...

See also GST Explorer for BAS

| Note |

|---|

Run report to PDFAny of the financial reports can be run to PDF by choosing that option |

Balance Sheet

The balance sheet is a "Point in time" report.

...

The Values on the report are directly from your General Ledger financial transactions.

Stock Valuation

The warehouse screen shows stock valuation (stock quantity x average cost) and compares it to the balances sheet stock valuation

Choose a warehouse to see the valuation in that warehouse

There is also a view of the change over time by day in a month and by month

Profit and Loss

The profit and loss is a period based report. From date and to date. The profit and loss cannot cross financial years.

See also - Customers and the Debtor Card#Debtorprofitandlosscanincludethechildrentransactions

Profit and Loss showing Sales Channels

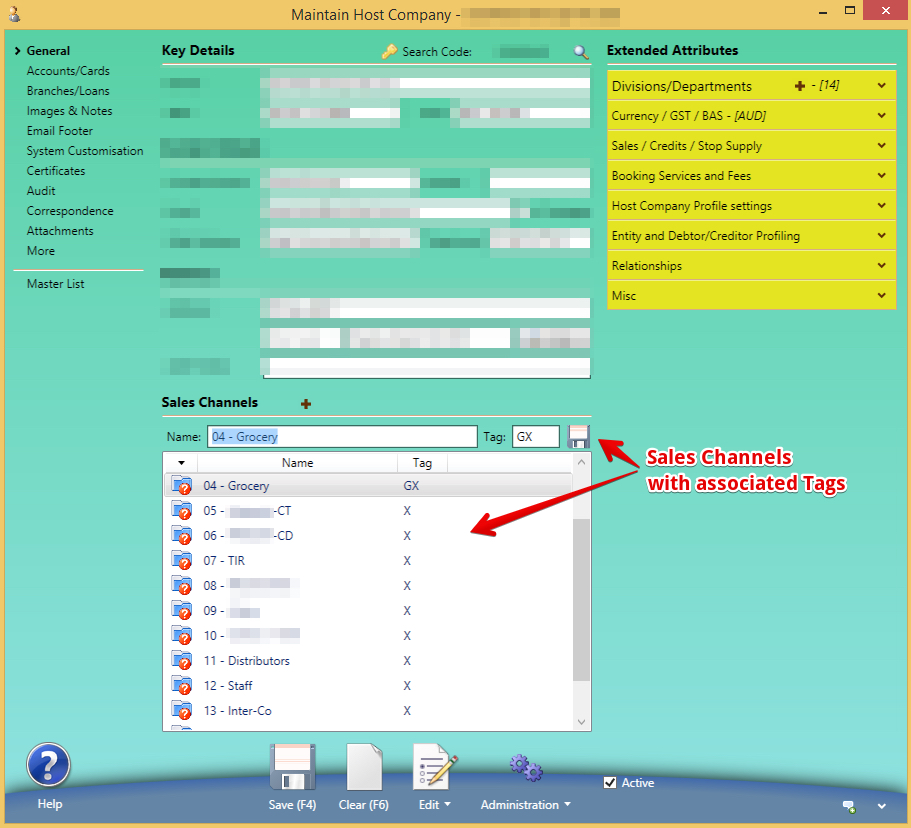

Define Sales Channels and Tags

Debtors are linked to a sales channel - this can be used to break out totals in the profit and loss reports.

Multiple sales channels may have the same tag.

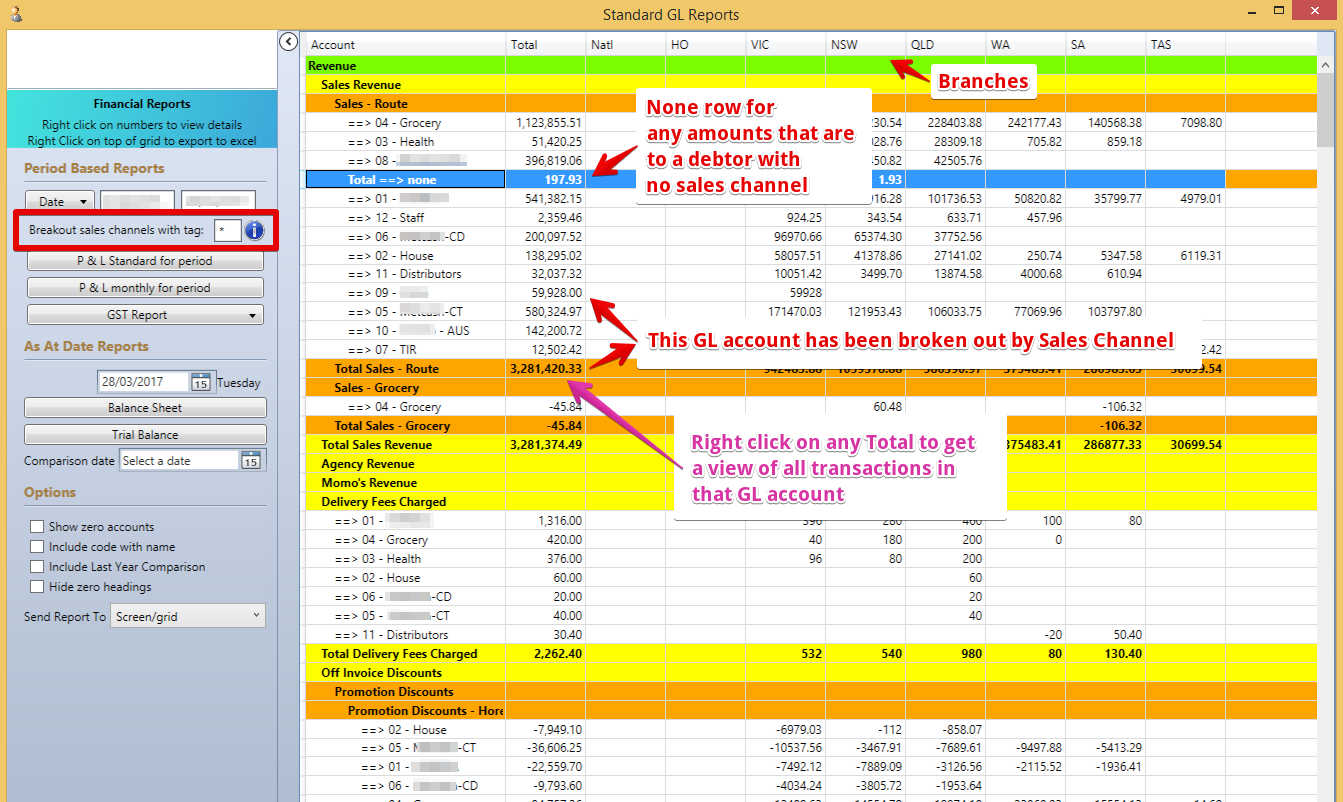

Profit and Loss showing breakouts by sales channel

| Note |

|---|

* = all sales channels Otherwise enter the tag/s to reference. |

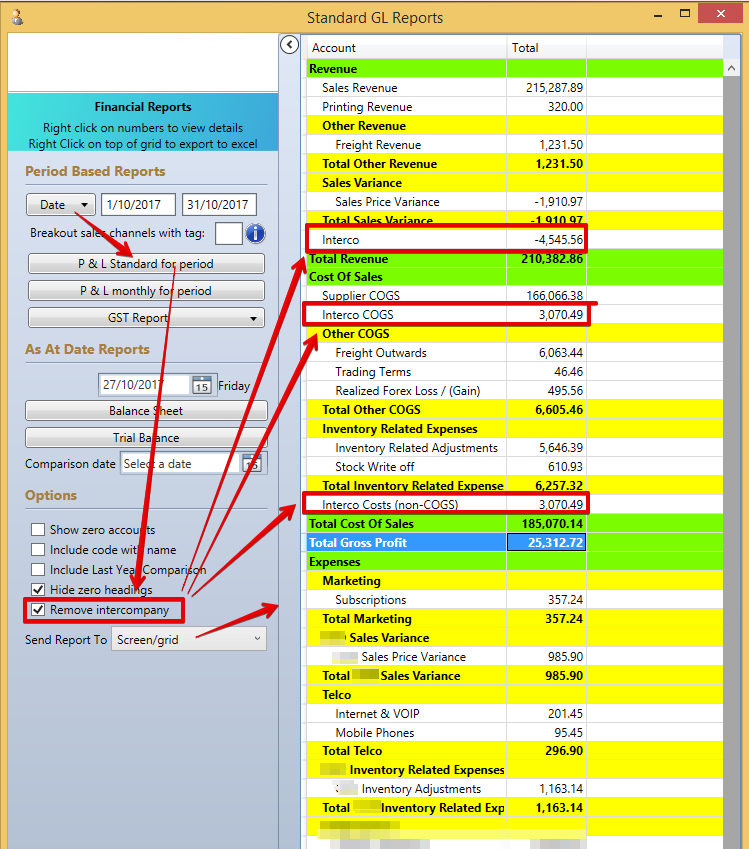

Profit and Loss Eliminating intercompany transactions

Any company that you trade with (Debtor or Creditor or Host Company) that your business is a 100% owner of will be eliminated

...

| Note |

|---|

The removal of intercompany values is at the end of the report section - as seen below at the bottom of the Revenue section is the removal. The only exception to this is the Cost of Goods Sold control account - they are removed directly below the Account (see Interco COGS) below - the remainder from the Cost of Sales section are removed at the bottom of the section (see Interco Costs (non-COGS) |

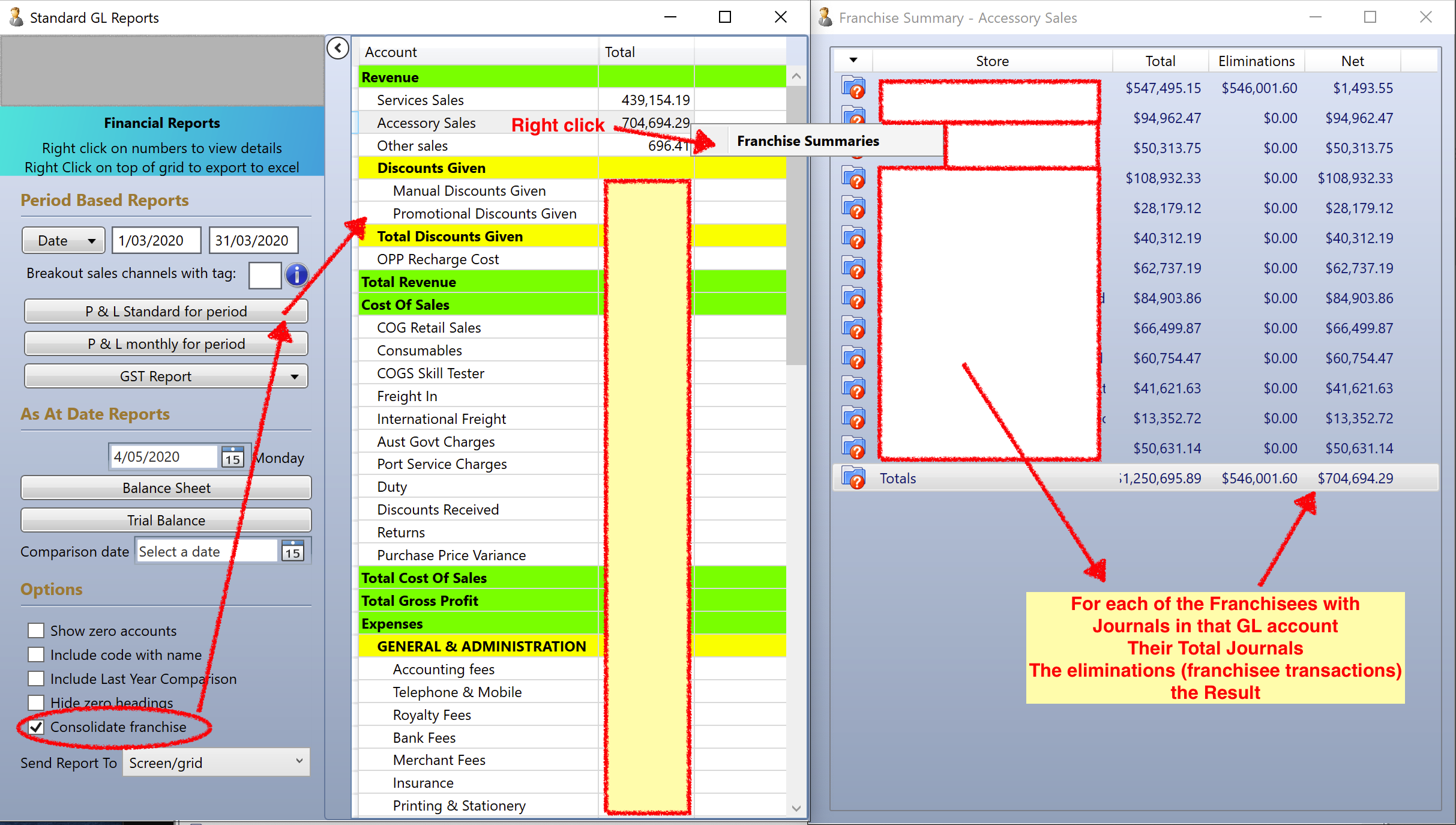

Franchise Group Profit and Loss

The Franchise group is a special type of inter company elimination allowing the breakup of each GL Account to be shown

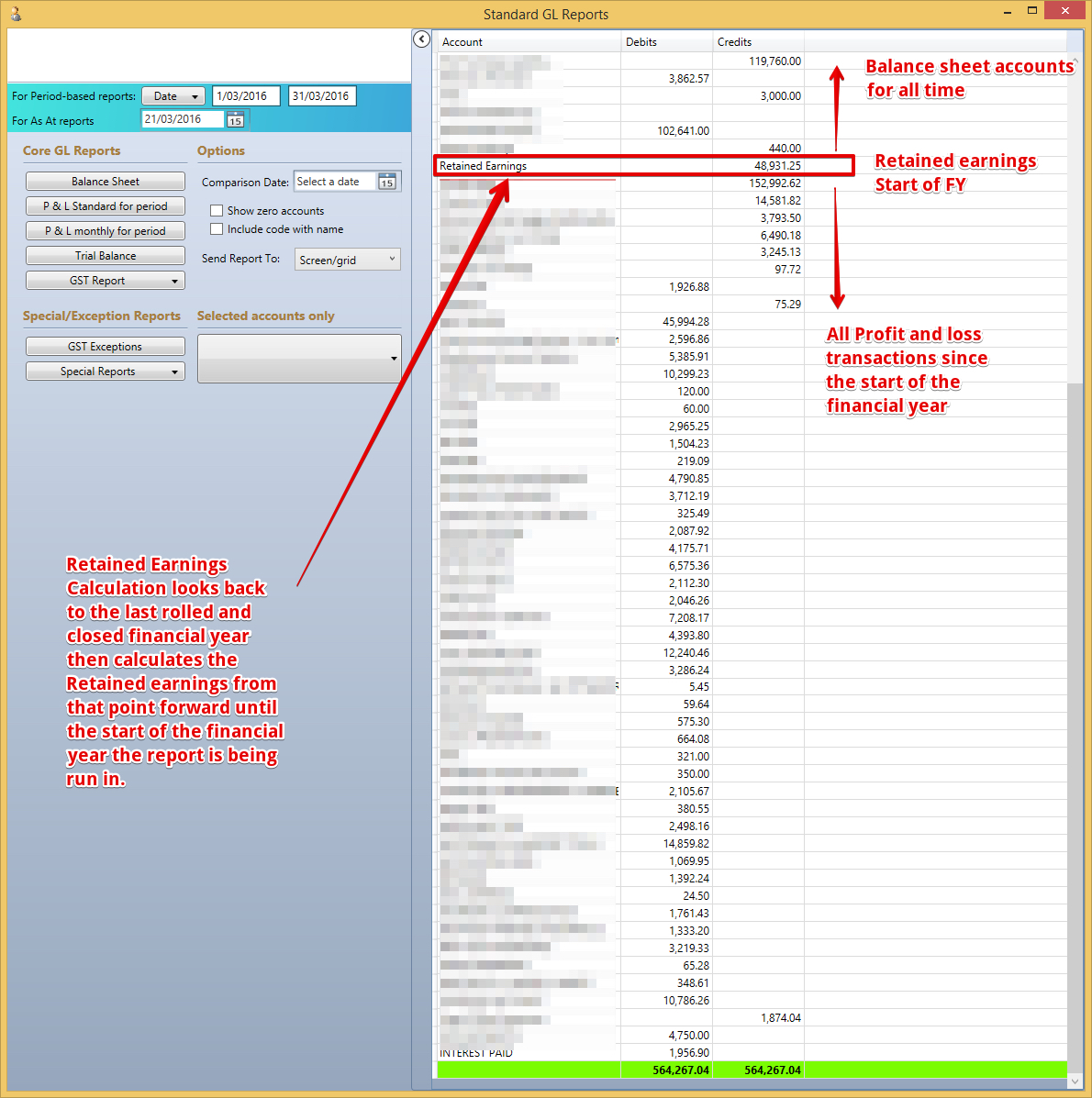

Trial Balance

The Trial Balance Report is an accounting report to check all journals in the system are balanced - it is an AS-AT report From the start of the financial year that the report is run in.

GST Report - Accrual / Cash

GST report - Accrual Basis

| Note |

|---|

Note that the GST Explorer for BAS is an online view of this information only for Accrual Accounting with the ability to drill to the journal details. |

...

The cash basis report indicates GST due based on when payments are made.

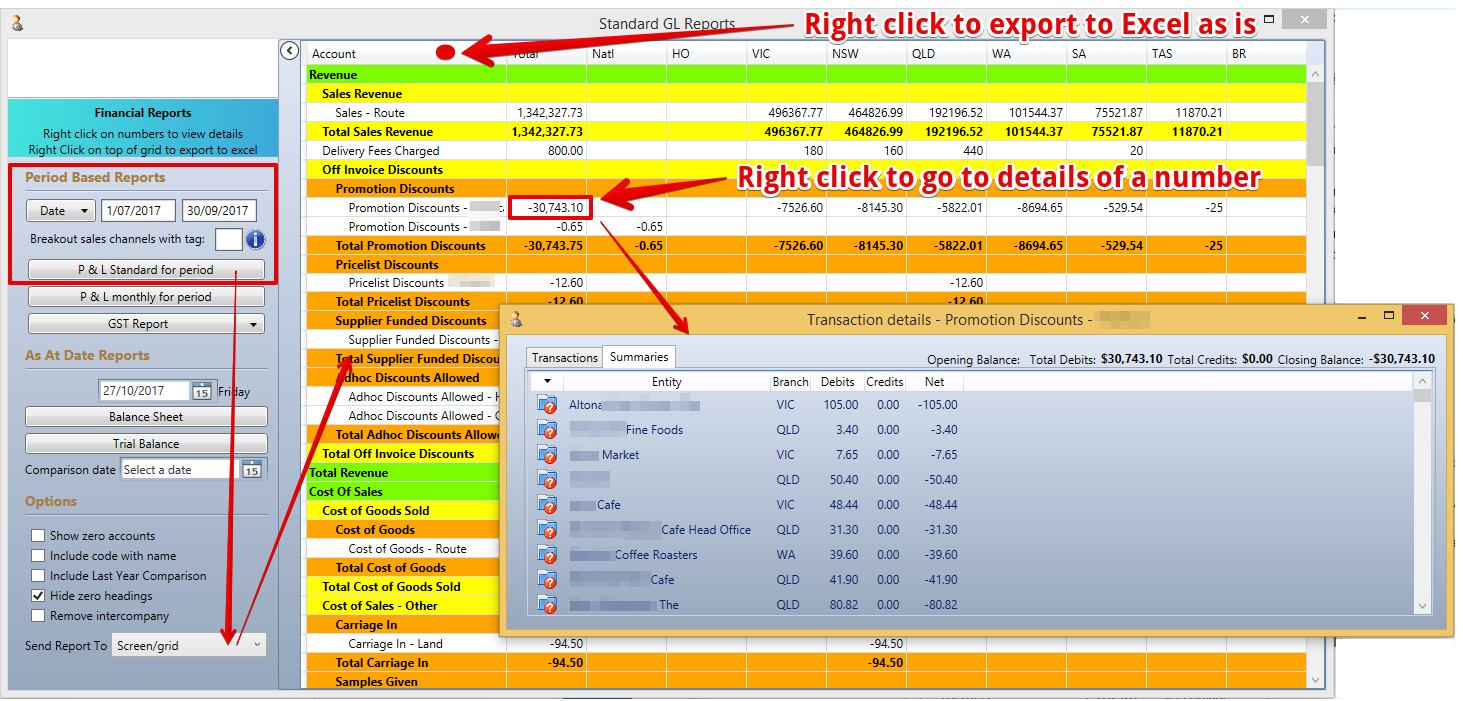

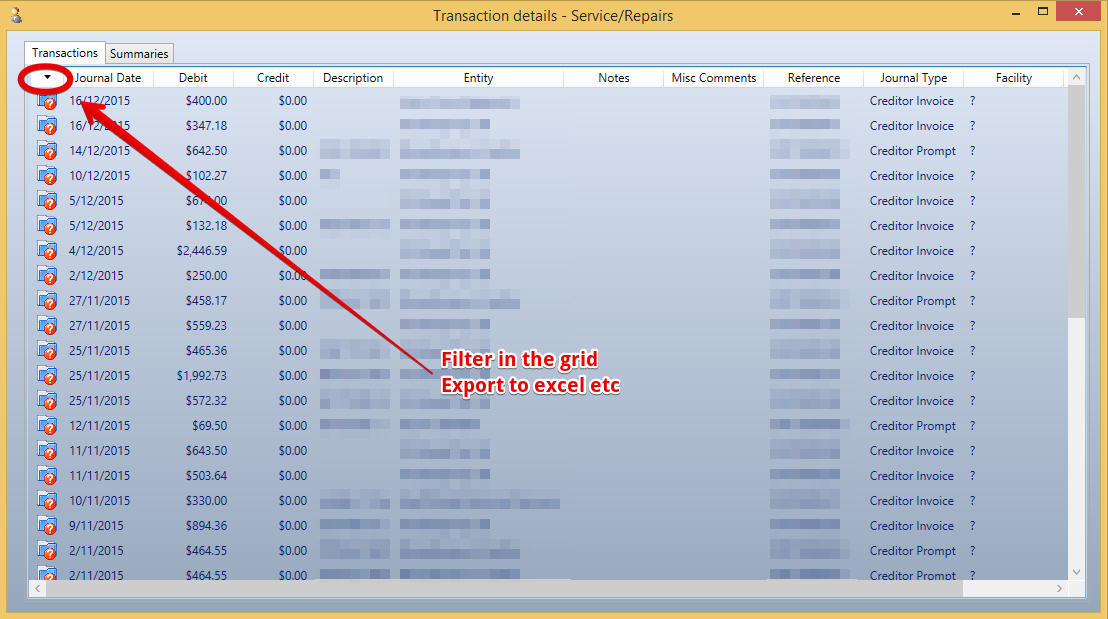

To review balances in any report from the report

Right click on a value in the report and "View Transactions" - you can then export these grids to excel if you would like to analyse them further.

...

Detailed transactions view...

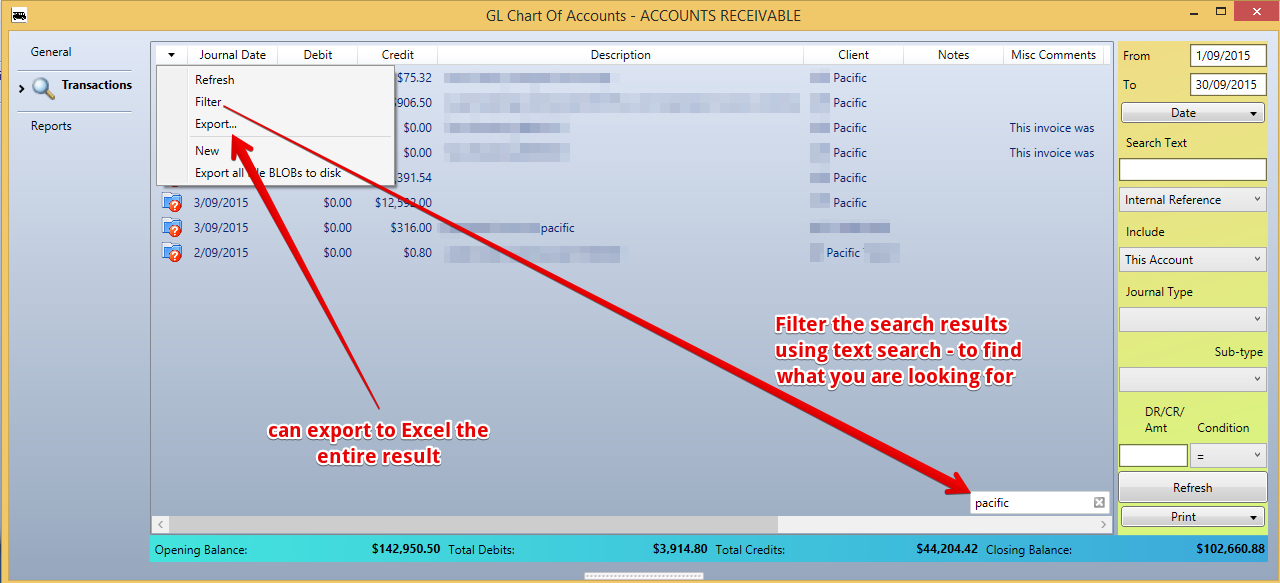

To Review Balances from any of the reports - in the GL

To review all the transactions for any of the values on the balance sheet - use the GL chart of Accounts

...

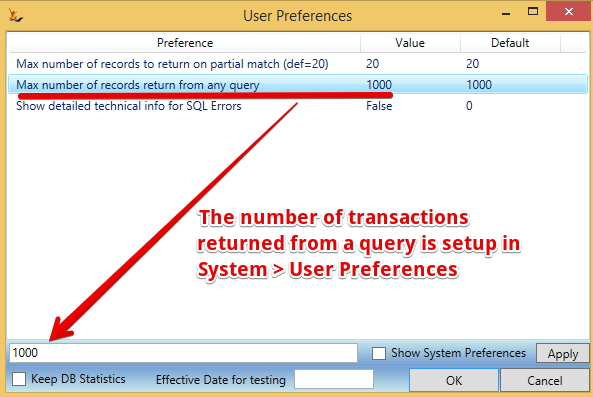

The number of transactions returned is limited by your user preference settings

Filter in the Grid

Note that you can filter in the grid

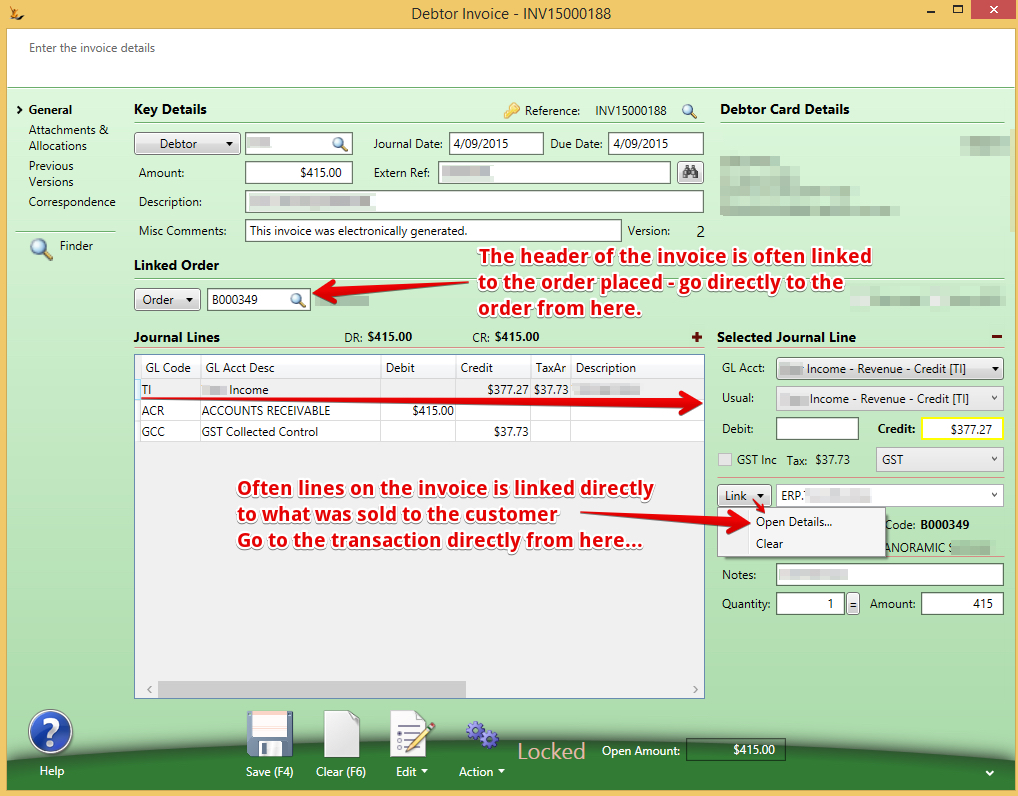

Double click to open any of the transactions

Example here is an invoice - Note that many links exist in the system

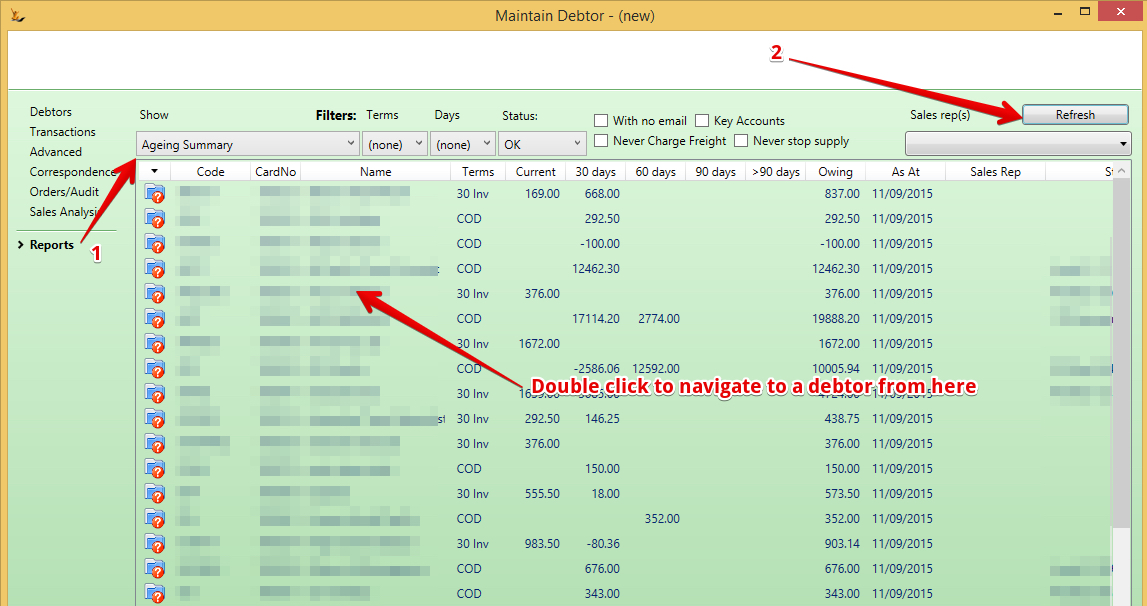

Aged Debt Report - on rear of Debtor Screen

To review aged debt report - have a look at the Customer Reports Section - you can export to excel to review the details. For more detail see Collecting Debt from Customers

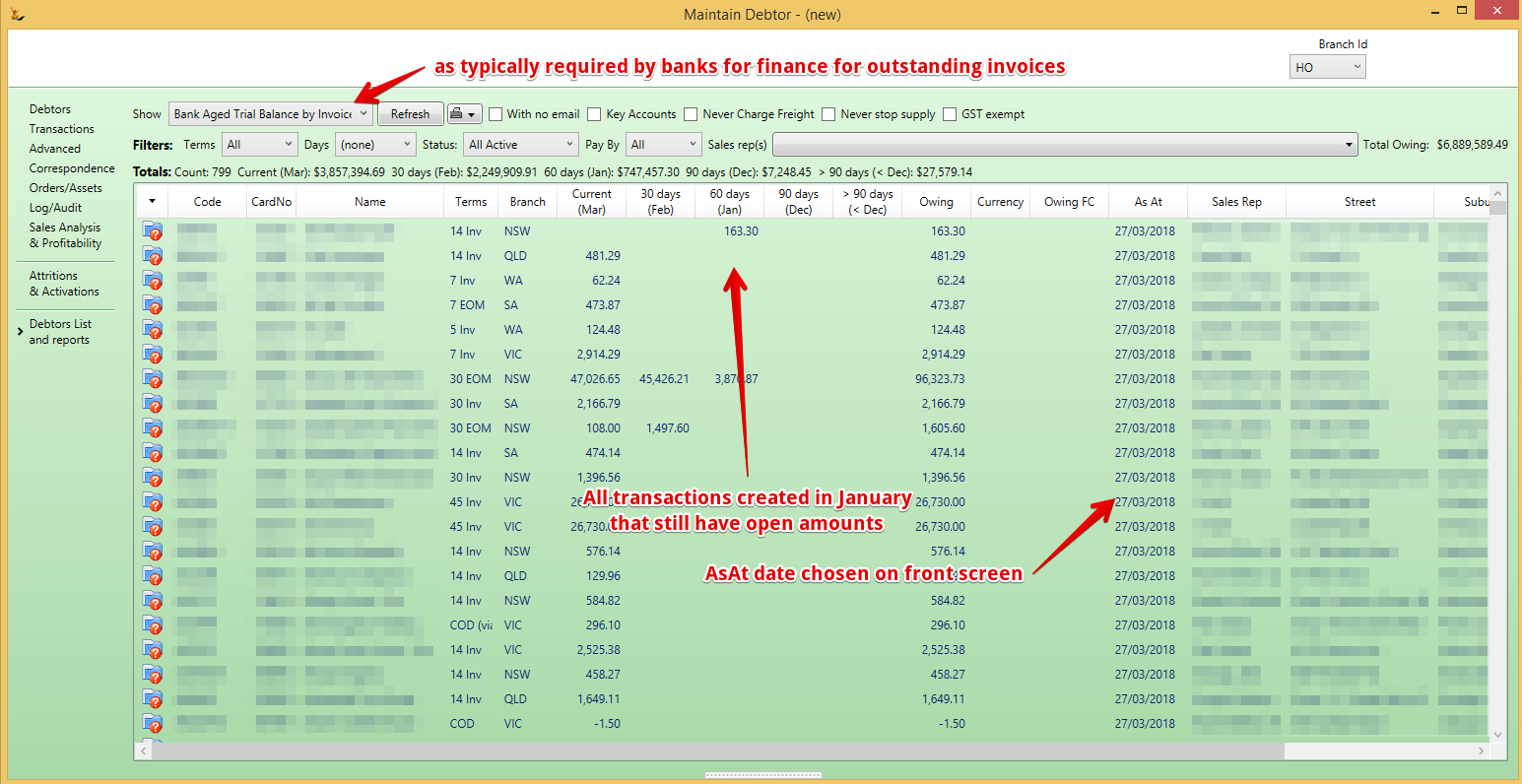

Aged Debt by Invoice Date (commonly required by the banks)

Some banks will request this report be provided weekly or monthly to secure funding

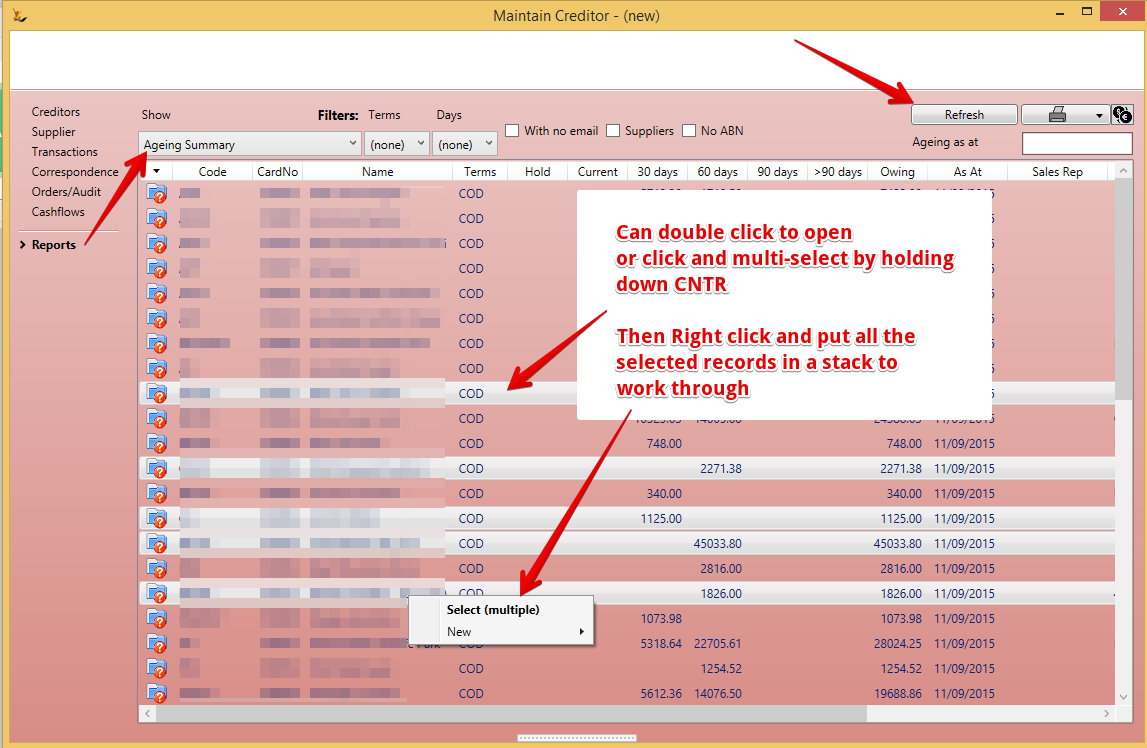

Ageing Receivables Report - rear of Creditor Screen

On the Supplier Reports section is the Ageing report in a similar fashion.

Related articles

| Filter by label (Content by label) | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

| Page Properties | |||

|---|---|---|---|

| |||

|