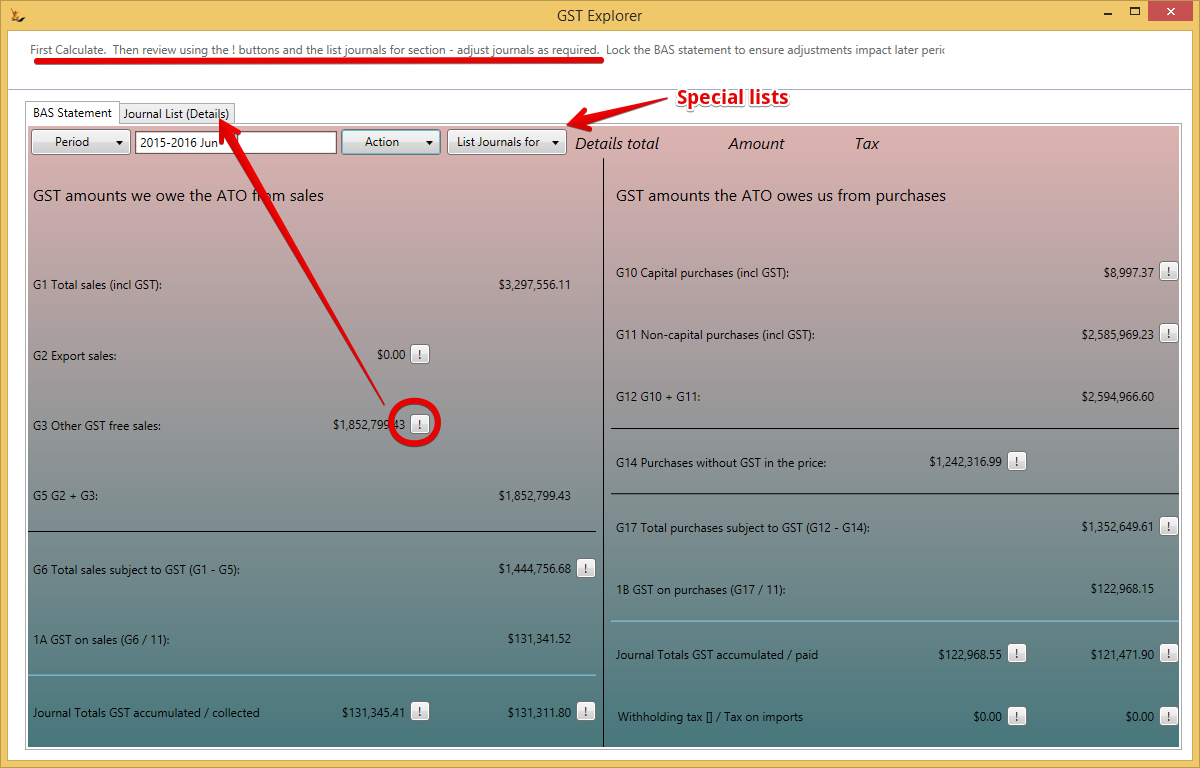

Use the BAS Statement tab to calculate the amounts to enter on your BAS statement.

Period

This specifies the date range that applies to all of the totals and journal lists on the form.

...

The account specified on a journal line is used in the selection of journals or journal lines to be included in a number of totals. The accounts referred to are defined in the GL Control Configuration form (Admin menu, Finance, GL Control Accounts).The accounts used are:

...

The tax amount in a journal does not have a sign. The tax is considered to have the same sign as the total of the journal line on which it appears.

Calculated Totals

Listing the journals that are included in a given total

Many of the totals have an exclamation mark (!) button to their right. Clicking this button will produce a list of totals by journal of amounts and tax included in this total. The list is displayed on the Journal List (Details) tab. The totals for the list of amount, tax and overall total is shown at the top right of the BAS Statement tab.

...

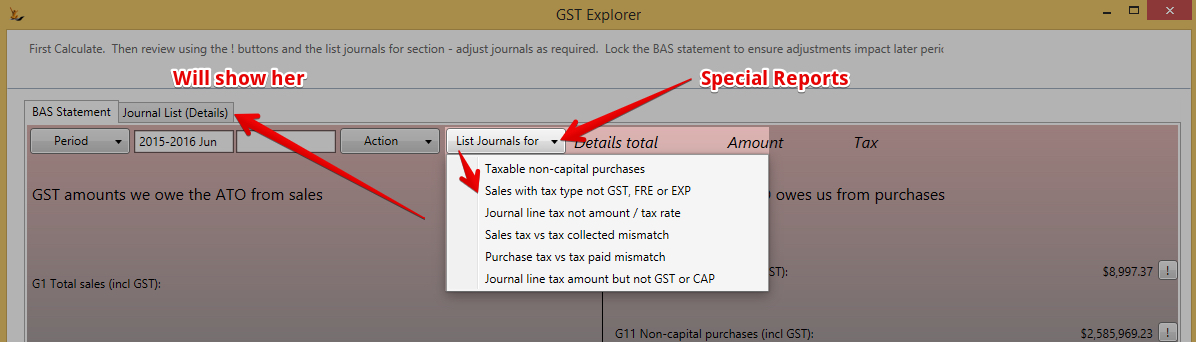

Use this button to display diagnostic lists of journals that might be in error. These reports show the journal reference number, date and description, the debtor or creditor ID (search code) and name, the journal amount and the journal tax amount, as well as other fields relevant to the particular list. NOTE that with the exception of the 'Taxable non-capital purchases' list the lists are not restricted to the selected period.

Taxable non-capital purchases

...