Bank accounts are a special type of GL account in the system.

Table of Contents

Setting up Bank Accounts

Bank Accounts require a GL Account first, then define the bank details (BSB and Account number and related cards) on Host Company

For foreign currency bank accounts see Foreign Currency Transactions (fx)#BankAccounts

Configure the definition of the bank branches

Admin > Financials >

If you already have GL accounts setup as bank accounts

Setting up a new GL account as a Bank Account on Host Company

Reference the account in the bank account configuration - see Chart of Accounts to add GL accounts

Note that once transactions have been entered to the bank account you cannot change the GL account

Setup a Credit Account as a Liability - Credit accounts are a liability for your business

Assigning Credit cards on Accounts to people and Assets

Then you can assign cards that operate on the account to people (expenses) or Assets

Trade Finance Bank Account

Discussion

Trade financing is when the bank will forward some funds to you for a % of invoices you have sent out to customers so you can have the cash earlier and not have to wait to collect it.

The account is normally effectively a loan.

The bank normally expects that all the debtors they are trade financing will be instructed to pay into the trade finance account. This helps minimise the loan and also keep track of the performance of individual debtors.

Bank Account Setup as Trade Finance Account

Note - only one bank account can be the Trade Finance account at a time

Bank Account on Invoices

When a bank account is flagged as "Trade Finance" then invoices sent from the system or viewed online will have the following bank details:

- Debtors flagged as "Exclude from Trade Financing" - will show the bank account with Default set to "Debtor" or "Both"

- All other debtors will show the Bank account with the special type "Trade Finance"

Regular Providing invoices to the Bank

The bank will request all invoices to be sent to them regularly - use the Trade Finance Screen for this.

Aging summary by Due Date

The aging summary can exclude Trade Finance Debtors

OLD Bank Reconcilation - Enter an opening balance for the bank account

New Statement Centred Bank Reconcilation process does not require an opening balance for the bank account. See Bank Reconciliation - Statement centric - uploaded and remembered bank statement lines

An opening balance is simply a journal - one side is the current bank (or credit account) balance - the other side is normally formation assets or an account chosen by your accountant

![]() Any journal to a bank account once reconciled cannot be changed. It is recommended therefore that opening balance journals NOT include a line for the bank account - but this is done as a separate journal so the opening balance journal can later be changed if required.

Any journal to a bank account once reconciled cannot be changed. It is recommended therefore that opening balance journals NOT include a line for the bank account - but this is done as a separate journal so the opening balance journal can later be changed if required.

Fuel Cards

Fuel cards are a Merchant Account - ie not a bank account - but a company you need to pay.

Create the Merchant Account on the Host company

Link the Fuel Card to the Asset

When the Fuel Statement Arrives

Note if you have Branches and Departments defined they will default from the Asset.

And the Asset will be linked to the $ and L from the line on the creditor Invoice

Credit Card Payments using Credit Card Terminals

When a bank provides Credit Card Terminals for processing transactions (card not present)

Setup the bank Account Details

Select Payment Method EFTPOS (terminal) - then machine. Bank will default from terminal

This is the only way a payment can be added to the batch for that terminal

Reversal of Payment Journals will be added to the batch (Status - Create a Reversal)

Payment Batch from EFTPOS Terminal Transactions (per terminal)

- When a payment is created

- if no batch exists for the Terminal / date / cutoff time combination - a new one is created

- if a batch exists then the payment will be added to it

Batches will be closed every day by the system

The batch is cleared in the bank account using the normal method - see Bank Accounts - Creating and Managing#ReconcilingCreditCardBatchesBatches

Credit Card Payments using credit card gateways like Eway

Register

- When you register with a credit card gateway - they will ask you for your bank details - and the bank will provide you with a merchant number that gets passed with the transaction information to identify the bank accounts to be impacted by the credit card transaction.

- When our system takes a credit card payment - the system passes your merchant number along with the transaction to the gateway and gets a response.

- Every response is logged and you will see the result on the transaction you are actioning (sales order, booking etc).

Indicate supported credit cards to limits the options users have on payment

Indicate the credit cards you support

The eway Merchant Number to pass through

Using eWay as an example: When you register with eWay - they ask for the bank details they are to put money into. Then they provide you with a Merchant ID number. Place this number in the Merchant ID field for that bank account. When the system takes a credit card transaction it looks for the bank account to use and the merchant ID to pass to eWay.

Note you need the Secure Feature of "CreditCardProcessing" to be a non- zero value on one of your roles in order to see this field. Do not allow many people to see this field

Payments are batched by eway

Multiple payments per day are deposited in your bank - not every transaction

- eWay will not send you a transaction for every individual transaction - they will instead send a lump of money 2x per day based on your overall transactions.

- So we need to group together all the transactions eWay has told us have been successful into a single $ value that we expect to see go into your bank.

- For this reason we batch together all credit card transactions into a "Batch" using the cut-off times told to us by eWay.

Using Tyro Credit Card (Card Present) Terminals in POS

The POS looks for the Tyro Software installed on the local machine

OLD Bank Reconciliation Format

The new format help is here Bank Reconciliation - Statement centric - uploaded and remembered bank statement lines

The POS then passes the amount to be paid to the Tyro software which passes it to the Tyro Cloud which puts it onto the device (so internet connection is required)

The user swipes the EFTPOS or credit card - Tyro then tells the tyro cloud to update our POS with the transaction reference, amount etc and the system then completes the transaction

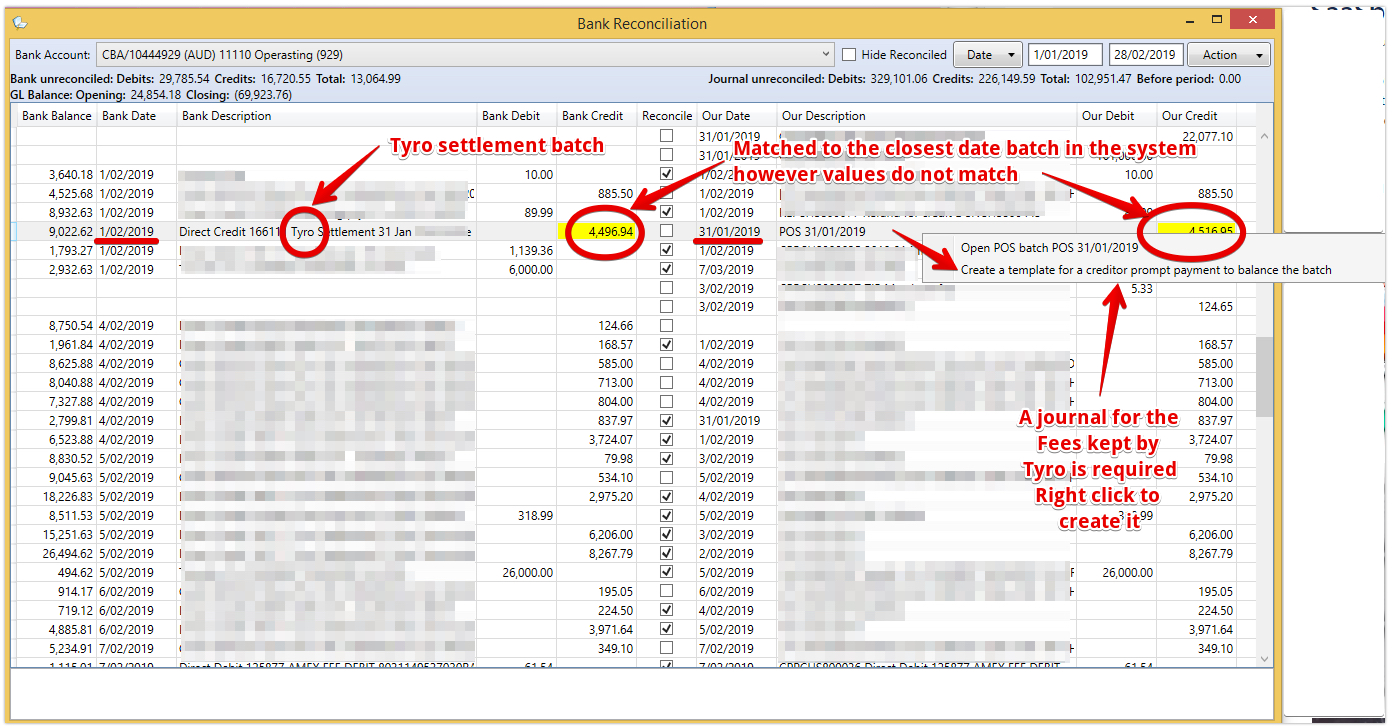

Tyro pays all the money for a day in a single payment (except AMEX which is paid directly by AMEX). To see these amounts - use the separate AMEX flag on the bank req.

If the totals are not the same as deposited or reported by Tyro - right click to open the batch an investigate all transactions involved

Clearing CC Batches in OLD Bank Statement

for new capabilibites see Bank Reconciliation - Statement centric - uploaded and remembered bank statement lines

Although the payments are grouped together - we have found that the credit card gateways frequently send a different $ amount to what we would expect based on the payments sent to them.

- Reasons for this include - fees they may take out, charges they may add, reversals from failures of payment and other reasons.

- So - when you look at the bank reconciliation we have a list of the expected total from the Credit Card Gateway (the batch total) that you can see.

- If the amount they put into your bank is the same as we expected - simply right click and "clear all in batch" on the batch - and it will tick all transactions as included in the statement.

If the amount they deposited is not the same - you will have to go through the statement they provided and tick off individual transactions on the bank statement so you know which transactions have cleared.

Payments from/to Debtors and Payments to/from Creditors and bank accounts

When you have entered an invoice you want a payment to reference

When doing a Creditor Payment, Creditor Refund, Debtor Payment or Debtor Refund - you can select the bank account when you do the transaction - and that will place the transaction in the reconciliation screen for that bank account

When you do not want to enter an invoice - you just want to record a payment

Normally you will want to enter all invoices into the system for record keeping reasons. DO NOT use this transaction and also enter an invoice - it will be double counting

Use "Supplier Payment (No Invoice)" or "Customer Payment (No Invoice)" to create the transaction - referencing the bank account

Cash Batches

If your business is collecting cash while delivering products on Waybills - review Waybills - Grouping deliveries together and doing consolidated picking across orders#Createthepaymentsandaddthemtothedriversbatchforthatday

Cash Batches are used when Cash is Collected by Sales Reps, Delivery Drivers and Bus Drivers

They count the cash in the batch as they drop it off.

Do a second count of each cash batch to confirm the amounts.

Group together multiple amounts of cash into a single bank deposit.

Capture the cash transaction

Sales Reps, Delivery Drivers and Bus Drivers are collecting cash during a day of driving around visiting customers.

- The cash they collect is grouped into a batch to be counted at the end of the day. This is known as a "Cash Batch"

- They may also spend some of this cash as they go - to wash the car, parking or other items. This is known as a "Spend Money" - cash was used.

- If they purchase items using a credit card (for example a fuel card) this is not included in the daily batch and is not a spend money as no cash was spent.

Cash payments may be recorded in a number of ways by drivers

If your business manages orders

- As a cash payment of a sales order or booking - from the sales order screen

As a cash payment not linked to a sales order - simply a cash collection from a debtor they visited from the debtor or in the driver portal.

If your business manages bookings

- The bus drivers portal as they drive

As a cash payment for a booking in the driver portal or entered later once they have returned.

The cash payment will default to their batch for the day

Cash Counting by drivers

Count the Cash taken during a number of days - Drop at office

At the end of the day the cash needs to be counted by the driver and will include

Cash total to count = Cash collected - cash spent (Spend Money Transactions Only).

The driver will do a first count of the cash and the cash batch will move to "Counted" status - note that the counted cash may not match the expected cash.

Then batch can then be counted by a second person and multiple batches banked in a single banking deposit.

Count the Cash taken over a number of days - Driver Deposit to the bank

If the driver is depositing the cash to the bank - the batch will be closed and a journal created to the bank for the amount deposited

Once the cash is dropped off to the office - second cash count

The office will do a second count of the cash - noting any discrepancies as an adjustment journal

Office does a second count and moves the batch to locked status

Group multiple cash counts into a single amount to deposit to the bank

Depositing cash into the bank - adding multiple amounts of cash into a total to take to the bank

After second counting a number of batches - the batches can be grouped together into a bank deposit

The batch will then have a reference on it to the journal that links it to the bank statement

The Banking Batches Screen Consolidates this view into a single screen

- Statement Centric Bank Reconciliation

- Overview

- FX Bank Accounts and related transactions

- Bank Reconciliation Example

- Process Flow

- Statement-centric bank Account reconciliation upload

- Overwriting a statement import

- Batches of Journals

- Retail Takings Bank Deposits

- Reconciling statement lines

- Rules Engine

- Example of a match with a batch

- Ticking the Reconcile Box

- Accepting proposed Journal templates

- Manually finding lines to reconcile

- Adding new transactions to match the bank

- Creating New Journal Templates

- Grouping Bank Statement Lines

- Unreconciled lines that have a cleared date

- Changing from the non-statement centric (old method) Bank Reconciliation process

Statement Centric Bank Reconciliation

Overview

Upload the bank statement and then match it to existing transactions

Use examples of bank lines matched to journals to create templates > so the system suggests journals you have not yet created - and will create them for you

After reconciling a journal may be adjusted in value - in this case the reconciliation flag remains however the values are highlighted in yellow

A single line in the bank can be matched to multiple transactions in the system by putting all the related journals into a batch. This happens automatically for credit card related batches.

FX Bank Accounts and related transactions

Foreign Currency Bank Accounts

- If bank account is in foreign currency then bank statement amounts are assumed to be in that currency.

- Foreign currency amounts of journals shown and used in matching.

- Amounts at top of bank rec are all in foreign currency.

- Journals with no foreign currency amount are not shown.

- Foreign currency standing journals are not supported so bank rec rules cannot be created.

- Foreign currency debtor prompt payments and general journals (bank transfers) are not supported so they cannot be created from the bank rec.

- To create a transfer from a foreign currency bank account to any other account use the "Foreign Currency transfer" wizard

- Journals

- A local currency journal cannot have a foreign currency bank account.

- A foreign currency bank account must be the same currency as the journal.

- A journal cannot have more than one foreign currency bank account

Bank Reconciliation Example

Upload of a bank statement

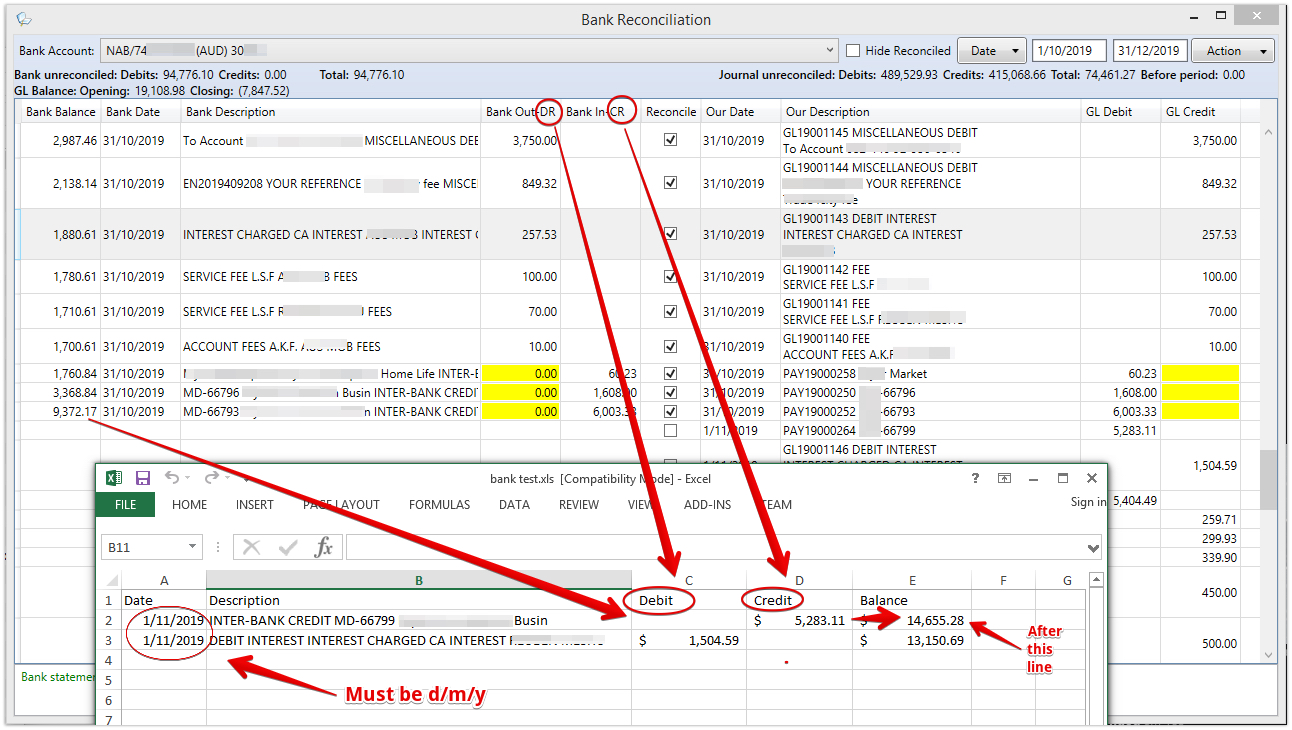

Example of xls sheet

Reconciliation view

LHS is the detail from the bank

RHS is the detail from the system

Only transactions in the date range selected will be processed by the rules engine

Reversal of a journal is not possible if it has been cleared in a bank rec (any lines have a cleared date)

- Displays all journals:

- that have been allocated to a bank line within the date range OR

- are not in a batch

- that are before the from date and have not been reconciled

- That have NOT been reversed (Journals reconciled in the bank cannot be reversed until reconciliation removed)

- have not been cleared in an old style bank rec

- that have been allocated to a bank line within the date range OR

- Display all batches:

- that have been allocated to a bank line within the date range OR

- that are before the from date and have not been reconciled

- have not been allocated to a bank line outside the date range

- have journals that have not been cleared in an old style bank rec

- that have been allocated to a bank line within the date range OR

- Displays all Bank statement lines that are

- within the date range

- before the from date and have not been reconciled.

Process Flow

Statement-centric bank Account reconciliation upload

There cannot be a gap in bank statement uploads.

Every upload checks that the balance showing in the bank is correct after the first transaction in the bank statement using the final balance of the last upload.

- Importing a statement file from the bank:

- The file must be an xlsx or csv format file.

- It must have column headings in row 1, containing (Column headings are not case sensitive) :

- narrative OR description

- date

- debit

- credit

- balance (optional)

- The balance on the first data row + debit - credit must match the balance on the last row of the previous import for the host/bank account, unless it is the first import.

- the date on the first import line must be after the last bank line Bank Date

- Drag the statement file over the Statement-centric bank rec form and drop it.

- Reply Yes to upload the file.

- Action menu

- 'Import bank statement'.

- 'List bank statement(s)'.

Overwriting a statement import

- Action menu option, 'Re-import bank statement days':

- Must have uploaded a spreadsheet or .csv file of bank statement lines.

- The balance on the first import line, if any, plus the Bank Out-DR or minus the Bank In-CR of the line must match the balance on the last bank line dated before the Bank Date of the line, if any.

- The balance on the last import line, if any, must match the balance on the first bank line dated after the Bank Date of the line, if any, plus the Bank Out-DR or minus the Bank In-CR of the line.

- All existing bank lines between and including the date of the first import line and the date of the last import line will be deleted before re-importing the uploaded bank statement lines.

When re-importing day(s) for a bank rec, the system checks for grouped bank lines that include lines within the date range.

If found, check if the groups include lines outside the date range.

If found then the re-import cannot proceed.

The system will Show a text box listing the group(s) and bank line(s) outside the date range.

Batches of Journals

Journal batches are common - example credit card batches where an aggregator deposits the result into the bank at the end of the day from a POS. In this case all the journals as they are created are linked to the batch.

Reconciling the batch will reconcile all the journals in that batch.

A rounding journal will be added only if a 1c difference exists in order to match a bank line and the batch value will show that it now matches the bank line.

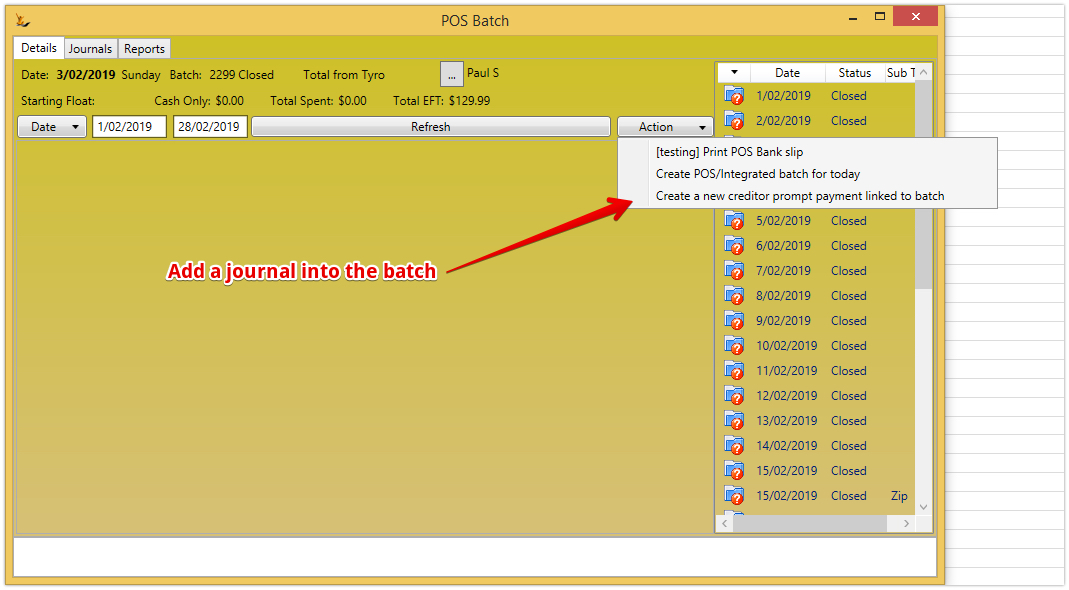

Tyro Batches

Tyro payment settlements are made in two amounts for a single day

- All non AMEX cards - normally the same day or next day

- AMEX cards - could be a number of days later

If the Tyro machine takes some offline transactions then the amount expected will be different to the amount paid. The matching process will find dates that align with amounts that do not so the missing journals can be added to the batch before it is matched off.

Adding a journal to the POS Tyro Batch

User will require to either swipe their thumb or use initials and pin

Can create a credit card refund linked to a closed batch. Options available American Express, EFTPOS, Mastercard, Visa. American Express will reduce the Amex total for the batch, others will reduce the tyro total.

Retail Takings Bank Deposits

Some organisations bank cash daily for the previous day and the full amount each time. In this case the expected bank deposit journal will have been created as the POS is closed in the following day ready to be reconciled. Right click to open and change it if required.

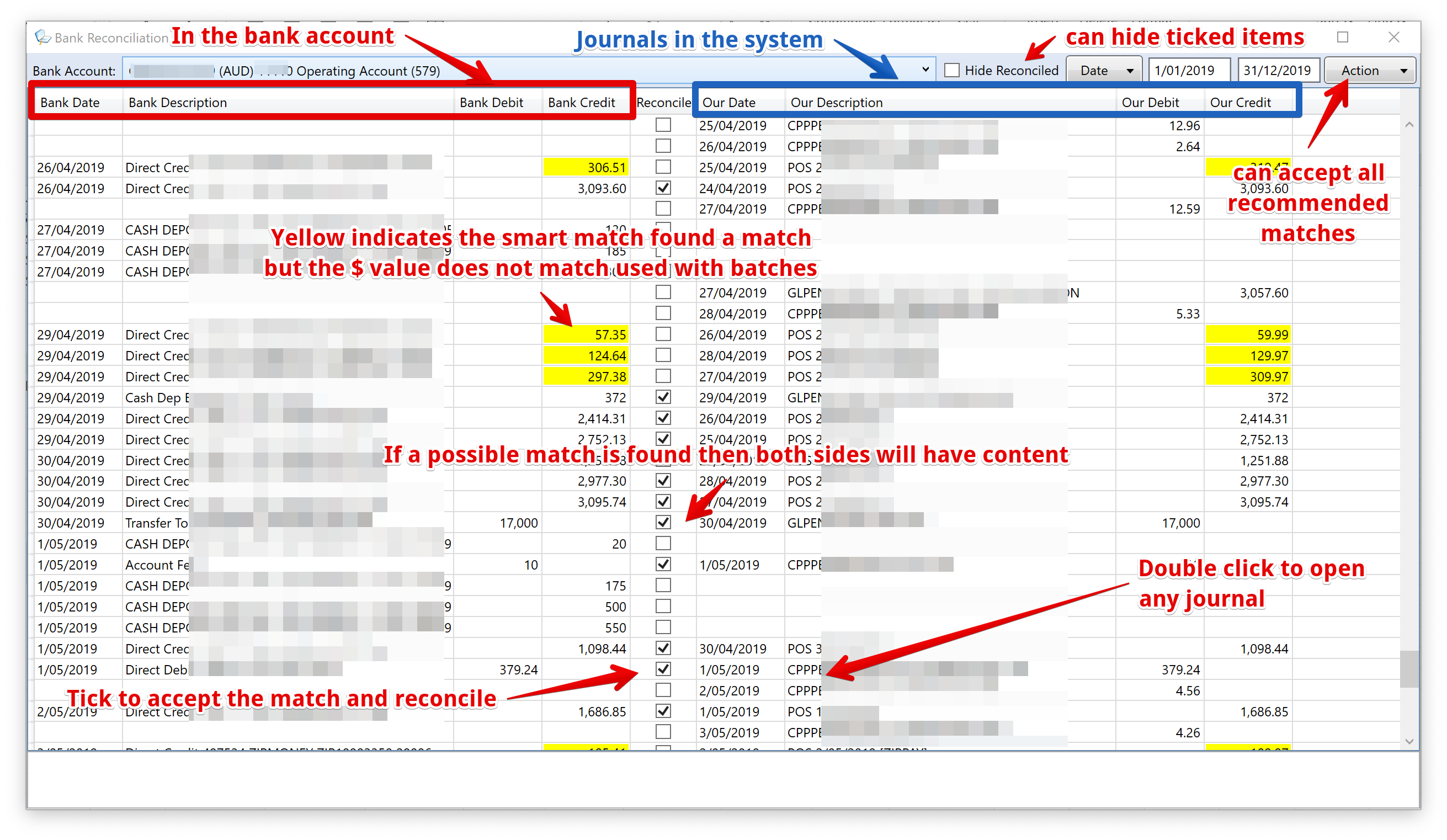

Reconciling statement lines

- If a line has been reconciled the Reconcile box will be ticked and the matching journal or batch details will be shown

- Lines in the bank statement may reconcile with individual journals or with the total of a journal batch

- The journal or batch can be opened from a right click on the line

- Likely matches are listed beside the bank statement line details

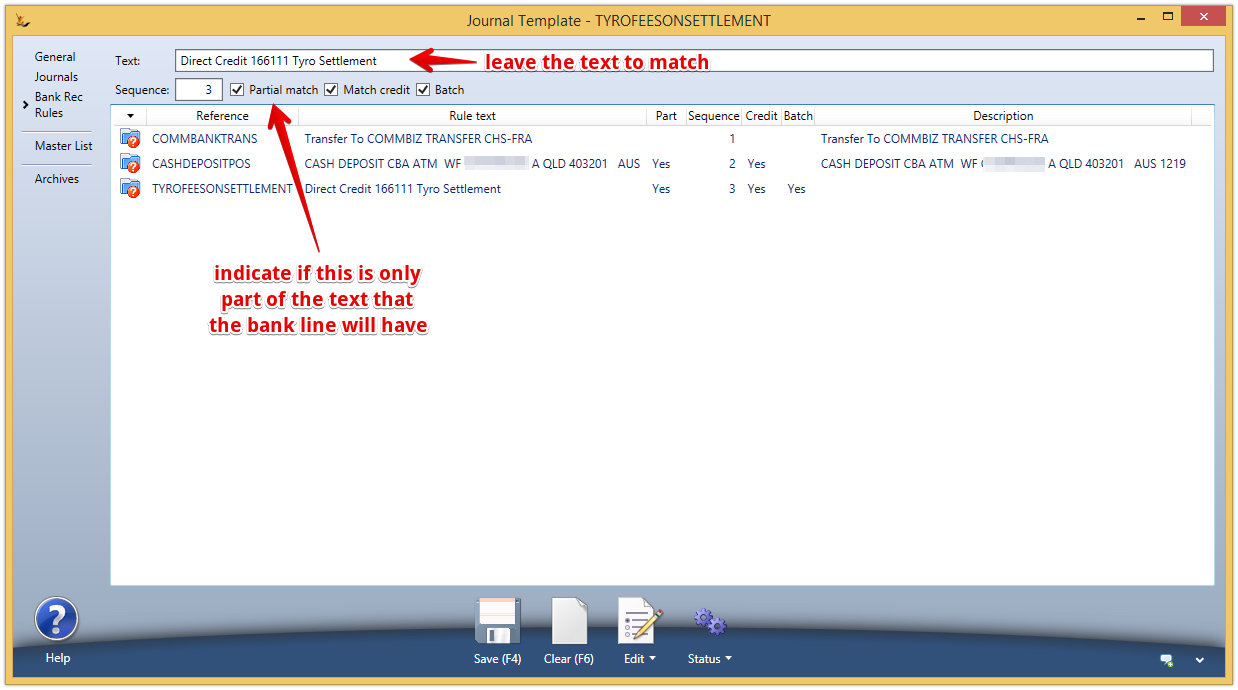

Rules Engine

The rules engine proposes the most likely match or template to the user that can be actioned, rejected or ignored.

Right click options offered to the user

- Right click on a line with bank details only

- will show matching amounts with different dates in the grid as possible matches - select to action (match and reconcile)

- Will provide option to create a new journal from scratch

- Right click on a line with our details only

- will show matching amounts with different dates in the grid as possible matches - select to action (match and reconcile)

- Will provide option to create a new journal from scratch

Unreconciling reconciled lines will split them again.

When creating a journal from a bank line (not via a journal template), on saving:

- If the bank line has been reconciled or re-imported then a message will display and the journal form will not close.

- If the amount of the journal going to the bank does not match the bank line amount then a message will display and the journal form will not close.

- Otherwise:

- The new journal will be reconciled with the bank line.

- All journal lines to the bank will be given a cleared date of today.

- The journal form will close.

How are matches made by the rules engine

| Matches are assessed as below | Pre-requisites | Test | Result | Action Required | |

|---|---|---|---|---|---|

| 1 | The journal or batch has not been ticked as reconciled in another bank statement or reconciled or assessed as a match in this bank statement | ||||

| 2 | the Bank Description contains 'Tyro Settlement' or ends in "Tyro" |

| The total of the journal lines for the bank account in the batch that do not have 'american' (not case sensitive) in the Transaction Summary matches the Bank Credit. | If the total does not match but the date does then it will be listed with the amounts highlighted. | If the totals do not match then Right click to create a fee journal within the batch |

| 3 | If the Bank Description contains 'AMEX GR' |

| The total of the journal lines for the bank account in the batch that have 'american' (not case sensitive) in the Transaction Summary matches the Bank Credit. | Matched | |

| 4 | If the Bank Description ends with or ends in " AMEX" and has a date in the description | All Journals in a batch must have "amex" in the Misc Comment | will match on date in bank description regardless of amount | Right click to open the batch and add journals to it so amounts match | |

| 5 | If the Bank Description contains 'ZIPMONEY' |

| The total of the journal lines for the bank account in the batch is equal to or greater than the Bank Credit | If more than 1 batch qualifies then the batch with the total closest to the Bank Credit. | Right click to open the batch and add journals to it so amounts match |

| 6 | If the Bank Description starts with 'Direct Credit' and ends with 'Payments' |

| The total of the journal lines for the bank account in the batch matches the Bank Credit. | Matched | |

| 7 | Otherwise |

| The total of the journal lines for the bank account matches the Bank Credit. | ||

| 8 | A journal template | Text rule Checked in Sequence order (small to large) | Offers Journal template as possible match | Tick match to create journal from the template or right click to find alternative | |

| 9 | Right click to review possible other matches or create a journal from scratch |

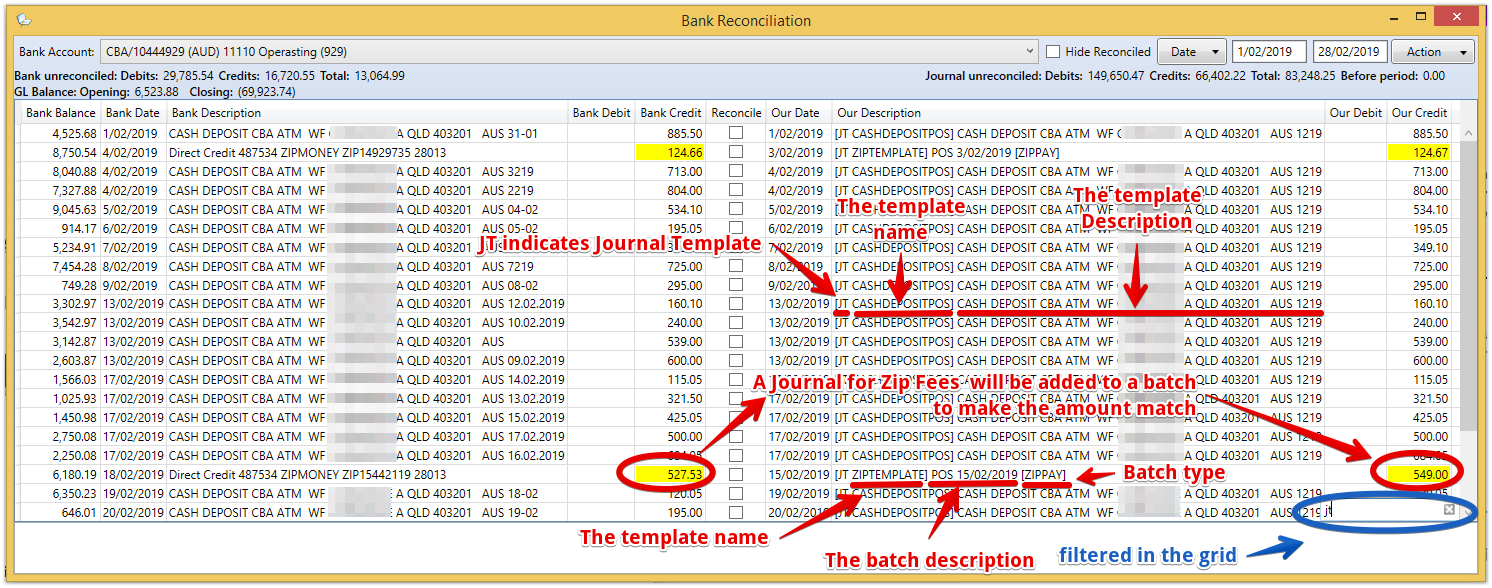

Example of a match with a batch

Example Tyro match of closest batch

The journal template created is expected to be used for all batches - it will not have a fixed amount but will be offered at the amount required to create a match with the bank line

Ticking the Reconcile Box

- Ticking the Reconcile Box will:

- Link the journal or batch to the bank statement line.

- Write today's date as the cleared date for all journal lines to the bank account in the journal or batch, unless the line already has a cleared date.

- Un-ticking the Reconcile Box will:

- Unlink the journal or batch from the bank statement line.

- Remove the cleared date for all journal lines to the bank account in the journal or batch, unless the date is on or before the last original bank rec reconciled date for the host/bank account.

- The Action menu includes an option to 'Reconcile all lines with matching amounts'

Mass tick using Action Button > Reconcile all lines with matching amounts

Accepting proposed Journal templates

Ticking the reconcile box will create the journal

Right click to

- ignore and create a different journal

- open the proposed journal to edit then save (eg to create multi-line journal)

Mass create using Action Button >Create and reconcile Journals from Rules

Manually finding lines to reconcile

Only transactions within the date range being viewed will be offered as potential matches

- Right click on a line with bank details only

- will search the grid for our transaction matching amount and show actions to match the bank line with our journal or batch.

- Right click on a line with our details only

- will search the grid for lines with bank details only and a matching amount and show actions to match the bank line with our journal or batch.

- Choosing to match will merge the lines and tick Reconcile.

- Unreconciling these lines will split them again

Adding new transactions to match the bank

If a Foreign currency Journal is being entered to a local currency bank account from a bank statement line then the bank statement line in local currency is preserved so a change to the FX rate will change the Foreign Currency value of the journal. To calculate an FX rate, clear out the FX rate and then enter the Foreign currency value > the FX rate will calculate.

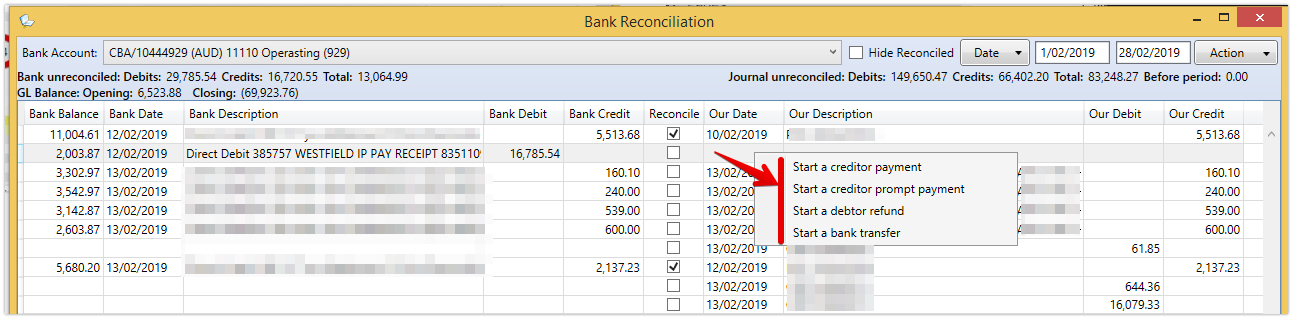

On lines with bank details but no matching journal, Right Click for options

- If Bank Credit has an amount:

- Start a debtor payment

- Start a debtor prompt payment

- Start a bank transfer

Note also > a local currency bank account can have a debtor payment from a foreign currency

- If Bank Debit has an amount:

- Start a creditor payment

- Start a creditor prompt payment

- Start a debtor refund

- Start a bank transfer

- Each option will open the appropriate form and pre-populate it with Bank Date, the selected Bank Account and the Bank Debit or Credit.

- When the journal is saved the Bank Statement list will be refreshed.

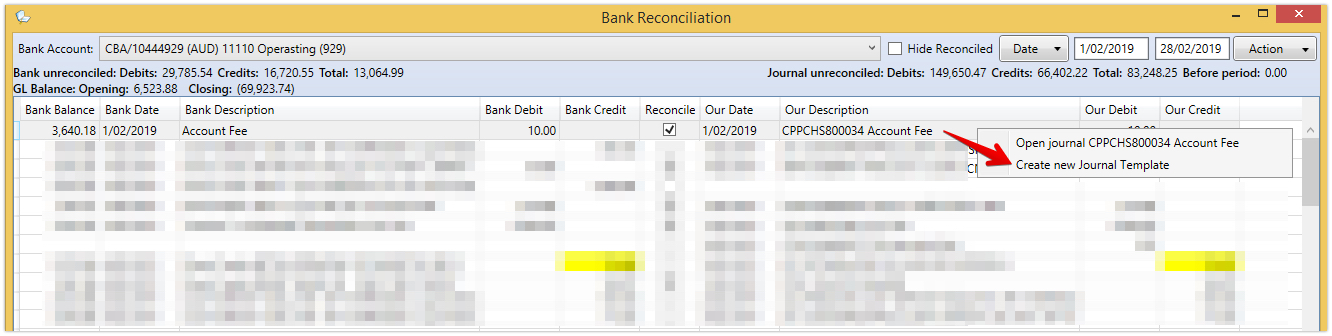

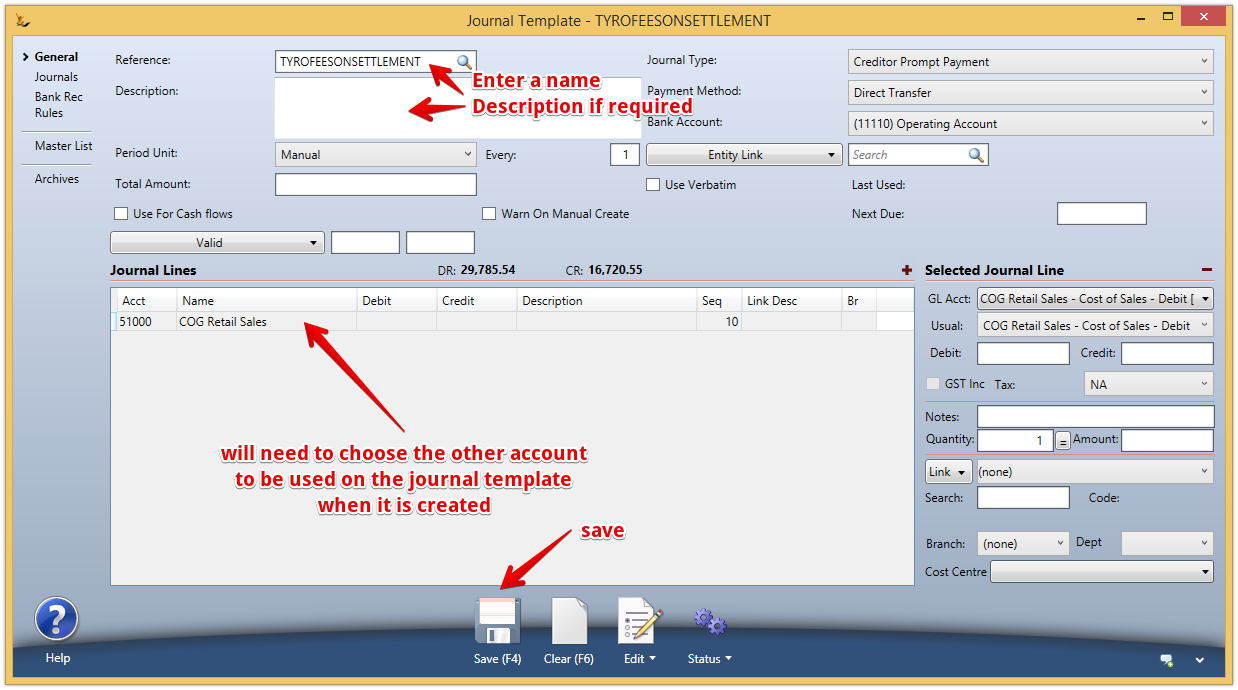

Creating New Journal Templates

Journal templates for bank rec rules must have a number of lines according to the journal type:

- 2 - general journal.

- 1 - creditor and debtor prompt payments.

- 0 - creditor and debtor payments.

- No other journal types are accepted

If a bank rec rule or a journal generated from a bank rec rule is saved then the bank rec will refresh

Franchisors may tick "Global" if all franchisees are to also use a rule. Franchisees cannot modify Franchisor Templates.

Right click on any matched line to use the journal that was used as a match to create a new Journal Template

The full Bank Description will be copied to the Rule Text. This can be edited and the Partial match check box ticked as required.

The result when the grid refreshes

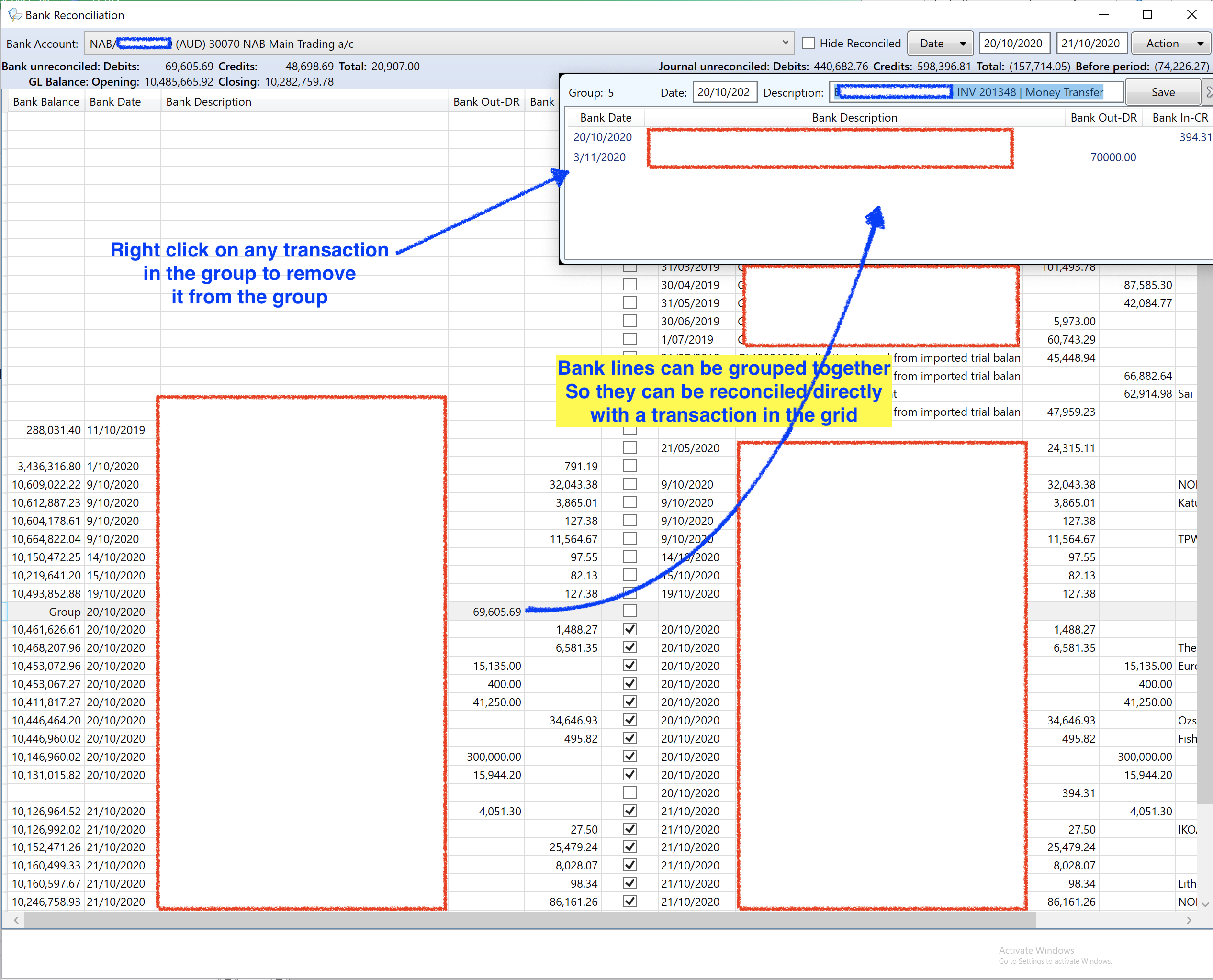

Grouping Bank Statement Lines

In some situations bank statement lines are desired to be grouped either for reconciliation reasons - or to hide the detail (eg salary payments).

- Bank Reconciliation (Statement-centric):

- Any bank lines that are in a group will not show in the bank rec.

- The group will show on a line with:

- 'Group' in the Bank Balance column.

- The group Date in the Bank Date column.

- The group Description in the Bank Description column.

- The sum of the debit amounts of the bank lines in the group in the Bank Out-DR column.

- The sum of the credit amounts of the bank lines in the group in the Bank In-CR column.

- The group line will have all of the same functionality of a bank line:

- Match to an existing journal or batch.

- Be reconciled to an existing journal or batch.

- Create a journal according to the DR or CR amount.

- Create a new Journal Template (bank rec rule).

- Show a draft journal according to a bank rec rule.

- If the user has secure feature Secure Features#CanPerformBankReconciliation with a qualifier greater than 0:

- On a bank line that has not been reconciled and is not a group, new right click option 'Add to new group':

- A new group will be created, with the Date and Description from the bank line.

- The bank line will be added to the group.

- A popup window will show the group and list the bank lines in the group.

- On a bank line that has not been reconciled and is not a group, new right click option 'Add to Date Description':

- One option for each unreconciled group shown in the bank rec.

- Multiple groups will be listed in order of the number of days difference between the bank line date and the group date.

- The bank line will be added to the group and contribute to its amount.

- On a group line a new right click option 'Show bank transaction group':

- A popup window will show the group and list the bank lines in the group.

- In the group popup window:

- The Date and/or Description for the group can be changed, and click Save in the popup.

- If the group has not been reconciled then a new right click option 'Remove from group'.

- On a bank line that has not been reconciled and is not a group, new right click option 'Add to new group':

- Right click option 'Delete all bank lines from here on' is not available if any of the lines that would be deleted are in a group. Remove from the group first.

Unreconciled lines that have a cleared date

A cleared date is put on the journal line when the line is reconciled in the bank statement. It cannot be removed by a user. This feature is an audit check and if you see this button please contact support.

When the Action menu option ‘List bank statement(s)’ is chosen then a check is done to see if there are any journal lines with

- the selected bank GL account

- and within the selected date range

- that have a cleared date

- but are not in any bank statement.

If any are found then a red button labelled ‘Cleared bank lines not in bank statement’ will show under the ‘Journal unreconciled;’ label.

Clicking this button will open the ‘G/L Health’ form at the ‘Cleared bank lines’ tab with the bank rec date range and bank account selected and the list of relevant journals showing.

G/L Health form (Admin menu, Audit, View G/L health checks), new ‘Cleared bank lines’ tab:

If no date range and no bank account are selected then all journal bank lines with a cleared date but not in a bank statement will be shown.

Journals with a journal date before the date of the first bank statement for the selected bank account will not be shown.

Right click with one or more lines selected to remove the cleared date from the selected journal line(s).

Right click on a line to open the journal.

Changing from the non-statement centric (old method) Bank Reconciliation process

- If there is a LOCKED old method bank reconciliation for a bank account (ie one that is active)

- then no journal or batch can be reconciled for the same host/bank account.

- Close or delete the LOCKED old method bank reconciliation

The Old Method bank reconciliation will no longer be available once the statement centric process starts to be used

- If journals or batches for the bank account have been ticked as Reconciled in this statement centric bank reconciliation then no old method bank reconciliation can be started for that host/bank account.

- History tab, Delete/Cancel context menu option, will get an error if any lines are ticked.

- Deselect all ticked reconciliations in this statement centric bank reconciliation and try again.

How does the cash deposited appear in the OLD bank statement

Cash batches appear as a single journal line in the bank statement ( A yellow General Journal) as all the cash was deposited as a single cash amount

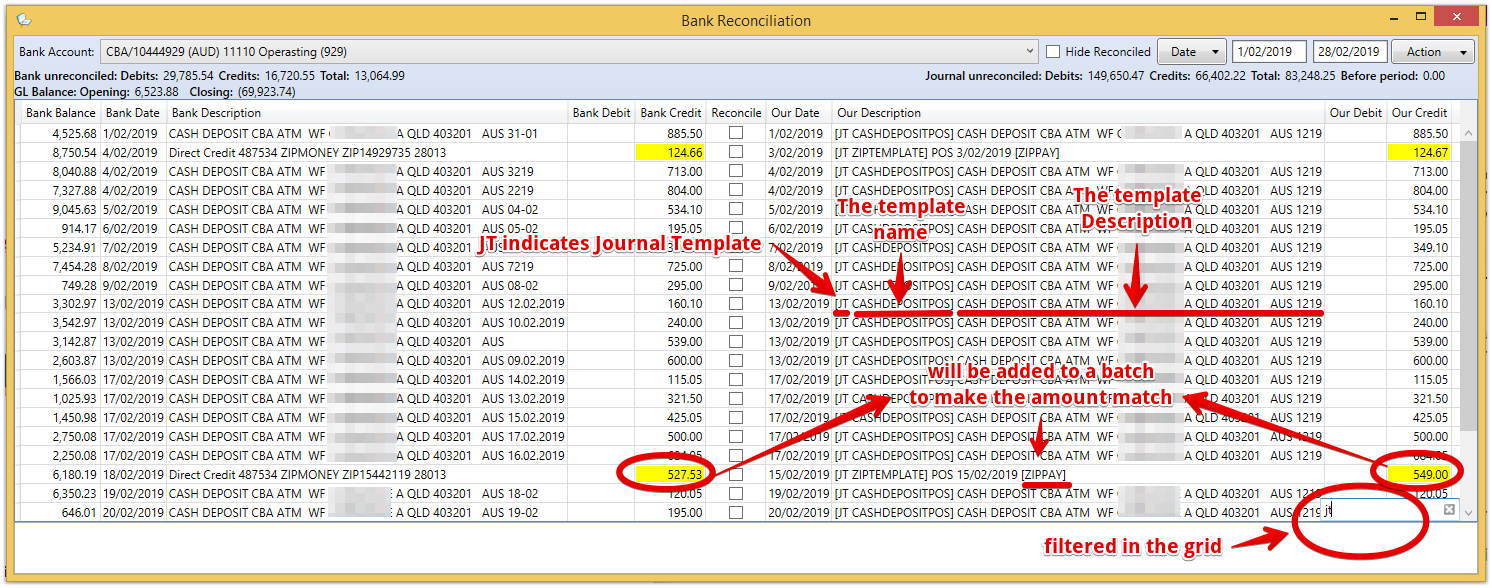

Reconciling the OLD bank statement

Getting ready to reconcile transactions

Reconciling the bank statement is a process of confirming each of the transactions you expect to have appeared are there and creating other transactions that you did not record in your business system. When you tick the box in the S column you are confirming that you have seen that transaction in the bank statement.

Choose the bank account

The Reconciliation screen will then open with the last reconciled date

Put in the date of the statement that you have in front of you - this is the date you are reconciling to

Enter the Statement Balance. The variance will populate showing how much $ transactions you have to find and tick as reconciled

Note that the transactions listed will be any transactions prior to the Reconciliation date that have not yet been reconciled.

OLD Bank Reconcilation - Reconciling individual transactions

Next you need to look through your bank statement to find transactions to clear. Normally you have a printed out statement and you tick off each transaction as you find it.

It can help to untick the "presented" list - this makes it easier to find the transactions you have not yet cleared. As you clear transactions you can refresh and they will hide.

The bank reconciliation shows some transactions that are part of a credit card batch (see credit card section above in this document) - If the amount we say should be there is the same as in the bank statement you can clear these using a rightclick.

OLD Bank Reconcilation -Reconciling Credit Card Batches Batches

The bottom RHS of the screen has a list of batches. A batch is a group of transactions. As you can see all the individual transactions are still visible in the bank statement - this is because it is common that what we expect and what is paid to you will often be different - because of fees, bounced transactions and other reasons. You can quickly clear all in batch using a right click if the values match. Otherwise you will need to use the credit card statement to clear them independently.

Enter Bank Fees

This is a good time to enter any bank fees that you find when looking at your credit card gateway trading statement

Remember that this is a grid like anywhere else in the system - so you can filter the transactions (CNTRL F) or top LHS of grid for filter - it will filter using any information in the grid

OLD Bank Reconcilation - Filtering the transaction list

using letters

Filtering using numbers

OLD Bank Reconcilation -Review of past reconciliations including the PDF report

At any time you can print a preview of the reconciliation report using the print button.

When you have completed the reconciliation (Reconcile Now) button all the transactions in the system that have been marked as reconciled will be locked and cannot be changed.

To view the report for any reconciliation - the current screen will then show all the transactions for that reconciliation (locked).

To view the report use the print screen - or the link to the saved report.

This is what the report looks like

The saved report shows exactly the situation at the time of doing the bank Req - there are two numbers that may now be different...

When viewing a closed bank Req - the unpresented values are live values (not saved ones). Hence they will show you if any transactions prior to the reconcilation date have STILL not been cleared.

The saved report shows accurately at the time of doing the bank req:

- The Journals that were cleared

- The Journals that are before the reconciliation date that had not been cleared at that time

- If a journal is not cleared for a number of reconciliations - it will be listed in each report as uncleared.

- Journals that have not been cleared in the bank req can still be adjusted.

The Bank Balance is often not the same as the Balance sheet balance - due to un-presented transactions.

- If at the time of doing a bank req you have unpresented payments or receipts (this is common)

- These will not add to the bank req balance at the time of the bank balance

- These will add to the balance sheet value of the bank balance

- If you want to change this

- Update the dates of all the unpresented transactions to be after the date of the bank req before saving the bank req

- Two cheques are entered into the system for an empty bank account dated 1st August (note I have used cheques but any transaction type applies here)

- $100

- and $1,000

- You do a bank req on 7th August and only the $100 is there - the $1,000 has not yet been presented.

- no problem as the $1,000 will be listed in the next bank req in case they have deposited it by then

- As the date on the journals is 1 August the GL Balance for the bank account is $1,100 on the 7th August - this is what will show on the balance sheet

- The Bank balance will therefore be different to the Balance sheet balance as it will be $100

- The $1,000 transaction has not yet been reconciled with the bank so it can be changed / deleted etc if required.

- If the date of the $1,000 is changed to a date after the 7th August then the balance sheet will now equal the bank balance.

- Say we change the date on the $1,000 cheque transaction to the 9th August

- The saved bank req report will still list this transaction as unpresented - it shows the system at the time of doing the bank req

- Viewing the details of the closed bank req in the screen will now show $0 un-presented (a different figure to the saved report) as this figure shows unpresented transactions that are prior to the reconciliation date NOW (not as at the date of the reconciliation).

OLD Bank Reconcilation - Deleting Bank Reconcilations

- Go to Bank Reconciliation for the bank account affected

You can only delete reconciliations if you have the Locked one selected - then right click on the ones to delete.

You can only delete reconciliations if you have the Locked one selected - then right click on the ones to delete. You can only delete the latest Closed reconciliation (and then once that has been deleted the next most recent etc).

You can only delete the latest Closed reconciliation (and then once that has been deleted the next most recent etc). Note that you may need to clear the date range on the filter to see all bank reconciliations.

Note that you may need to clear the date range on the filter to see all bank reconciliations.- Delete reconciliations as far back as you need to including the first reconciliation

![]() Note - if you need to delete the first reconciliation check to make sure that the GL account does not have any transactions prior to the from date of the first reconciliation.

Note - if you need to delete the first reconciliation check to make sure that the GL account does not have any transactions prior to the from date of the first reconciliation.

OLD Bank Reconcilation - Uploading the bank statement - and find the matches quickly

Why upload the bank statement? If all your transactions are already in the system you do not need to upload the bank statement.

- To use an upload of your bank statement to quickly create missing transactions

- You may pay people and not have entered a payment yet - that is ok - we make it easy to create the payments from the bank reconciliation screen

- Upload your bank statement - this will provide a list of all transactions you have in your bank

Upload File Format

The Bank statement upload needs to have the following headings - modify your CSV file to suit

- Date (of transaction)

- Credit

- Bank Account this is an increase in $ Value > (this is a positive number not a negative number)

- Credit Account this is a decrease in Amount owed) > (this is a positive number not a negative number)

- Debit

- Bank Account this is an decrease in $ Value

- Credit Account this is a increase in Amount owed)

- Description - the text on the transaction

Negative values will NOT be converted - you need to create separate columns of debit and credit

Then search for each transaction to find a match - or create the transaction in the system by right clicking on it.

Note that the menu available on right click will depend if the transaction went out of the account (you paid someone) or came into the account (someone deposited money)

A "Creditor Payment" is when you are matching to an invoice on a Creditor

A "Creditor Prompt Payment" is when you are not bothering to enter a Creditor Invoice.

You can start a bank fee journal from here as well - this will create a journal on the creditor you configured for the bank with the other side defaulting to using the account referenced in Symbols Config - BankFeesGLAccount

FX bank account transfer of funds

Use the wizard to transfer funds - see Foreign Currency Transactions (fx)

Shutting Down Bank Accounts

When you are closing a bank account there are a couple of things to do in the system

Do a final reconciliation - when you get that final statement - do the last reconciliation. The final value of the bank account statement balance should be zero.

In the GL - flag the GL account as "Disallow new entries" so it cannot be used as a bank account any more.

Related articles

Filter by label

There are no items with the selected labels at this time.

Related issues