Use Sidebar LHS to navigate

For global help click here

Fixed Asset Register and deprecition

Table of Contents

Overview

The system allows you to track all types of Assets - some are financial assets and some are not.

Any asset in the system can be a financial fixed asset and have associated depreciation journals created.

The user requires the Secure Feature "FixedAssetManagement" to use this functionality

Viewing your Fixed Asset Details

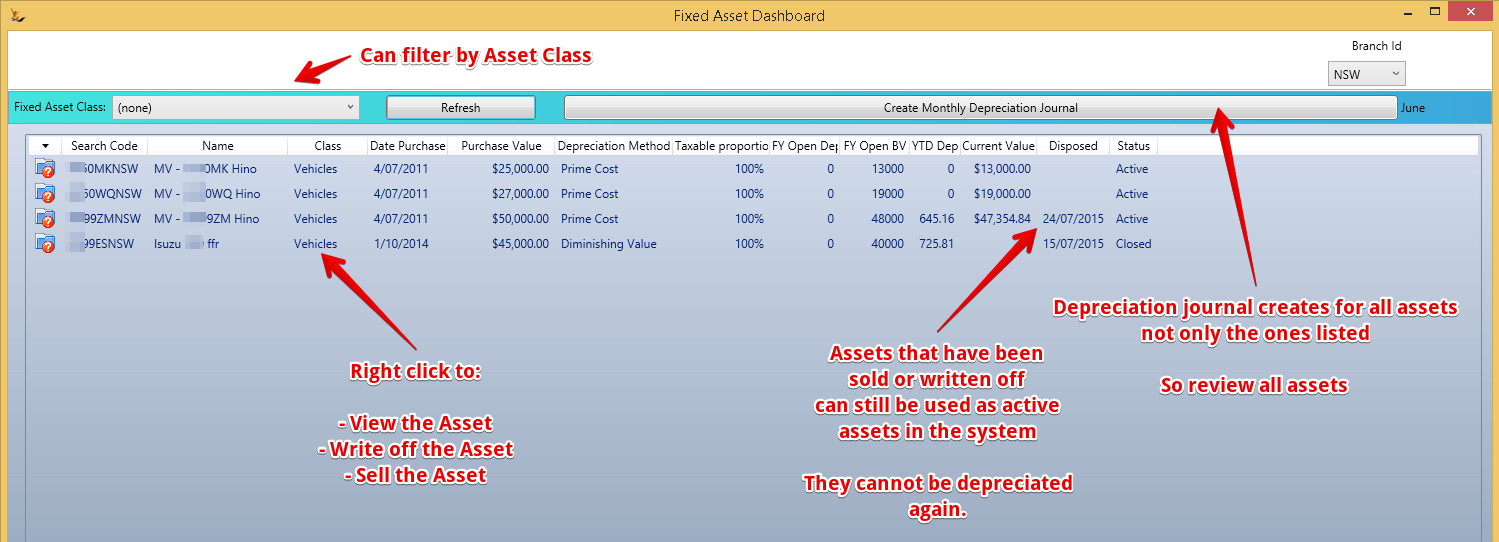

Fixed asset details for any assets with any depreciation journals for the current financial year are displayed in the Fixed Asset Dashboard

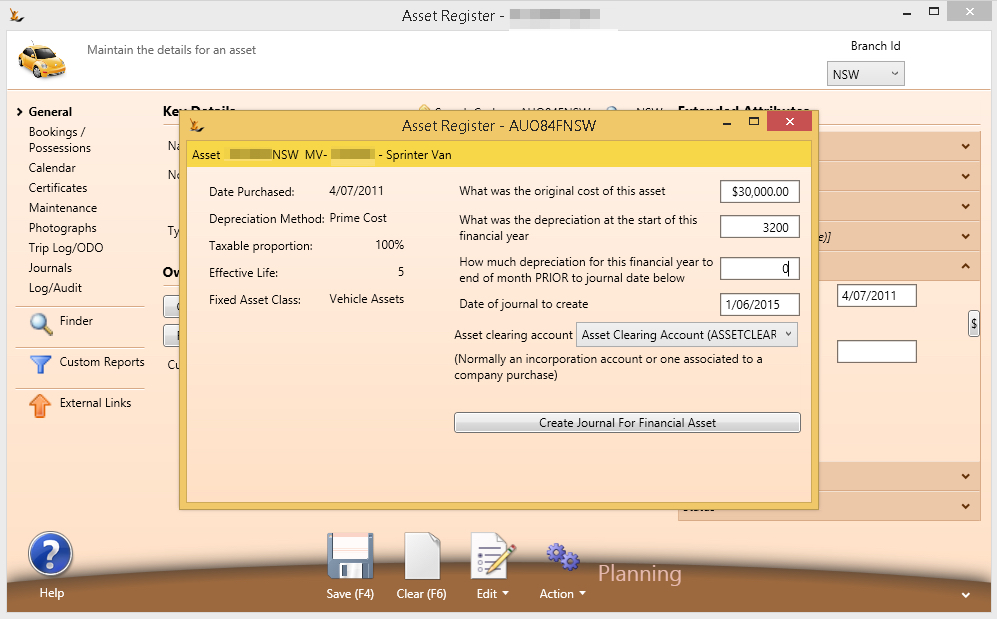

Creating Depreciation Journals - a manual monthly end of month task.

If you want to you can delete the depreciation journal that latest was created and create it again. Note you can only delete the most recent journal

- ie if a journal has been created for December and you want to sell an asset in November

- Delete the depreciation journal for December

- Delete the depreciation journal for November

- Write the asset off in November

- Recreate the depreciation journal for November

- Recreate the depreciation journal for December

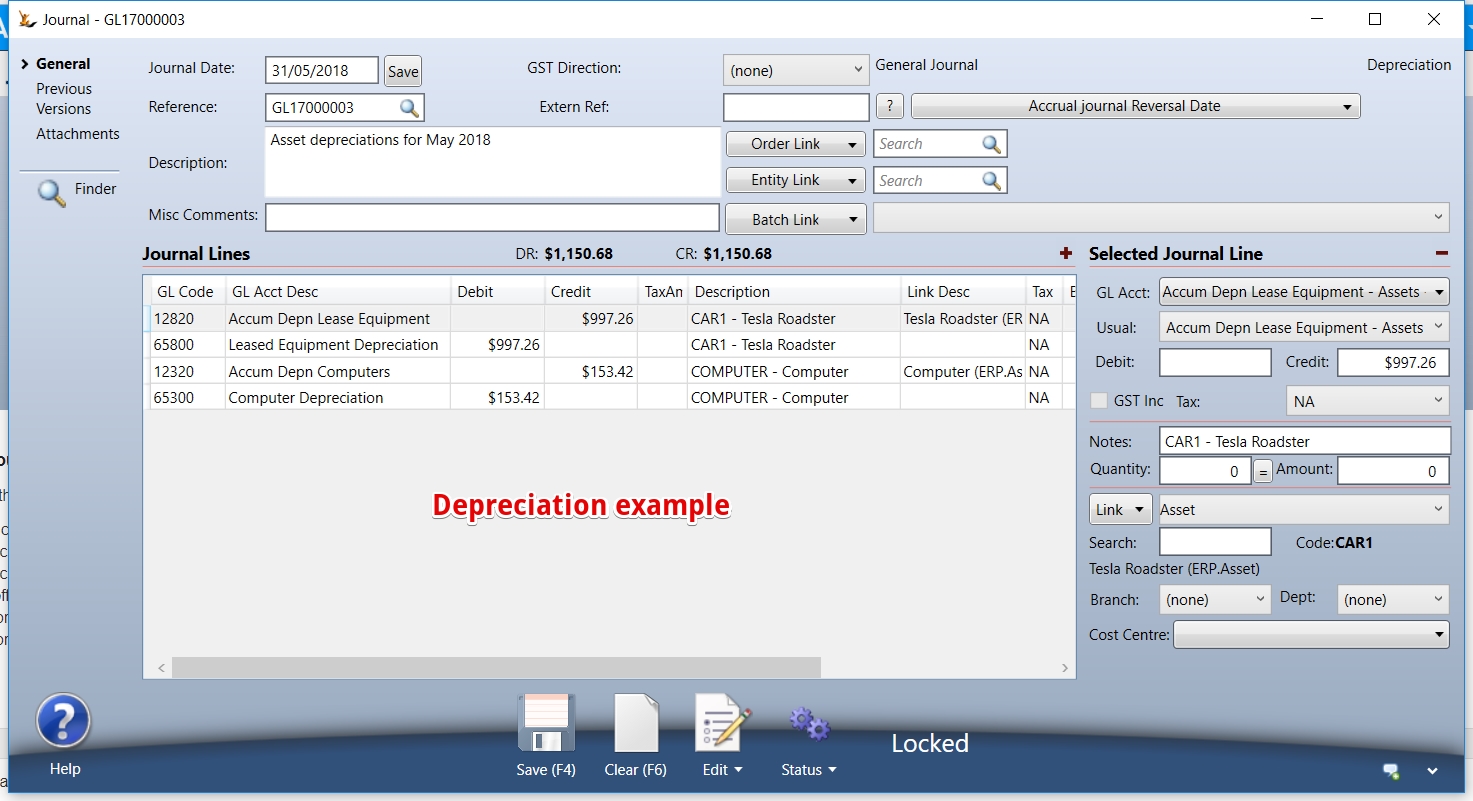

Example Journal

If the Asset was owned for a part of a month (ie was purchased during a month) - the system automatically only calculates the depreciation for that part of the month.

Depreciation is only calculated for assets with a financial book value.

Assets that were written off during a month will the depreciation journal written at the time of the write off and must be written off before the mass depreciation journal is written.

Software is an asset with a 2.5 year life using straight line depreciation

Setting up

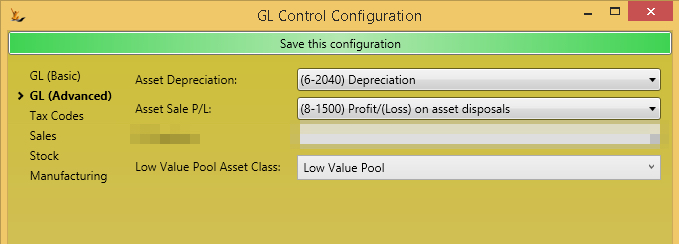

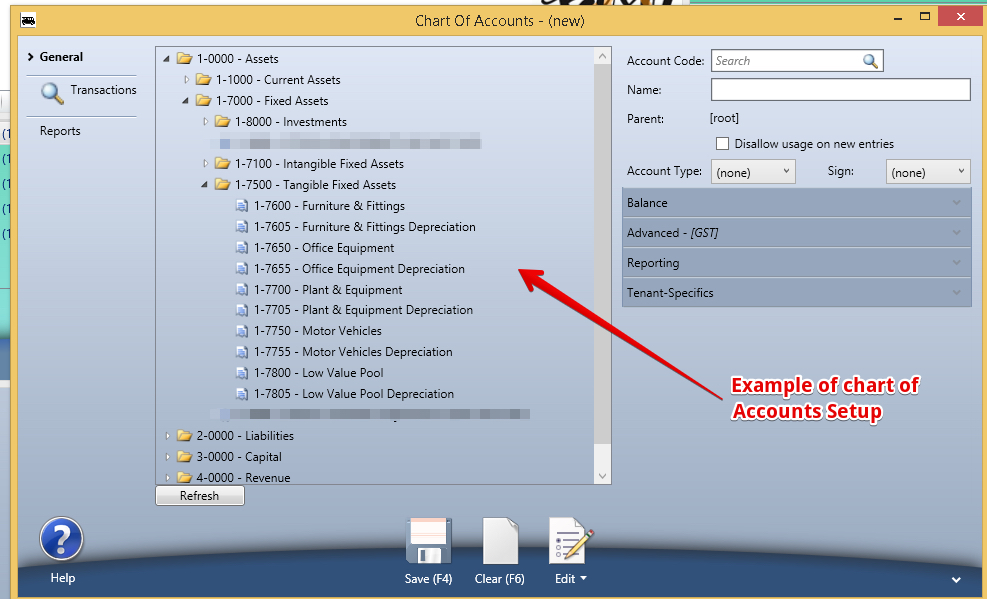

Setting up the GL Control Accounts

For Asset Sales (normally an "other income" account

For Depreciation Offset (normally an "Expenses" account) - this is a default in case there is not one defined on the Asset Classifications

For Low Value Pool (links the Asset Group that is considered the Low Value Pool)

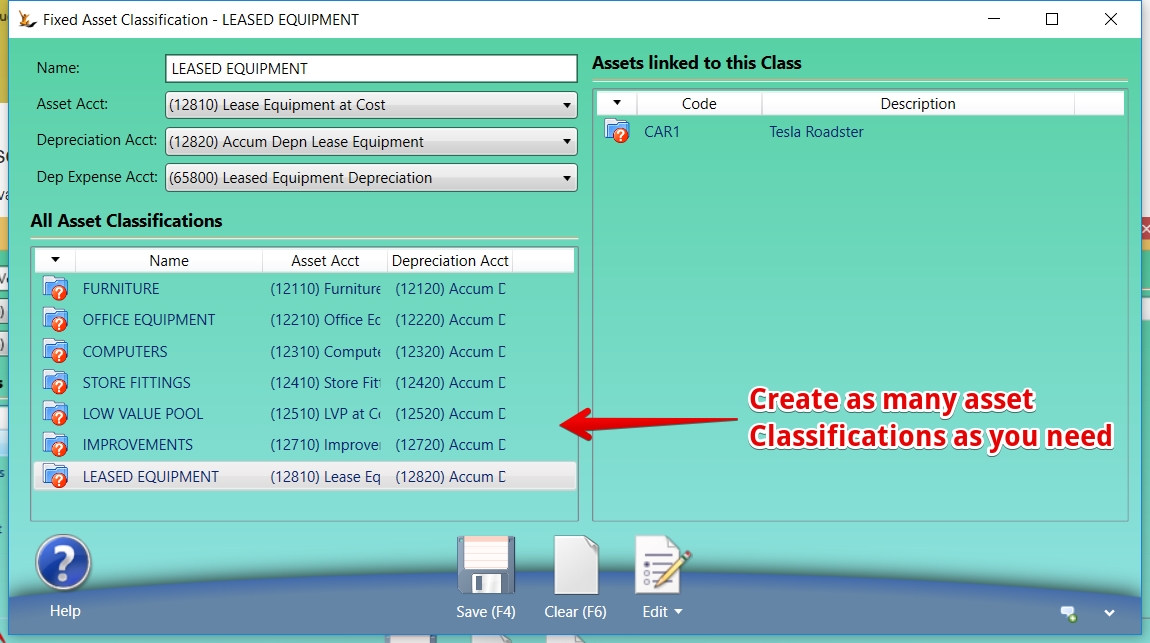

Setting up Fixed Asset Classifications

Asset Groups link the Asset value and Depreciation value accounts

Normally Asset Accounts and Depreciation Accounts are in the Assets - Fixed Assets section of your GL

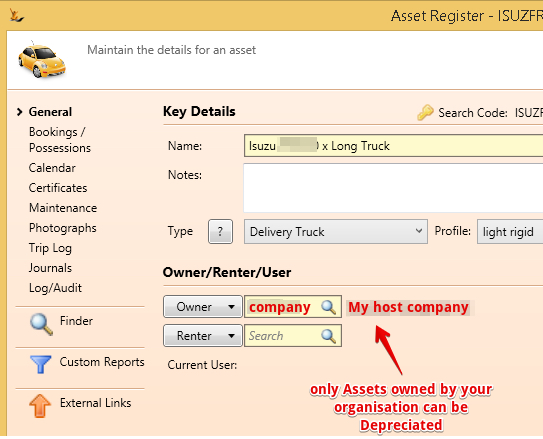

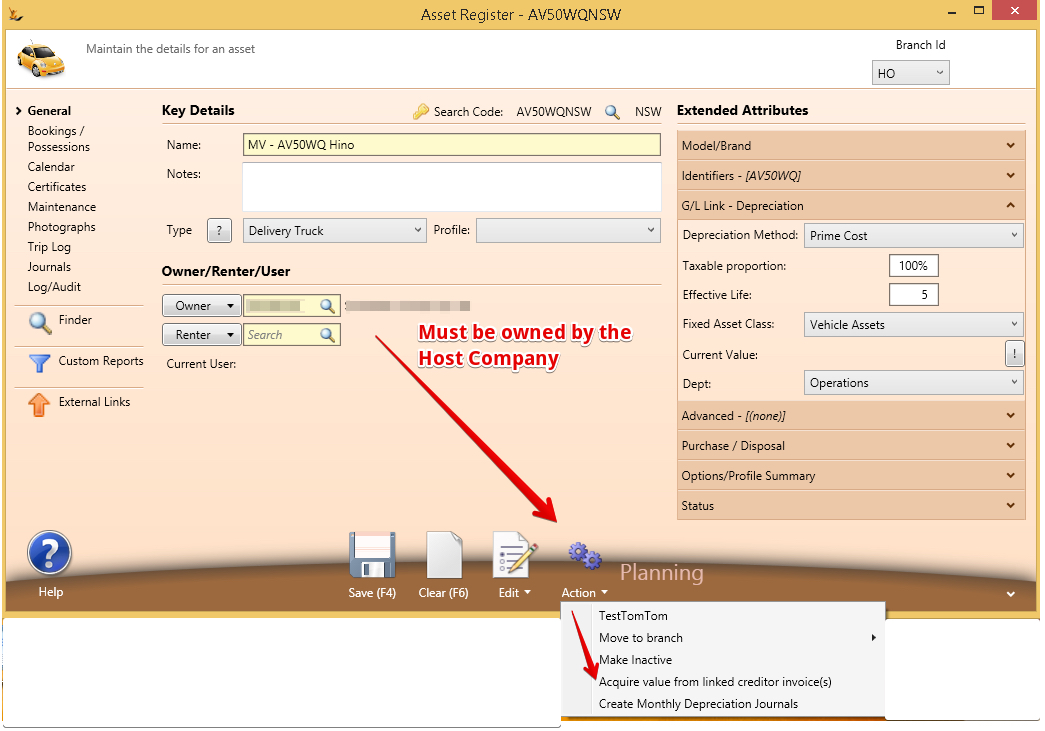

The Asset must be owned by the Host Company

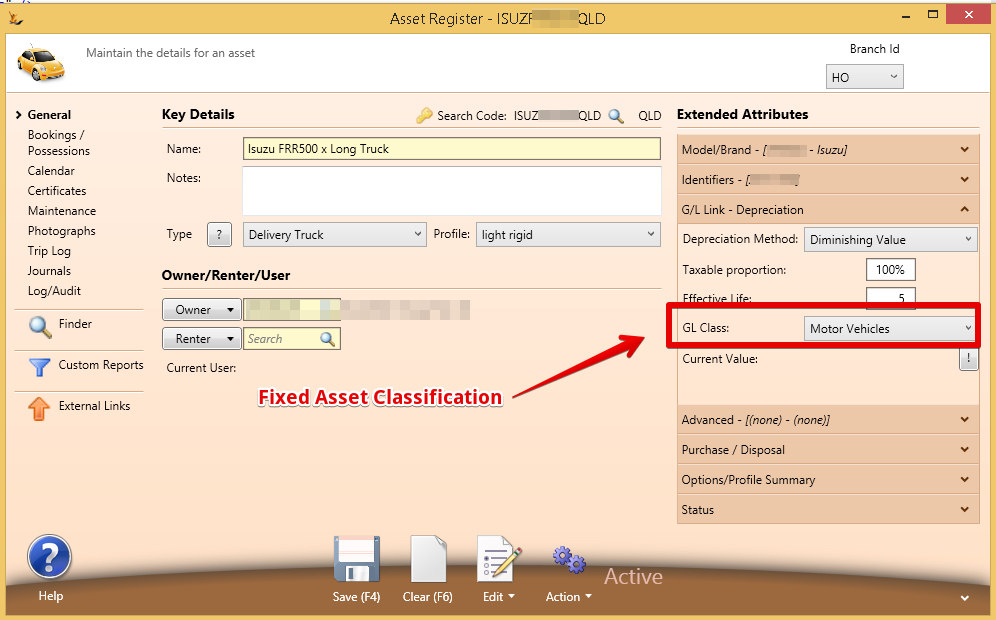

Each Asset that is to have a financial value must be linked to a Fixed Asset Class

Low value Pool Asset Class

The low value pool has special depreciation calculations.

- First FY portion diminishing value calculation with a 18.75% annual depreciation allowance

- After first FY standard diminishing value calculation with a 37.5% annual depreciation allowance

Each Asset will have its value tracked individually and be visible in the Asset Dashboard like any other Asset.

Once you have setup the Low Value Pool nominate it in the GL Control Accounts

Setting up the Initial Value of the Asset

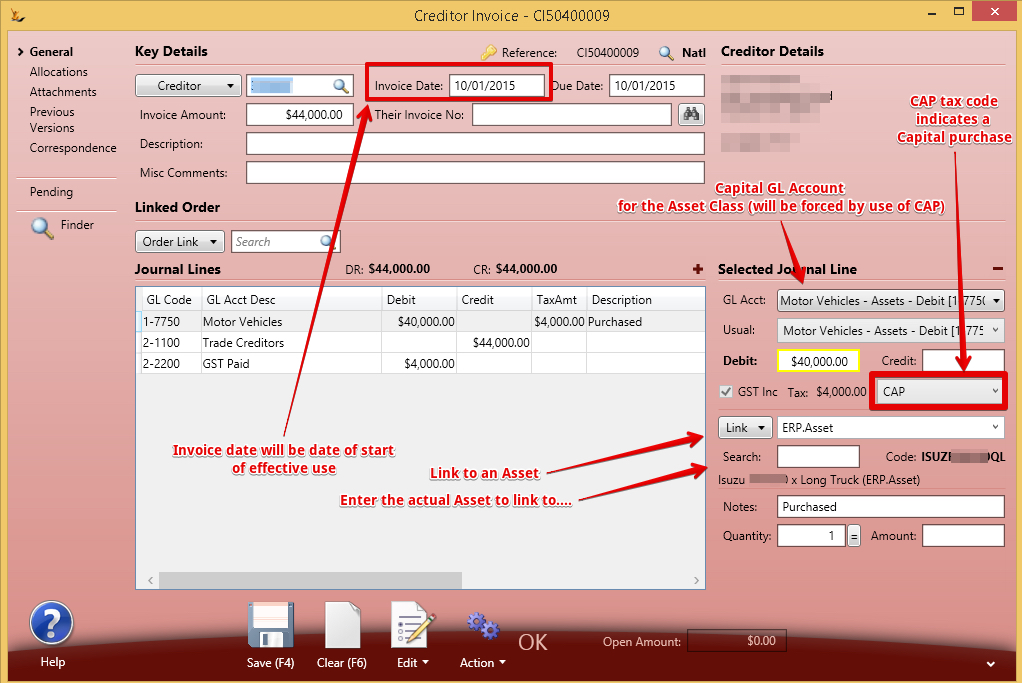

Supplier invoice to purchase the Asset

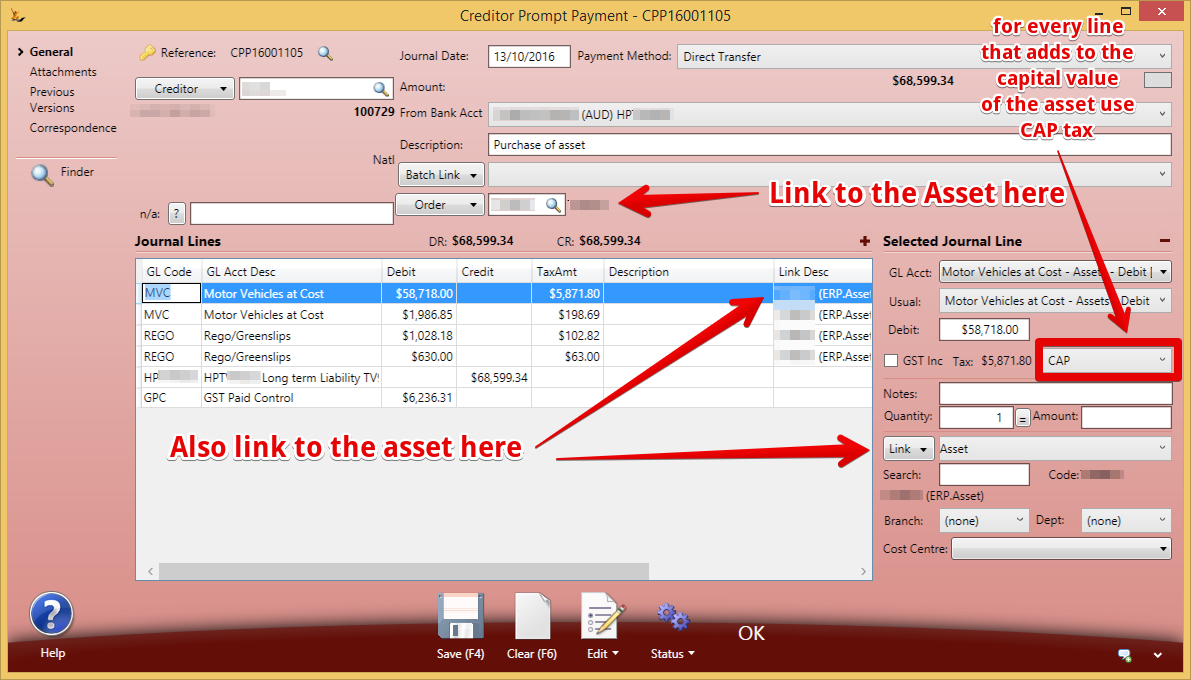

Asset value comes from Supplier Invoices that:

- Have a Tax code of CAP

- Have been linked to the Asset at the line level

Note that the GL code for the Capital value lines will be forced to be the same as the Asset class linked to the Asset. To link an Asset Class to an Asset you will require the Secure Feature

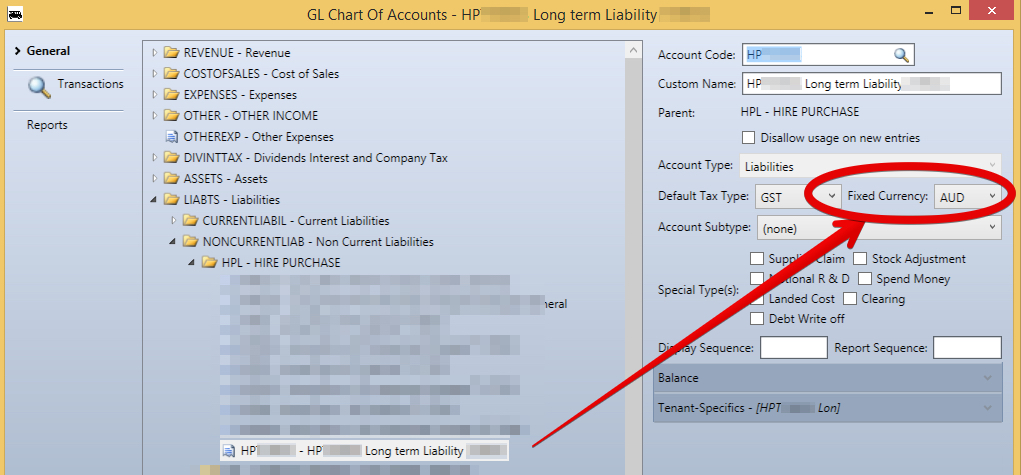

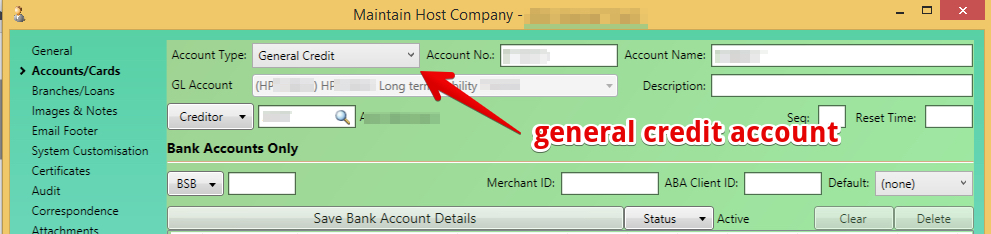

Note - if you are purchasing the asset using a loan:

Create the loan account in the GL

Setup the loan account as a General Credit Account (Host Company > Accounts Cards)

Use a payment without invoice using the general credit account as the account used to make the payment.

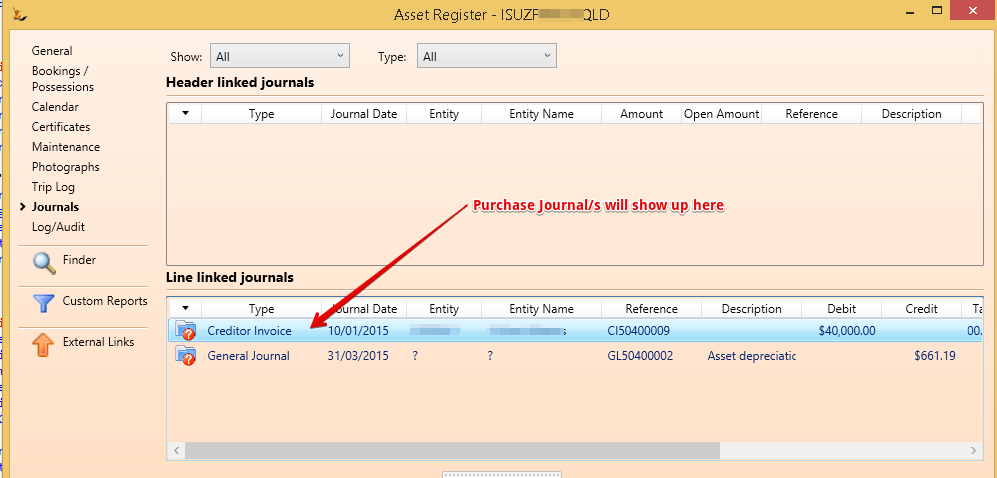

The Asset will have a link to the journal/s - choose link type "Asset" and enter the Asset code to create the link

Create the Financial Asset Book Value

Once all the Creditor invoices you want to have included in the initial asset value have been linked to the asset - you can create the Asset Financial Value.

The Current book value is found on the Asset Screen

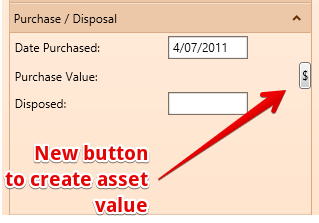

Bringing in Assets that are partially depreciated already

Examples when to use this include

- Purchasing another company

When you purchase a company they will have assets already on their books and you will not have a Creditor Invoice to create the Asset Value

- First setup of the system

- When you are first setting up in the system you will not have an Creditor Invoice to create the Asset Value

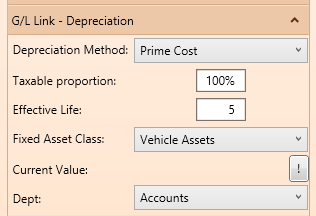

Asset Depreciation Fields

First setup on the Asset - all the fields required for Depreciation

Access to the create asset value wizard

Then a new button will appear

Use the wizard to enter the values required by the Journal

The Asset Clearing Account must be flagged as a clearing account in the GL

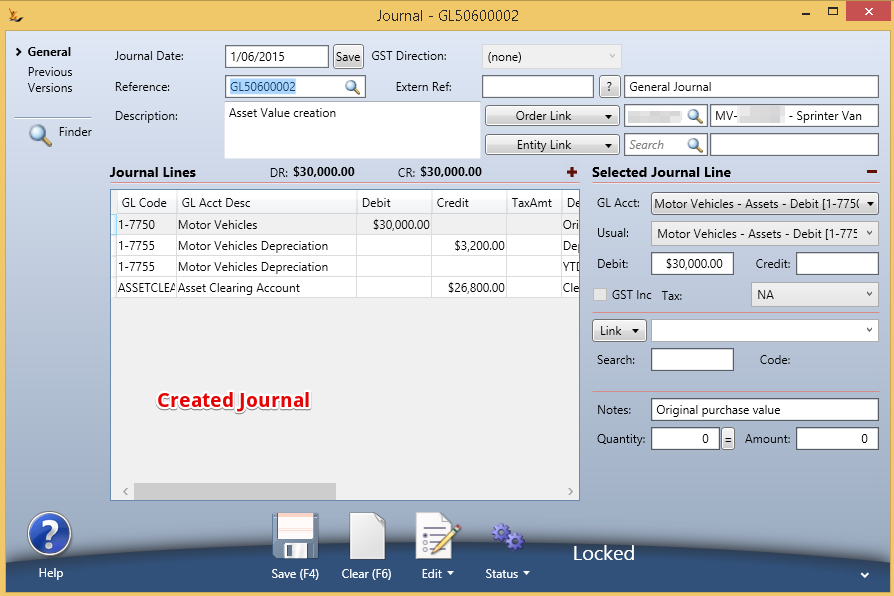

Then the Journal will be created

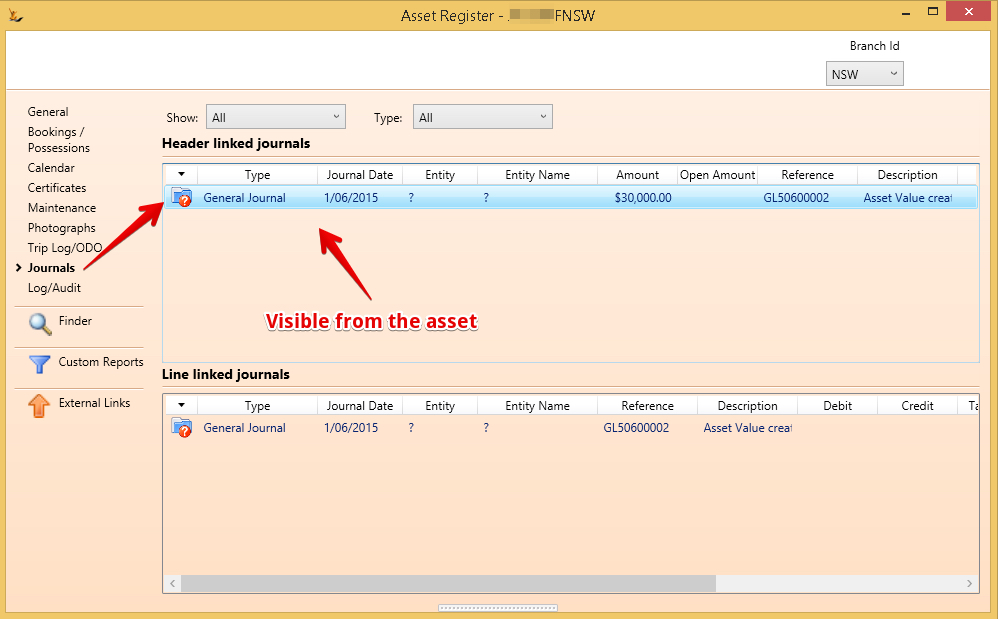

And can be found on the Asset later

Rolling back Depreciation Journals

Delete the last journal Created until back to the month with the problem. Adjust. Run depreciation each month until up to date.

Writing off Assets

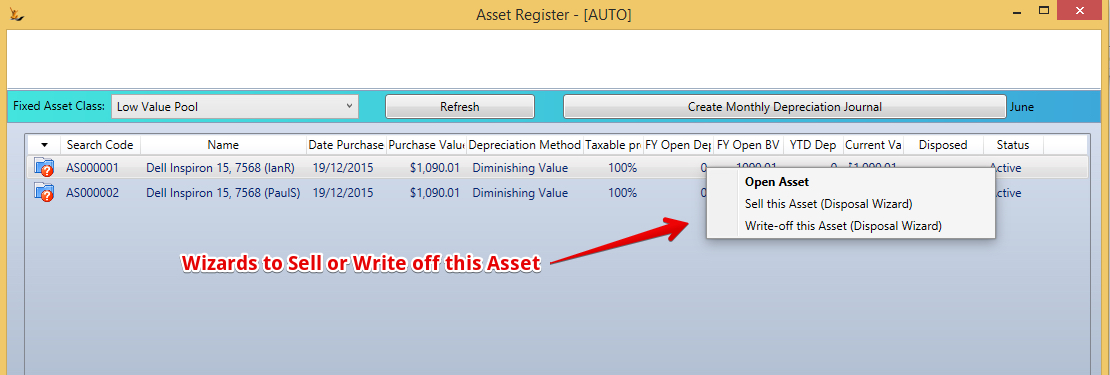

In Asset Depreciation Workbench - right click - Write off this asset

On Asset Screen - Action - Write off this Asset

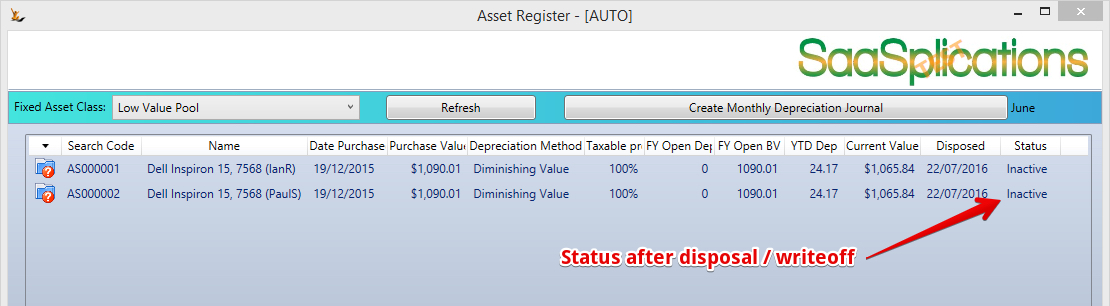

After write off

Selling Assets

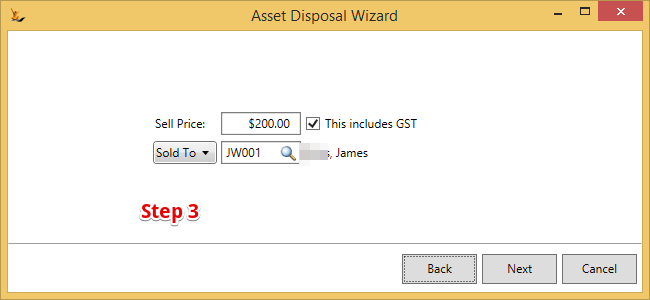

In Asset Depreciation Workbench - right click - Sell this asset. (or On Asset Screen - Action - Sell this Asset)

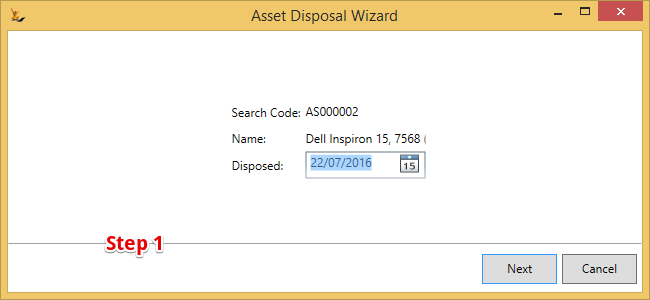

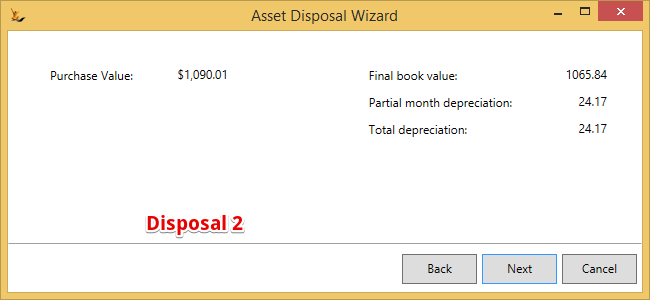

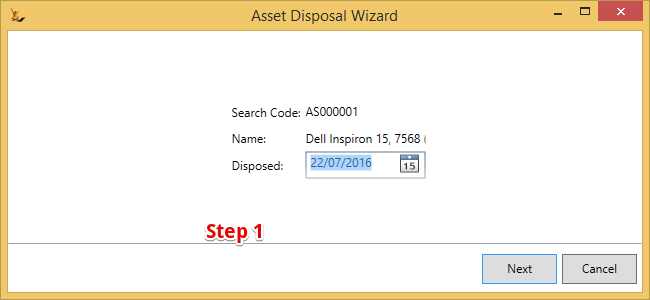

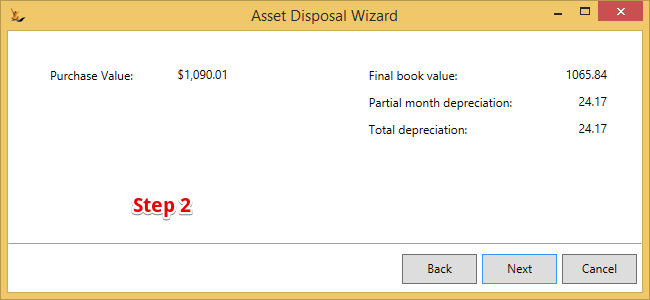

Asset Disposal Wizard

After disposal

Related content

For information about SaaSplications go to http://saasplications.com.au