Use Sidebar LHS to navigate

For global help click here

Accrual Journals

Accrual Journals are used when:

- An expense cross multiple time periods

- The expense is expected in the future

- An accrual is required each month for the purposes of analysis of the business

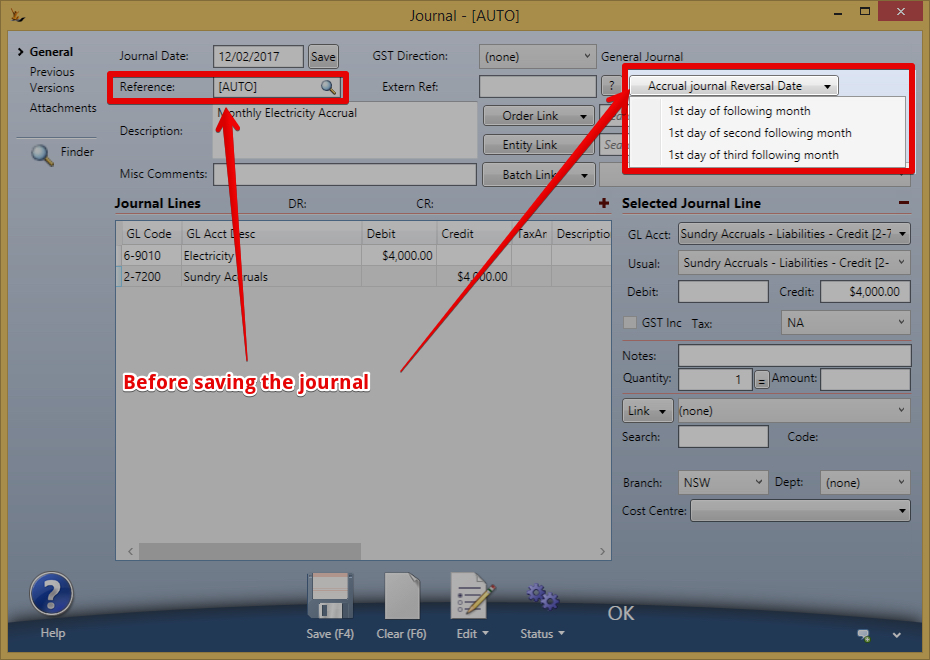

The Accrual reversal must be setup before the journal is saved

Normally accrual journals are created using Journal Templates

Preconditions

Journal must be end of the month (last day)

Action - Create Accrual - Pick Journal Reversal Date (next month or 3 months time)

Save - system creates mirror copy of that journal dated the month chosen

A link is shown to the Accrual Journal

Example

- Electricity Invoice is expected in 3 months for $300 (ie $100 per month)

- The Accountant wants to show $100 expense every month

- A General journal is required in each month for $100

- Best practice is to reverse this journal at the beginning of the next month

- Then create a new journal for $200 in the second month with a reversal in the third month

- Then the actual journal for $300 should arrive in the Third month

The result appears to be an expense of $100 in each month

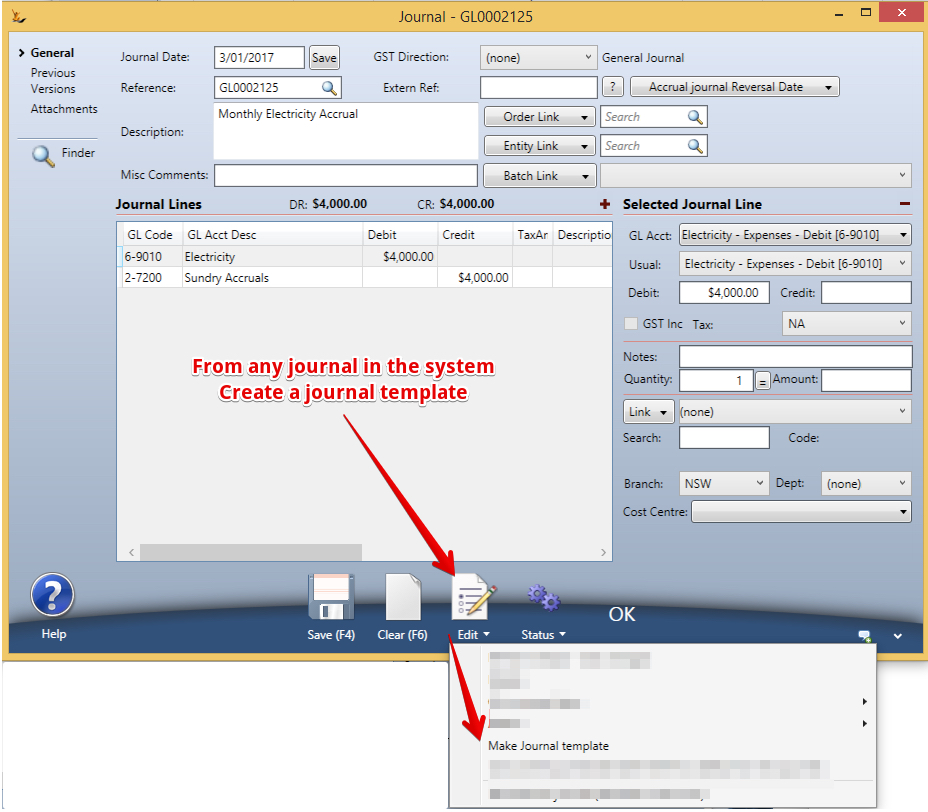

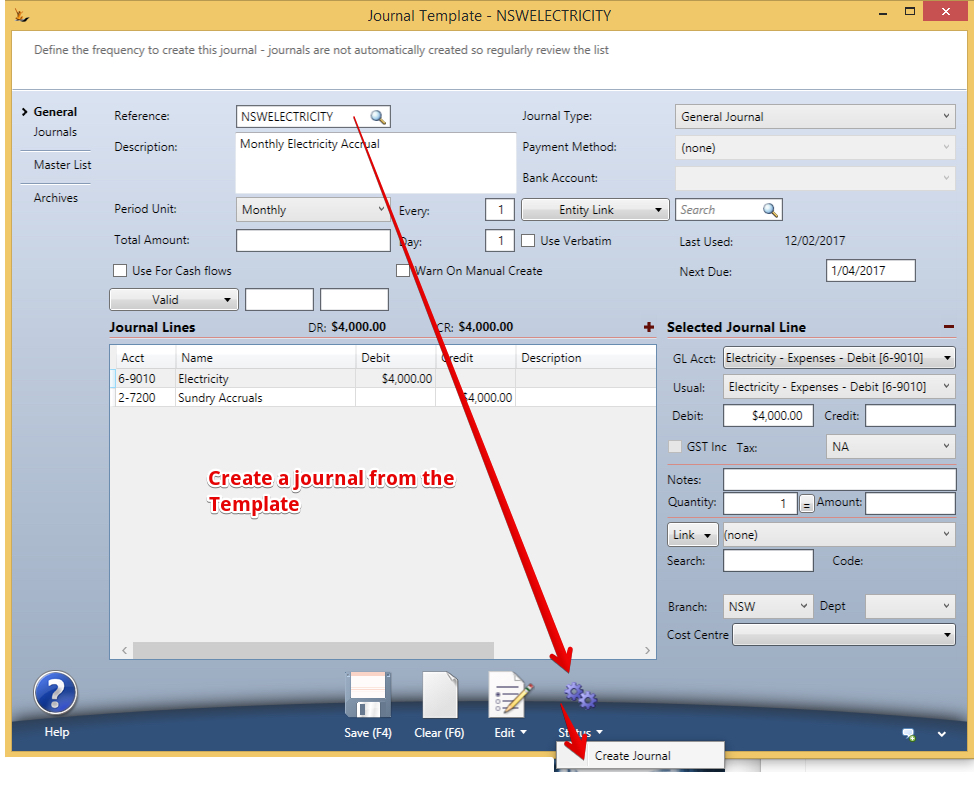

Electricity Accrual Journal - Create a Journal Template

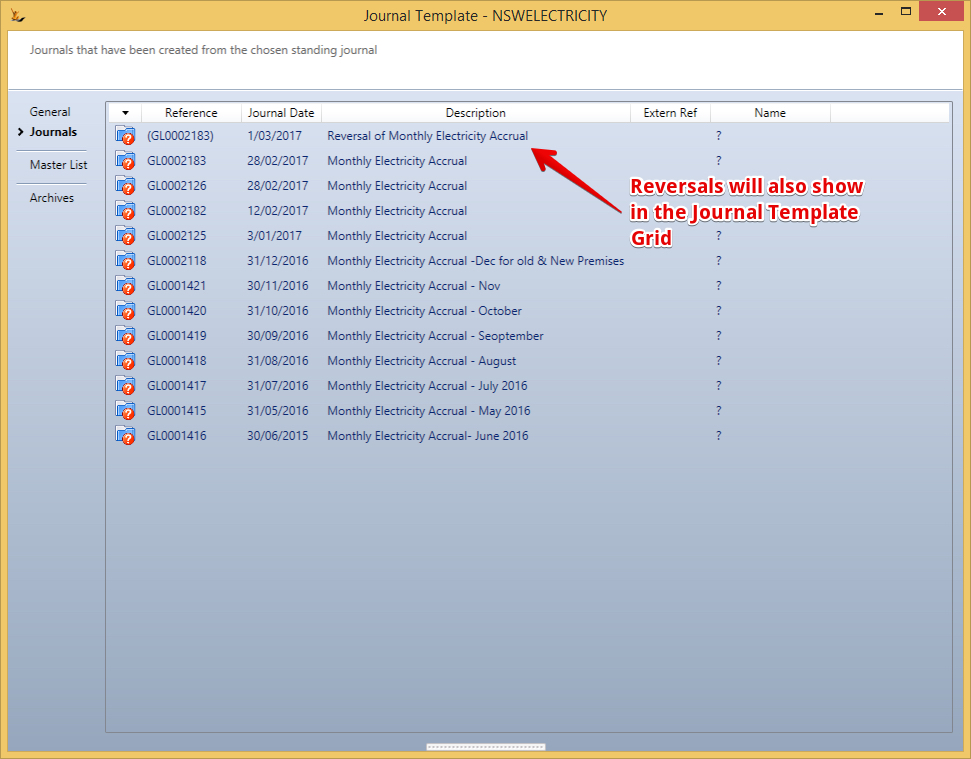

A Journal Template is useful as a place to see all the journals created

Use the template to create the accrual journals

Edit and then save the journal

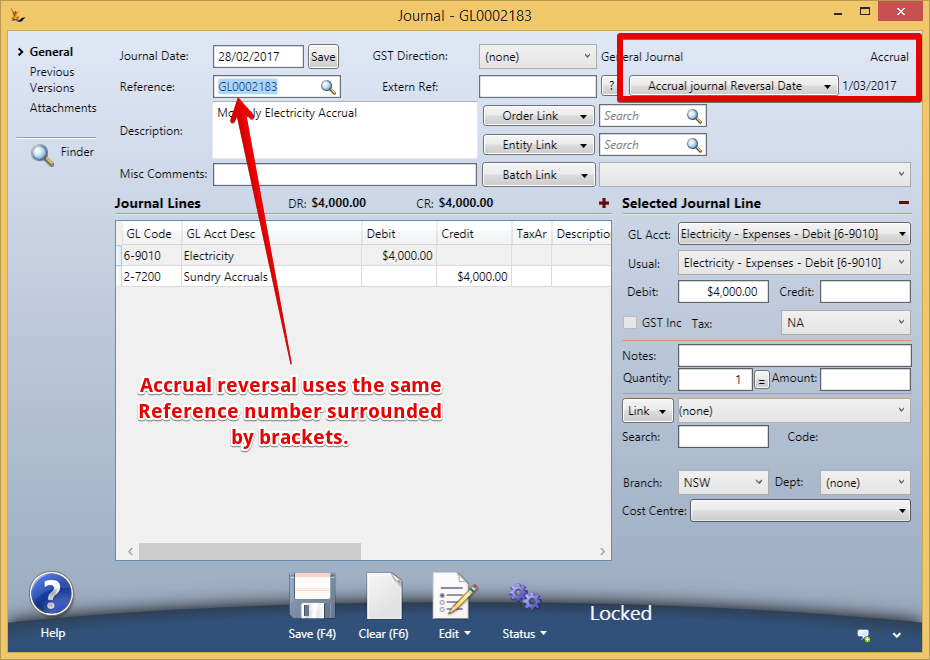

Choose the Accrual Details BEFORE you save the journal

Accrual Journals must be dated the last day of the month

After saving

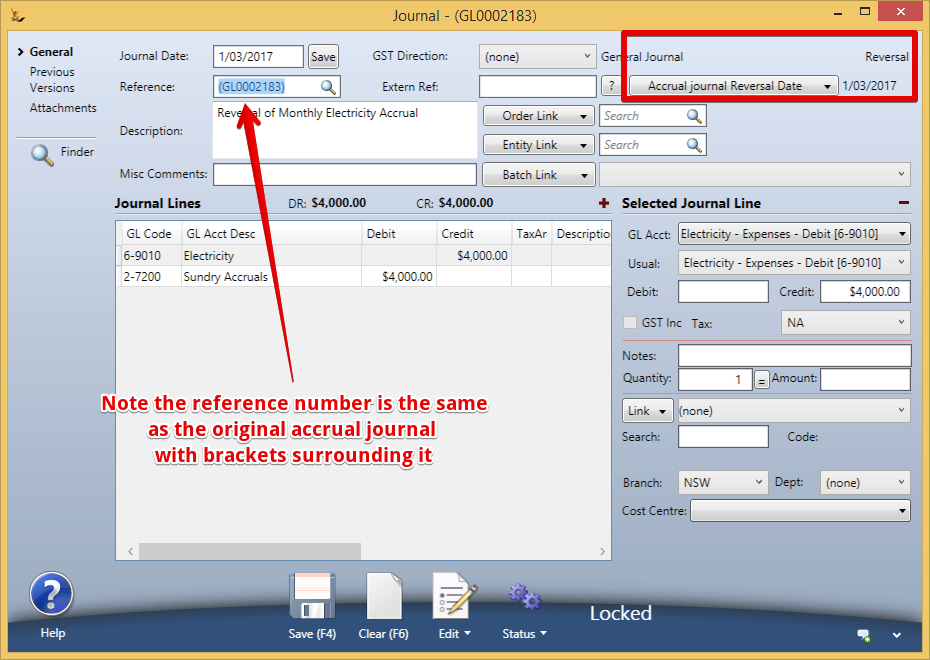

A corresponding Reversal is created as you save

, multiple selections available, Use left or right arrow keys to navigate selected items

For information about SaaSplications go to http://saasplications.com.au